In this Wealth Management Simulation, participants act as advisors designing client strategies - balancing investments, risk, taxes, and goals while navigating market shifts, ethical considerations, and the complexities of long-term financial planning.

Client profiling and financial goal setting

Asset allocation and portfolio construction

Risk-return trade-offs and diversification

Tax and estate planning considerations

Retirement planning strategies

Ethical challenges and fiduciary responsibility

Communicating with clients under uncertainty

Impact of market shocks on client strategies

ESG integration in wealth management

Long-term relationship management and trust building

Review detailed client profiles and objectives

Design portfolios that balance growth, risk, and liquidity

Incorporate tax and estate planning into recommendations

Respond to shocks such as recessions or regulatory changes

Address client concerns with clarity and empathy

Present strategies through meetings, memos, or updates

By the end of the simulation, participants will be able to:

Build tailored wealth management strategies for diverse clients

Apply asset allocation and risk management techniques

Integrate tax and estate considerations into financial planning

Communicate effectively and empathetically with clients

Manage ethical and fiduciary responsibilities

Adapt plans in response to market shocks or life changes

Balance short-term needs with long-term goals

Recognize ESG’s role in client portfolio design

Strengthen trust and credibility in advisory roles

Gain confidence in holistic wealth management practices

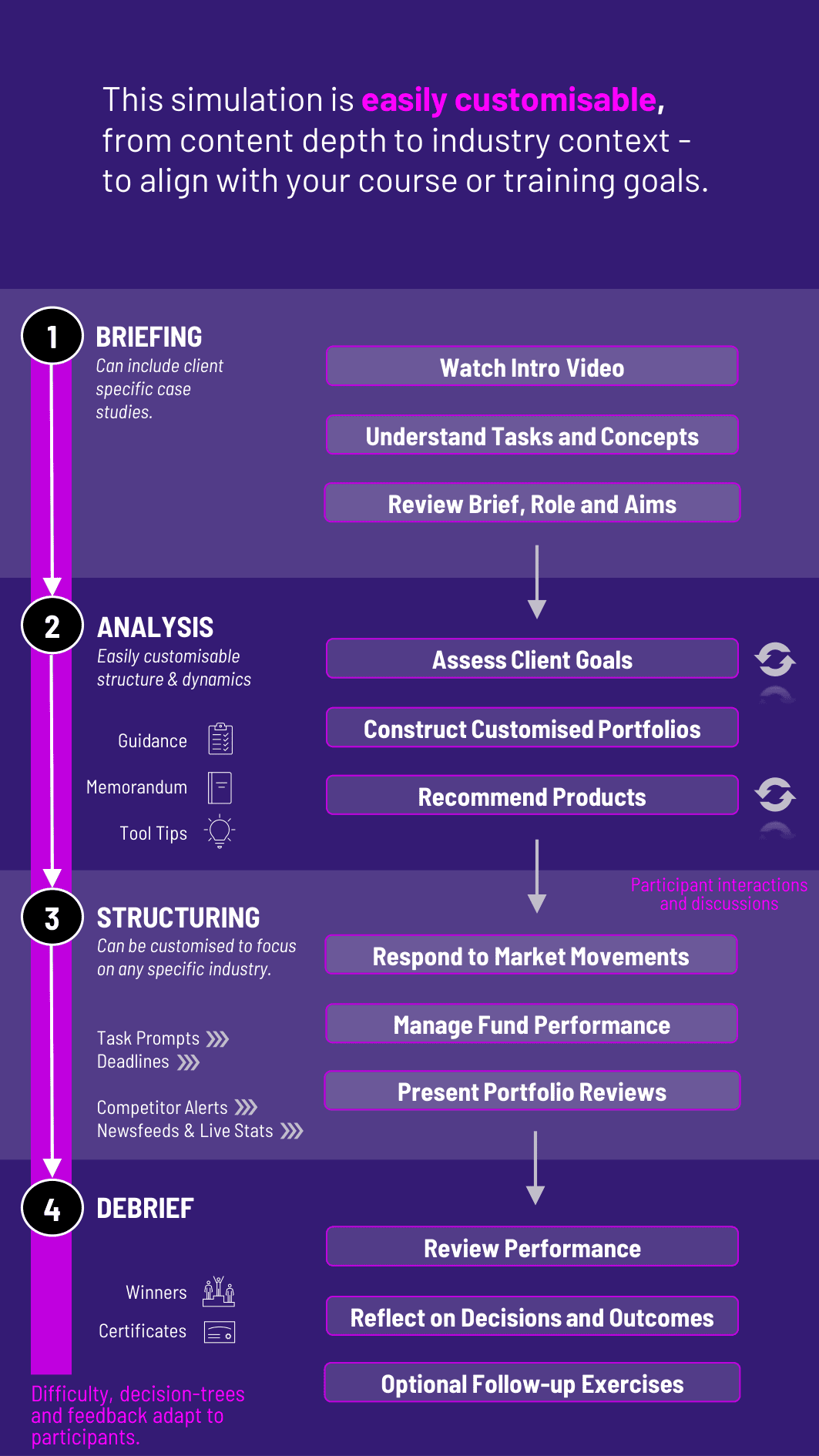

The simulation’s flexible structure ensures that these objectives can be calibrated to match the depth, duration, and focus areas of each program, whether in higher education or corporate learning.

1. Receive a Scenario or Brief: Participants are introduced to a client with specific goals, constraints, and market conditions.

2. Analyse the Situation: They review financial statements, risk preferences, and life stage details.

3. Make Strategic Decisions: Participants design portfolios, tax strategies, or estate plans under given constraints.

4. Collaborate Across Roles: Teams may role-play as wealth managers, clients, or regulators debating outcomes.

5. Communicate Outcomes: Participants present strategies through client meetings, memos, or presentations.

6. Review and Reflect: Feedback highlights portfolio performance, client satisfaction, and ethical alignment. Participants refine strategies across rounds.

Do participants need prior advisory experience? No. The simulation introduces wealth management principles in a practical way.

What roles are included? Advisors, clients, and regulators can be simulated.

Does it cover tax and estate planning? Yes. These are integrated into the scenarios.

Can it be customized for different clients? Yes. Profiles can range from young professionals to retirees.

Is it only about portfolios? No. It covers client trust, ethics, and communication.

How long does it run? It can be delivered in 3-hour sessions or multi-day programs.

Can it run online? Yes. The simulation works in-person, hybrid, and online.

Does it include ESG integration? Yes. ESG investing can be incorporated into scenarios.

Is teamwork part of it? Yes. Teams may role-play as advisors and clients.

How is performance measured? By portfolio outcomes, client satisfaction, and ethical decision-making.

Assessment can be tailored to focus on technical, communication, or ethical skills. Participants may be evaluated on:

Portfolio design and performance against goals

Responsiveness to market shocks or client changes

Clarity and empathy in client communication

Ethical judgment and fiduciary responsibility

Collaboration and professionalism in advisory teams

You can also include memo writing and debrief presentations as part of the assessment structure. Additionally, you can also add a built-in peer and self-assessment tool to see how participants rate themselves. This flexibility allows the simulation to be easily integrated by professors as graded courses at universities and by HR at assessment centres at companies.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.