Students take on the role of investment analysts, valuing securities, analyzing financial performance, and issuing recommendations to optimize portfolio decisions under real-world pressures with our securities analysis simulator.

The Securities Analysis Simulation is a rigorous, research-intensive experience developed by equity analysts and portfolio managers to reflect the realities of public market investing.

Students take on the role of buy-side or sell-side analysts, diving deep into company fundamentals, market trends, and valuation techniques. Their task: build a defensible investment thesis and recommend whether to buy, sell, or hold.

Students must navigate a stream of financial reports, earnings calls, news updates, and macroeconomic signals. Every piece of data could shift the market view - and their valuation. The Securities Analysis Simulation builds the discipline and intuition needed to succeed in equity research, asset management, and investment strategy roles.

This securities analysis simulation is especially effective in helping students understand the nuances of security selection and the tension between risk and reward. It teaches them how to navigate imperfect data, forecast under uncertainty, and manage stakeholder expectations. With immediate feedback and market-driven pressure, the learning becomes dynamic, personalized, and highly transferable to a wide range of financial careers.

Who is this securities analysis simulation for? It’s ideal for students pursuing careers in equity research, asset management, investment banking, or corporate finance.

Do I need advanced modeling skills? No. The securities analysis simulation includes guided model templates and helps students build skills progressively.

How long does the securities analysis simulation take? Typically 6–8 hours, either as a single immersive session or broken into modules.

Does it cover both equity and fixed income? Yes. Students engage with both stock and bond analysis to develop a well-rounded view.

Is it individual or team-based? It supports both formats. Team-based delivery enhances debate and collaborative decision-making.

What kind of data do students work with? Realistic financial statements, market data, and news summaries are provided in each scenario.

Are ESG elements included? Yes. Students assess sustainability metrics and incorporate ESG factors into their recommendations.

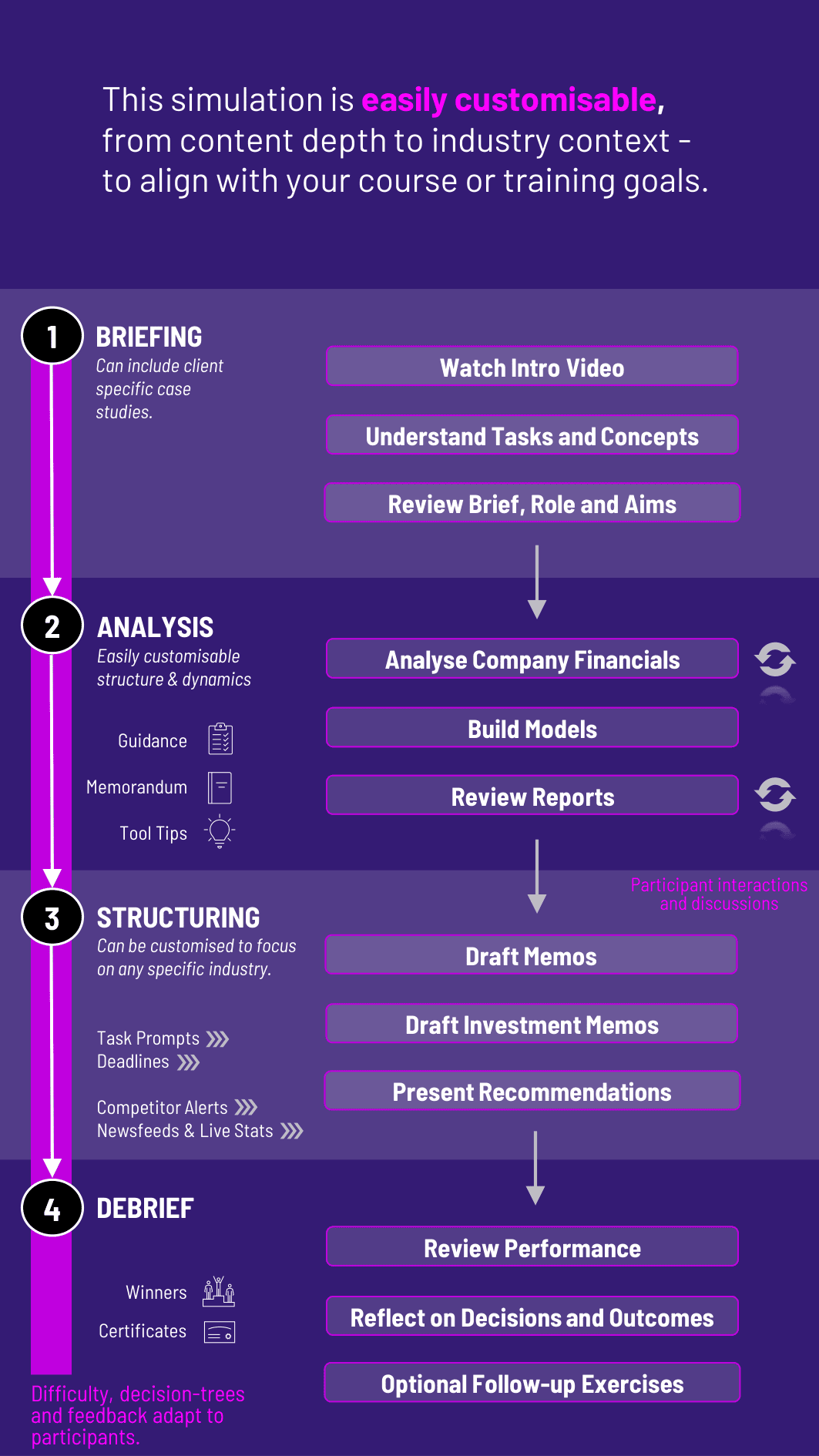

Can it be customized by instructors? Absolutely. Instructors can tailor the focus by sector, region, asset class, or valuation method.

How is performance assessed? Based on analytical quality, valuation accuracy, and clarity of communication.

What careers does it prepare students for? The securities analysis simulation builds real-world skills for careers in investing, analysis, wealth management, and more.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the securities analysis simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the securities analysis simulation can benefit you.