Participants of our corporate finance training program act as corporate finance professionals, making strategic decisions on investments, cash flow, capital structure, and mergers.

In today's corporate finance landscape, effective corporate finance training programs are essential for business success. Corporate finance focuses on strategic decisions that enhance organizational growth and maximize shareholder value. It involves making data-driven decisions regarding capital budgeting, funding, and risk management to ensure a company’s long-term resilience.

Practitioners in corporate finance training analyze investment opportunities, evaluate financial statements, and develop optimal capital structures to support business goals. They play a crucial role in high-stakes transactions, such as mergers and acquisitions, providing strategic insights to navigate complex deals.

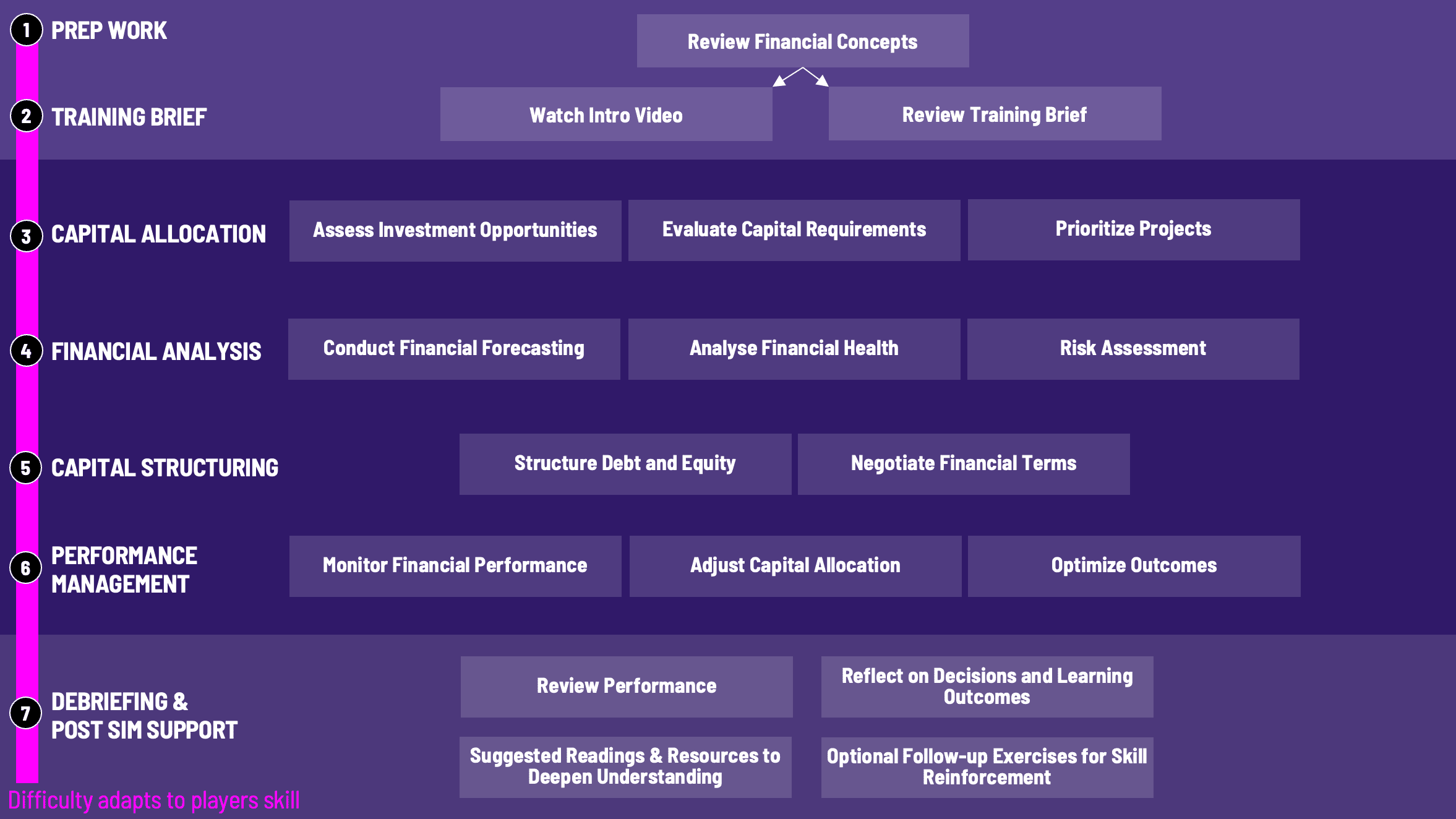

For corporate trainers, teaching corporate finance goes beyond theory- it’s about preparing participants to make real-world decisions in real-time. This is where the corporate finance training becomes invaluable. In a controlled, immersive environment, participants experience the pressures of financial decision-making, preparing them to apply these skills effectively in their roles.

Capital Budgeting

Financial Statements Analysis

Cost of Capital

Corporate Valuation

Risk Management

Capital Structure Optimization

Dividend Policy

Mergers and Acquisitions (M&A)

Working Capital Management

Cash Flow Analysis

Analyze Financial Statements: Review and interpret balance sheets, income statements, and cash flow statements to assess company health.

Evaluate Investment Opportunities: Identify and assess potential investments, weighing expected returns against risks.

Determine Capital Structure: Decide on the mix of debt and equity financing to maximize value and minimize risk.

Perform Capital Budgeting: Prioritize projects based on their potential to enhance company value, using techniques like NPV and IRR.

Optimize Cash Flow: Develop strategies to improve cash flow and ensure liquidity for ongoing operations.

Assess Cost of Capital: Calculate the cost of capital and assess its impact on the company’s investment decisions.

Develop a Dividend Policy: Formulate a dividend policy that balances investor expectations with business growth needs.

Make M&A Decisions: Analyze merger or acquisition opportunities, evaluating the strategic fit and financial implications.

Manage Working Capital: Strategize to efficiently manage the company’s short-term assets and liabilities.

Prepare for Real-World Scenarios: Work under simulated real-time pressure to make swift, informed financial decisions.

Financial Statement Analysis: Learn how to assess a company's financial health through comprehensive analysis of its financial reports.

Investment Evaluation: Gain skills to evaluate and select the most promising investment opportunities for maximizing returns.

Capital Structure Strategy: Understand how to structure debt and equity effectively to balance risk and growth potential.

Risk Management: Develop approaches to identify, assess, and mitigate financial risks that impact company stability.

Decision-Making Under Pressure: Build confidence in making rapid, high-stakes decisions with limited information.

Cash Flow Management: Learn techniques for optimizing cash flow to ensure ongoing liquidity and operational efficiency.

Corporate Valuation: Master methods to value companies accurately, which is essential in investment and acquisition decisions.

Strategic Financial Planning: Gain a holistic understanding of planning and forecasting to support long-term business goals.

Investment Banking: For structuring deals, analyzing financials, and advising clients on transactions.

Private Equity: To assess and manage investments in private companies, focusing on maximizing value.

Corporate Treasury: Managing the company’s finances, liquidity, and financial risks.

Mergers & Acquisitions: For evaluating potential mergers or acquisitions, negotiating deals, and due diligence.

Financial Planning and Analysis (FP&A): Forecasting, budgeting, and analyzing financial performance to guide strategic decisions.

Risk Management: Identifying and managing financial risks in both corporate and investment settings.

Consulting: Advising companies on capital structure, financing options, and value creation strategies.

Real Estate Finance: Applying corporate finance principles to structure, finance, and evaluate real estate investments.

Entrepreneurship: For startups and small businesses to make sound financial decisions and optimize funding.

Public Sector Finance: Managing budgets, investments, and financing decisions within government or nonprofit organizations.

What is the main objective of the corporate finance training? The corporate finance training aims to equip participants with the practical skills needed to make strategic financial decisions that drive growth and manage risk.

What background knowledge do I need to participate? A basic understanding of financial principles and statements is beneficial, though the corporate training for finance is designed to build expertise progressively.

How does the corporate finance training reflect real-world corporate finance challenges? The corporate finance training incorporates realistic scenarios and pressures, requiring participants to make quick, informed decisions similar to those in actual corporate finance roles.

What tools will I use during the corporate finance training? Participants will use financial analysis tools, valuation techniques, and capital budgeting methods to complete tasks and make decisions.

Can this corporate finance training help in preparing for corporate finance certifications? Yes, the concepts and skills covered align well with the material in corporate finance certification exams.

How is performance evaluated in the corporate finance training program? Performance is assessed based on the quality of decisions made, the effectiveness of strategies implemented, and the final outcomes in each scenario.

Will I receive feedback on my decisions? Yes, participants receive real-time feedback to help them understand the impact of their decisions and improve their skills.

How does this corporate finance training benefit my current role? The skills learned are applicable to any role that involves financial analysis, investment decisions, or financial planning.

Is teamwork involved in the corporate finance training course? Some scenarios may require collaboration with peers, reflecting the team-based nature of many corporate finance functions.

What types of companies or industries does the corporate finance training focus on? The corporate finance training includes a variety of industry scenarios, allowing participants to apply skills across different business contexts.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the corporate finance training.

or

Book a 15-minute Zoom demo with one of our experts to explore how the corporate finance training can benefit you.