Participants step into the role of personal financial advisors - designing investment strategies, balancing client goals, and navigating market changes - in our Wealth Management Course.

Goal-Based Financial Planning: Retirement, education, liquidity, and legacy planning

Asset Allocation: Diversification across equity, fixed income, alternatives, and cash

Risk Profiling: Assessing risk appetite, horizon, and behavioral tendencies

Investment Vehicles: Mutual funds, ETFs, insurance-linked products, and discretionary mandates

Behavioral Finance: Managing client biases, fear, and overconfidence

Tax Efficiency: Portfolio construction with after-tax returns in mind

Regulatory and Ethical Standards: Suitability, fiduciary responsibility, and disclosure

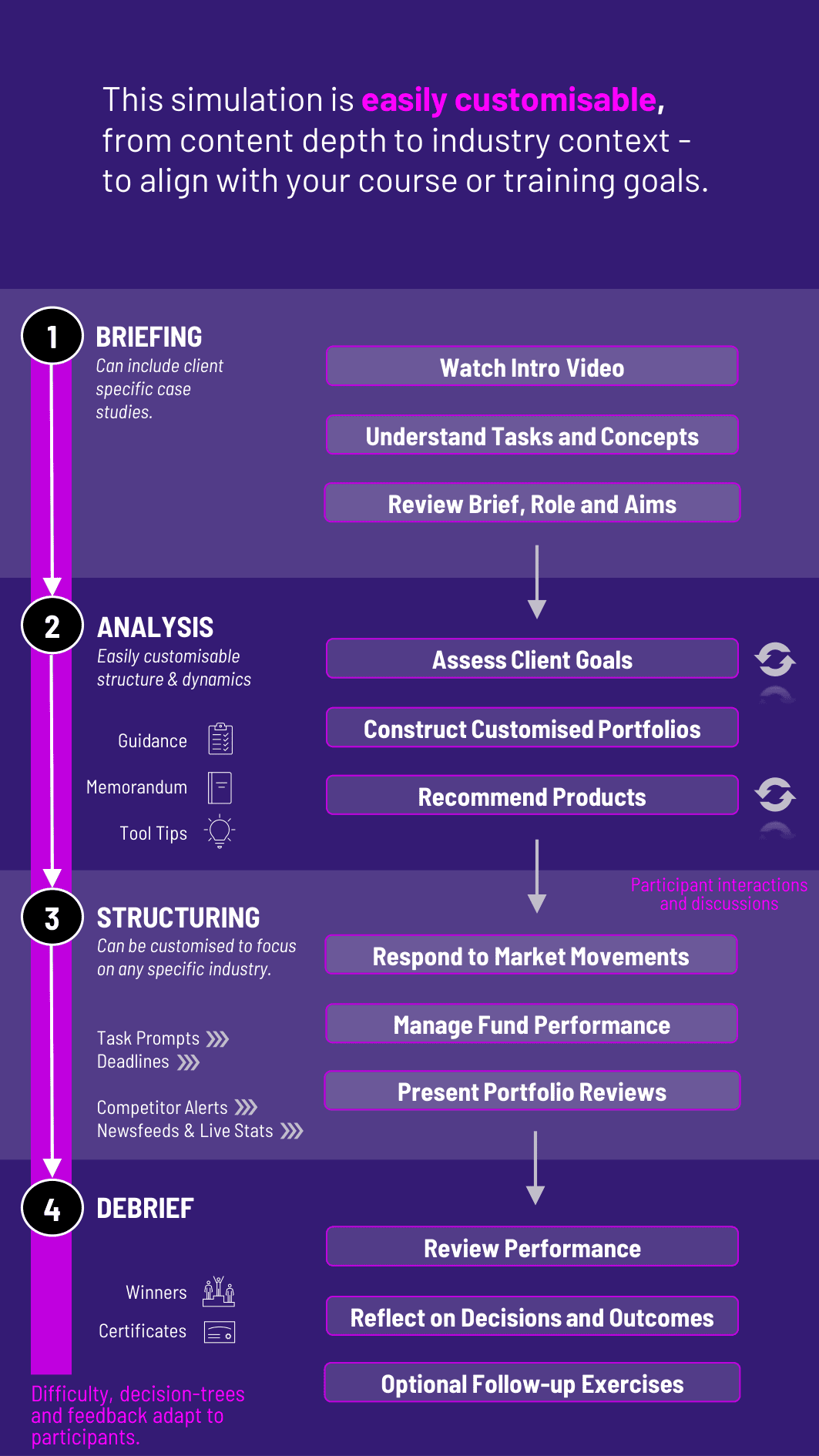

Conduct fact-finding and assess client goals, income, risk profile, and family needs

Construct customized investment portfolios based on client preferences

Recommend suitable products with appropriate justification and disclosure

Respond to market downturns, regulatory changes, or life events (e.g., marriage, illness, inheritance)

Handle difficult conversations around performance, fees, or product suitability

Present portfolio reviews and propose plan adjustments in line with evolving goals

This course builds practical advisory, interpersonal, and analytical skills. Participants learn to:

Align financial strategy with individual goals and risk tolerance

Apply asset allocation models in a human-centered context

Anticipate and navigate behavioral responses to volatility

Communicate investment concepts clearly and empathetically

Balance ethics, compliance, and commercial objectives

Reflect on trust-building and long-term relationship management

Do participants need prior knowledge of investment products? Basic familiarity with asset classes and risk-return concepts is helpful. The course includes product overviews and client goal definitions.

Are the client cases customizable? Yes. Instructors can choose from a library of client personas across demographics, life stages, and complexity levels - or request custom cases.

Does the course include ethics or regulatory content? Yes. participants must adhere to disclosure requirements, suitability standards, and manage ethical trade-offs within client scenarios.

Can participants manage multiple clients? Yes. As the course progresses, participants or teams manage a portfolio of clients with differing objectives and constraints.

How realistic are market and life event scenarios? The course includes real-time news events, economic shifts, and unexpected client developments that mirror actual advisory challenges.

Is the focus more on strategy or relationship management? Both. participants must design robust strategies and build trust by communicating decisions clearly and navigating client emotions.

How long does the course take? A full cycle typically runs over 5 - 7 hours but can be extended across multiple sessions with evolving client cases.

Can this be run in teams? Yes. Teams can act as advisory groups managing client portfolios and collaborating on review meetings or investment policy statements.

How is participants performance evaluated? Based on portfolio suitability, goal alignment, communication quality, client satisfaction (simulated), and ethical decision-making.

Does the course include documentation or reporting tasks? Yes. Participants prepare investment proposals, review reports, and memos that mimic real advisory deliverables.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the course.

or

Book a 15-minute Zoom demo with one of our experts to explore how the course can benefit you.