Students take on the role of financial risk managers, balancing liquidity, interest rate exposure, and profitability to optimize institutional performance under real-world pressures with our asset liability management simulator.

The Asset Liability Management (ALM) Simulation immerses students in the complex world of financial balance sheet strategy. Students act as risk managers or treasury professionals for a financial institution, responsible for optimizing profitability while managing liquidity, interest rate exposure, and regulatory constraints. Every decision impacts both sides of the balance sheet, requiring a strategic, forward-looking approach.

This ALM simulation challenges students to respond to macroeconomic changes, forecast interest rate movements, and maintain financial stability amid shifting funding needs and investment opportunities. By balancing risk and return in real time, learners gain a deep understanding of the core mechanics that drive financial institutions and the tools they use to maintain solvency and competitiveness.

Because ALM sits at the intersection of finance, risk, and regulation, the asset liability management simulation is uniquely suited to building integrated thinking across disciplines. It gives students firsthand experience with tools and frameworks used by global banks and insurers, making it ideal preparation for roles in treasury, risk management, and financial strategy.

Who should take this asset liability management simulation? It’s ideal for students interested in banking, risk management, insurance, treasury, and regulatory finance careers.

Is prior ALM knowledge required? No, but familiarity with basic finance and balance sheet concepts will be helpful. Introductory materials are included.

How long does the asset liability management simulation last? The full experience typically runs 6–8 hours but can be split into shorter modules.

Is this asset liability management simulation based on real data? It uses a blend of real-world financial assumptions and dynamic, scenario-based modeling.

Do students work in teams? Yes, the asset liability management simulation supports both team-based and individual decision-making formats.

What financial instruments are included? The asset liability management simulation includes loans, securities, deposits, wholesale funding, and derivatives.

What kinds of scenarios are simulated? Interest rate shifts, funding pressure, regulatory change, and macroeconomic stress events.

How is performance evaluated? Based on risk-adjusted return, regulatory compliance, liquidity health, and strategic alignment.

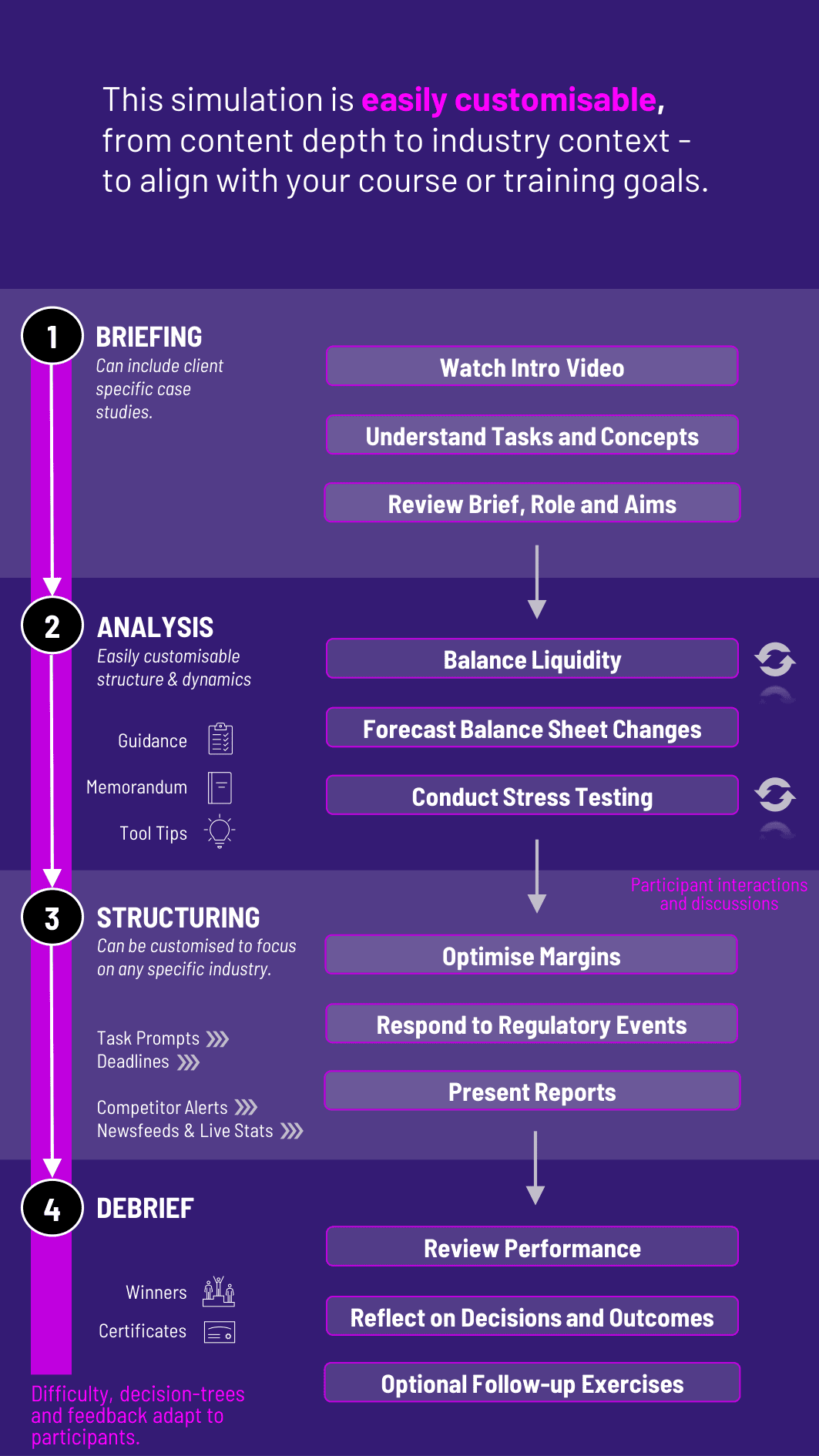

Can instructors customize it? Yes, instructors can adjust scenarios, metrics, and learning emphasis.

What careers does this support? The asset liability management simulation prepares students for roles in treasury, asset management, banking, insurance, and regulatory strategy.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the asset liability management simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the asset liability management simulation can benefit you.