Participants take on the role of real estate finance professionals, underwriting property deals, modeling cash flows, and structuring financing to maximize returns under real-world pressures with our real estate finance course.

The Real Estate Finance Course gives participants the opportunity to step into the role of real estate investment professionals, analyzing development deals, managing cash flows, evaluating risk, and structuring financing for commercial and residential properties. Participants make strategic decisions in a dynamic market environment, simulating the high-stakes challenges of the real estate finance industry.

From navigating zoning regulations to assessing cap rates and negotiating loan terms, participants are exposed to a wide range of technical and strategic elements. The real estate finance course encourages practical learning by modeling realistic property investment scenarios. It’s designed to develop the financial and analytical skills required in real estate investment, development, and asset management careers.

This real estate finance course is especially effective because it mirrors the structure and workflows of real-world real estate firms. It strengthens technical proficiency in valuation and modeling while developing soft skills in negotiation, communication, and strategic thinking. As a result, participants walk away prepared for the pace and pressure of careers in real estate investment and finance.

Who is this course designed for? It’s ideal for participants pursuing careers in real estate, investment, development, or commercial lending.

Do I need prior real estate knowledge? No, but a foundation in finance or accounting helps. Introductory materials are included for all participants.

How long does the course take? The real estate finance course typically spans 6 - 8 hours but can be delivered in shorter modules.

Does it cover both commercial and residential real estate? Yes, it includes scenarios from both asset types to offer a broad learning experience.

What tools are used for modeling? The course is web-based, and participants work with built-in modeling tools and templates.

Is the course collaborative? Yes, it can be run in individual or team modes, replicating real-world firm dynamics.

What outputs do participants generate? Participants create financial models, investment memos, and presentations.

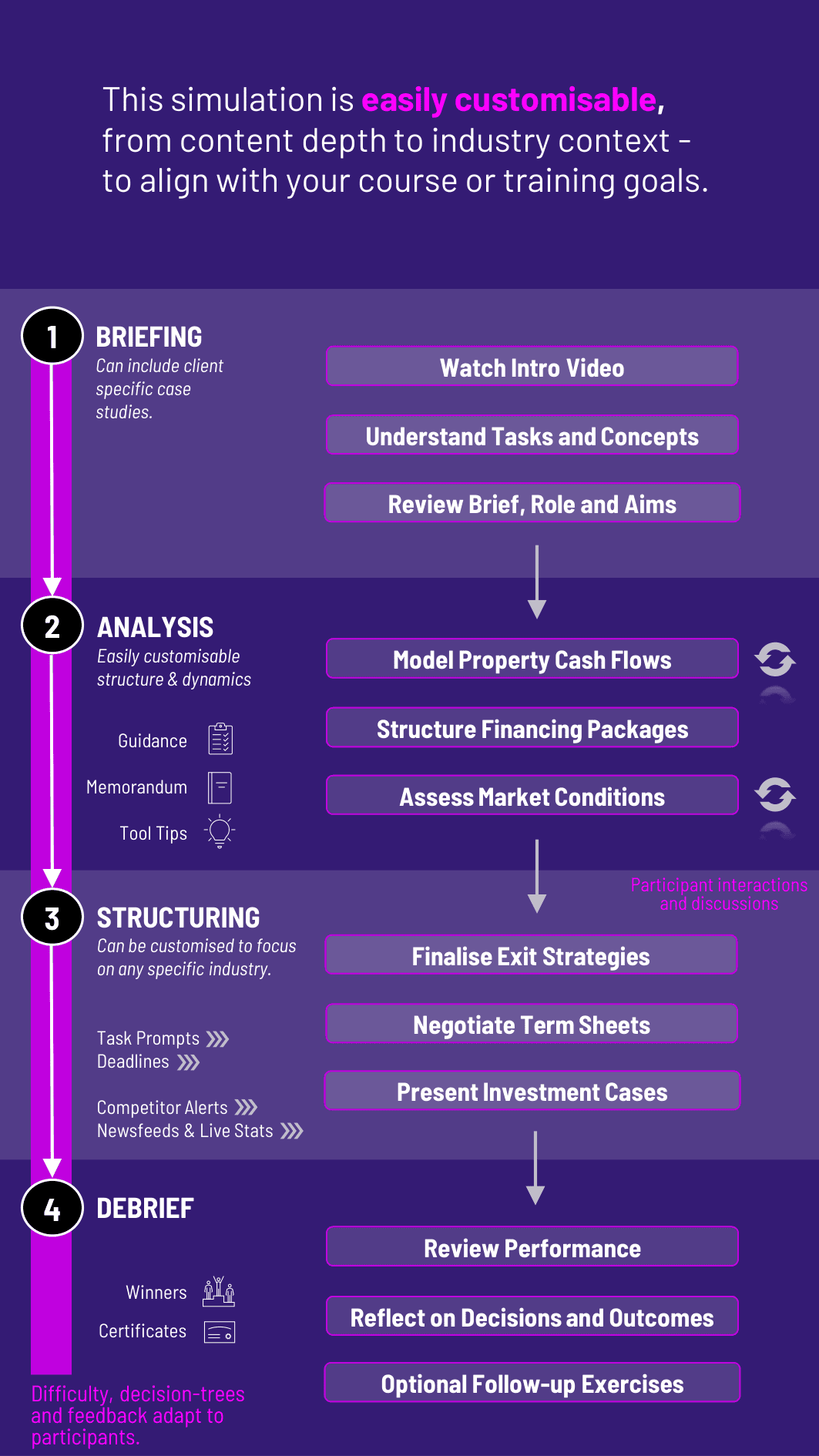

Can instructors customize the course? Absolutely. Instructors can select from different property types and investment strategies.

How are participants assessed? Evaluation is based on accuracy of analysis, decision-making rationale, and communication.

What career paths does this course support? The real estate finance course prepares participants for roles in investment analysis, asset management, development, and finance-focused real estate positions.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the real estate finance course.

or

Book a 15-minute Zoom demo with one of our experts to explore how the real estate finance course can benefit you.