In this hands-on Working Capital Management Training, participants are financial decision-makers responsible for managing liquidity, improving cash flow, and balancing operational efficiency.

Cash Conversion Cycle: Interplay of inventory, receivables, and payables

Accounts Receivable: Credit policies, collections, and DSO

Inventory Management: EOQ, safety stock, and stockout risk

Accounts Payable: Payment terms, supplier negotiations, and DPO

Liquidity Management: Cash forecasting and short-term funding

Cost of Capital: Trade-offs between liquidity and profitability

Crisis Response: Managing disruptions in supply, demand, or credit

Stakeholder Communication: Justifying changes to procurement, sales, or operations teams

Reviewing cash flow statements, working capital ratios, and performance metrics

Adjusting credit terms for customers to influence receivables

Managing payment timelines with suppliers

Deciding how much inventory to hold across product lines

Responding to unexpected shocks (e.g. customer default, supplier delay)

Communicating decisions to sales, operations, and senior management

Tracking outcomes such as free cash flow, customer satisfaction, and supplier stability

Revising policies to meet evolving targets across training rounds

By the end of the training, participants will:

Understand how operational decisions affect cash flow and financial health

Learn to calculate and optimize the cash conversion cycle

Gain fluency in liquidity metrics like DSO, DPO, and inventory turnover

Balance competing priorities (growth vs. cash preservation, sales vs. credit risk)

Learn how to negotiate better terms with suppliers and customers

See how external events (macroeconomic shifts, seasonality) affect short-term financing needs

Communicate finance decisions effectively across business functions

Apply working capital knowledge in a strategic, cross-functional context

This training is ideal for students in finance, accounting, and operations, as well as professionals in treasury, FP&A, or supply chain roles.

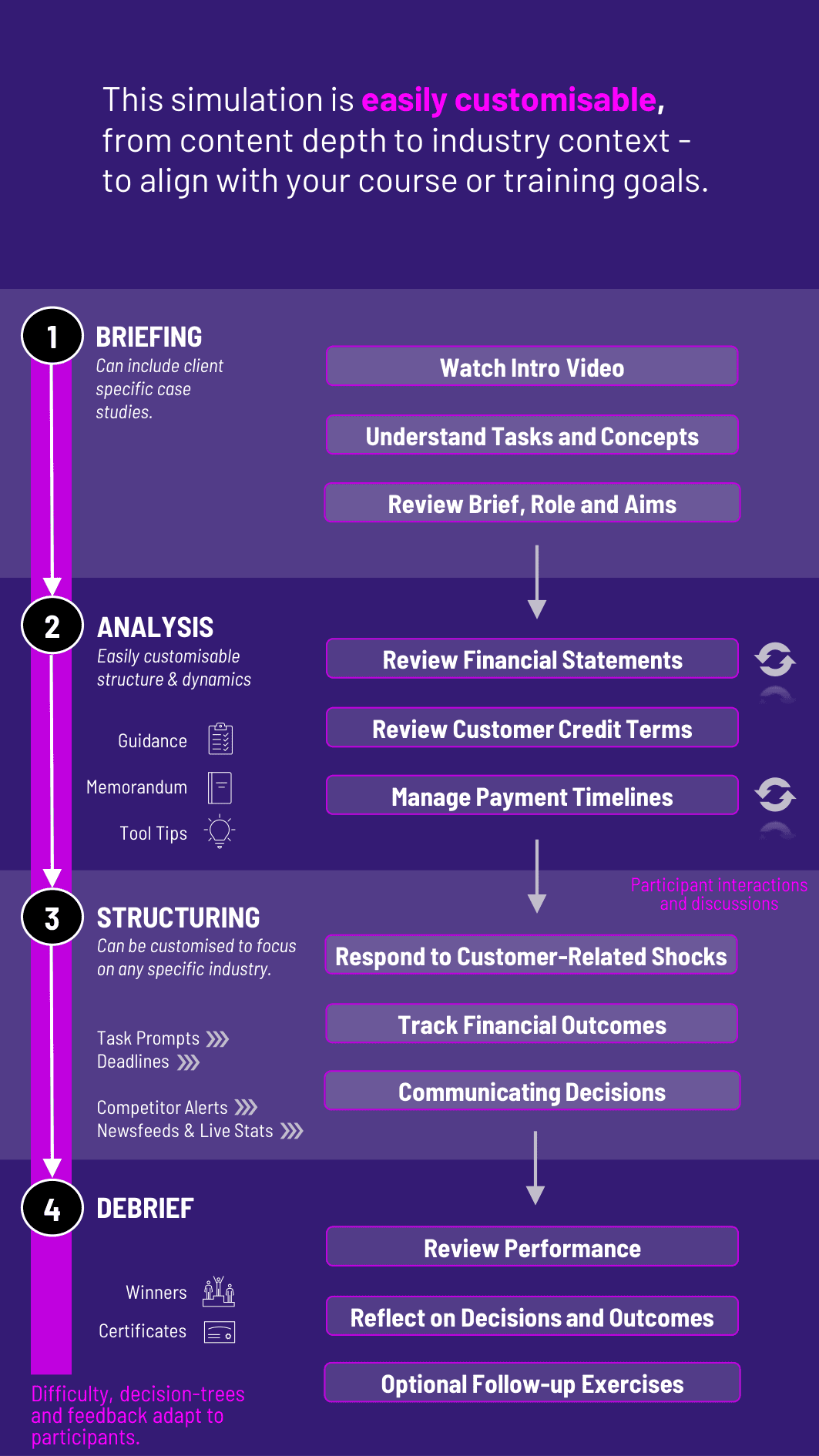

1. Receive Company Brief and Objectives Each round begins with a scenario: declining cash flow, supplier delays, growing sales pipeline, or unexpected expenses.

2. Analyze Metrics and Risk Participants review key indicators - current ratios, turnover metrics, projected liquidity gaps - and assess risks and opportunities.

3. Make Strategic Adjustments They fine-tune payment terms, credit policies, inventory holdings, and purchasing strategies based on priorities.

4. Evaluate Results The training calculates the effects of their decisions on financial performance and stakeholder sentiment.

5. Communicate and Justify Participants must explain their logic in team discussions, board memos, or stakeholder presentations.

6. Adapt in Subsequent Rounds New developments (e.g. interest rate changes, supplier exits, customer churn) challenge participants to evolve their approach.

Do I need accounting experience? Basic familiarity with balance sheet and cash flow concepts helps, but the training is beginner-friendly and fully guided.

Can the training be tailored to industries? Yes. The business scenarios can be adapted to fit manufacturing, retail, consumer goods, or services.

Does it include real financial ratios? Yes. Participants work directly with ratios like DSO, DPO, inventory turnover, current ratio, and cash conversion cycle.

Is this a solo or team training? It works well both ways. Teams can represent different departments or divisions within a company.

Can I use this in an operations course? Absolutely. The cross-functional nature of working capital makes it ideal for both finance and operations programs.

How long does the training last? It can run in 90 minutes to 3 hours, or over multiple sessions with deeper analysis and peer learning.

How is performance measured? Participants are assessed on liquidity improvement, stakeholder alignment, risk management, and ability to justify decisions.

Is this good for professionals too? Yes. It’s an excellent training for treasury, procurement, sales ops, and FP&A teams.

Does it simulate crises? Yes. Each round introduces new variables - from economic downturns to supplier strikes and inventory shortages.

Is the training competitive? It can be. Teams can compare outcomes, benchmark decisions, and compete for optimal working capital performance.

Financial performance (cash flow, liquidity ratios, working capital turnover)

Strategic alignment of their decisions

Justification and communication of trade-offs

Team collaboration and stakeholder negotiation

Adaptability in response to new conditions

Written or verbal presentation quality (e.g., CFO memo or stakeholder debrief)

Optional components like reflection essays or group presentations can also be included for deeper learning.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the training.

or

Book a 15-minute Zoom demo with one of our experts to explore how the training can benefit you.