The Wealth Manager Simulation immerses students and professionals in the role of a portfolio manager for a diverse set of clients, making real-time investment decisions, managing risk, and communicating with clients.

Modern Portfolio Theory and Asset Allocation

Risk Profiling and Tolerance Assessment

Investment Policy Statement (IPS) Development

Equity and Fixed-Income Analysis

Mutual Fund and ETF Selection

Behavioral Finance Biases

Performance Measurement and Attribution

Client Relationship Management and Communication

In the simulation, participants will:

Conduct initial meetings to understand client goals, time horizons, and risk appetite.

Create customized Investment Policy Statements for each client.

Execute trades across a wide universe of stocks, bonds, and funds to implement strategic and tactical asset allocation.

Analyze real-time market news, economic indicators, and corporate events to inform decisions.

Adjust holdings periodically to maintain target asset allocation and manage risk.

Write periodic performance updates and respond to client inquiries and concerns.

Use dashboard analytics to evaluate returns, risk metrics, and benchmark performance.

Construct customized, multi-asset investment portfolios aligned with specific client profiles and IPS.

Evaluate the risk-return characteristics of various securities and their role within a broader portfolio.

Implement strategic asset allocation and tactical adjustments based on changing market conditions.

Measure and interpret portfolio performance using industry-standard metrics and attribution analysis.

Develop strong client communication skills to explain strategy, report performance, and manage expectations during market volatility.

Synthesize concepts from finance, economics, and behavioral psychology into a coherent wealth management practice.

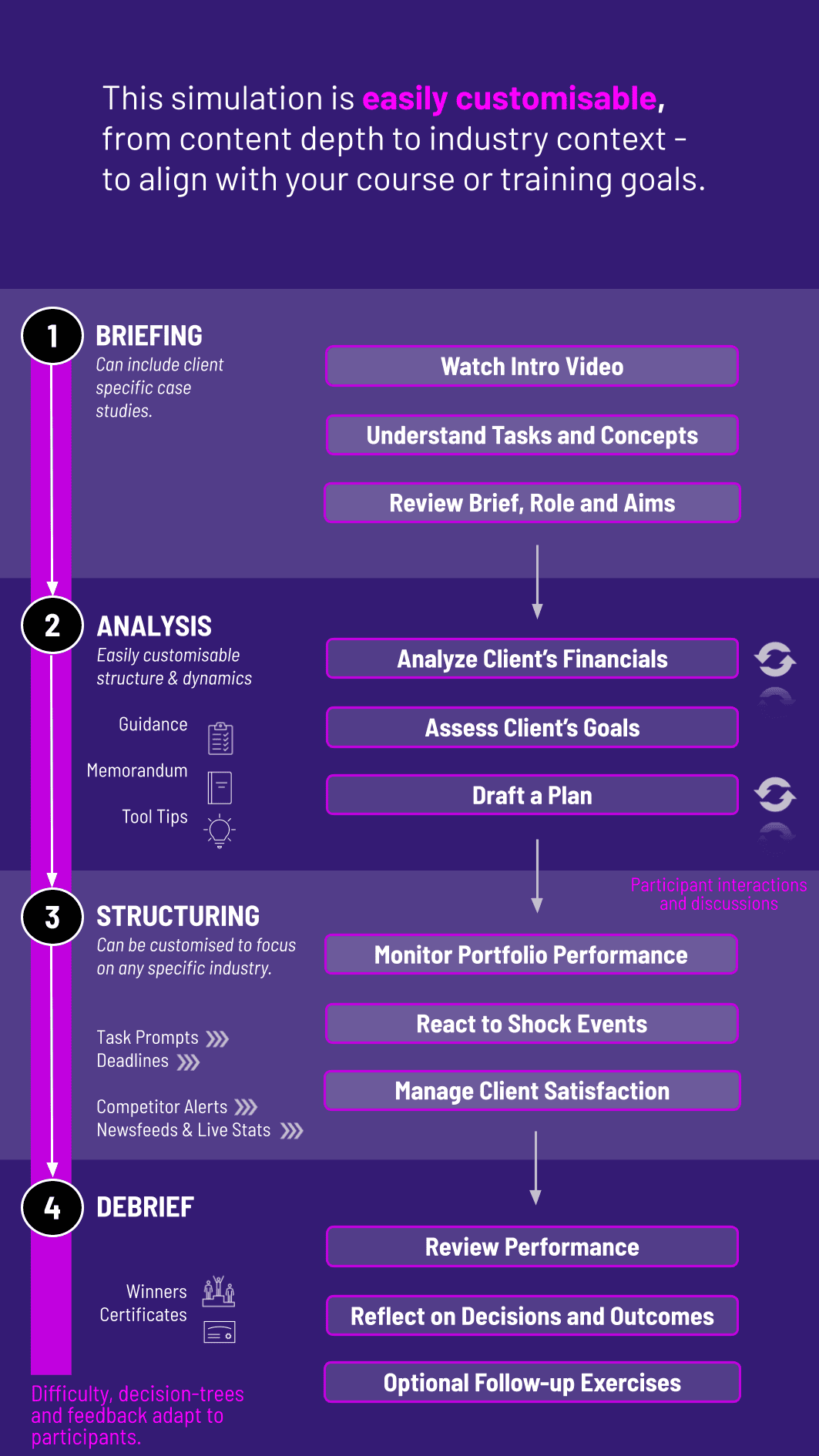

1. Setup Participants are introduced to their firm and assigned their book of virtual clients.

2. Research and Planning They access client profiles, market data, and security screeners to develop their initial strategy and IPS.

3. Trading and Management In a series of rounds (each representing a quarter or year), participants execute trades, rebalance portfolios, and react to market events.

4. Client Interaction At key intervals, participants receive messages from their clients and must respond appropriately to maintain satisfaction.

5. Reporting and Analysis After each round, a detailed performance report is generated, showing returns vs. benchmarks and client satisfaction scores.

6. Debrief The simulation concludes with a comprehensive debriefing session, allowing participants and the instructor to review decisions, outcomes, and key takeaways.

Who is the Wealth Manager Simulation designed for? It is ideal for undergraduate and graduate students in finance, MBA candidates, and professionals in banking or finance seeking to transition into wealth management and private banking roles.

What are the technical requirements to run the simulation? Our simulation is cloud-based and requires only a modern web browser (like Chrome, Firefox, or Safari) and a stable internet connection. No specialized software is needed.

Can the simulation be customized for our specific curriculum? Absolutely. Instructors can adjust parameters such as simulation duration, starting capital, client profiles, market volatility, and available securities to fit their course learning objectives.

What is the ideal team size for participants? The simulation works well with individuals or small teams of 2-3 participants. Teams encourage collaboration and debate over investment strategy, mirroring a real-world advisory environment.

How long does a typical simulation last? A standard simulation runs between 4 to 8 rounds, which can be completed intensively over a weekend or spread across a full academic semester.

Do participants need prior trading experience? No prior experience is necessary. The simulation includes tutorial materials and guides. It is designed to apply theoretical knowledge learned in the classroom to a practical, risk-free environment.

How does the simulation incorporate real-world market dynamics? Our proprietary economic engine generates realistic market movements, interest rate changes, and economic news cycles that directly impact the prices of all simulated securities.

How is performance graded in the simulation? Performance is multi-faceted. The grading algorithm considers risk-adjusted returns, adherence to each client's IPS, achievement of specific client goals, and client satisfaction scores from communication modules.

Performance against relevant benchmarks, and progress toward each client's specific financial goals.

Evaluation of how well the participant adhered to the client's IPS, including asset allocation limits and risk constraints.

Penalties are applied for excessive risk-taking or strategy drift.

Ability to communicate effectively, manage expectations, and provide sound rationales for their decisions.

Ability to adapt and revise valuations in light of news shocks or changes.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.