Experience the thrill of venture capital investing: evaluate startups, structure winning deals, and manage dynamic portfolios all while building the future’s most innovative companies.

Venture capital ecosystem and roles

Startup evaluation and due diligence

Financial modeling and valuation

Deal structuring and term sheets

Funding rounds: seed, Series A, B, etc.

Portfolio diversification and risk management

Negotiation strategies with founders

Exit strategies: IPO, M&A, secondary sales

Impact of market conditions on funding

Legal, regulatory, and compliance issues

In the simulation, participants will:

Receive and analyze startup investment briefs

Conduct due diligence on business models and financials

Construct valuation models using multiple approaches

Decide on investment amounts and funding terms

Negotiate term sheets with startup founders

Allocate capital across a portfolio of startups

Manage portfolio risk, monitor performance, and pivot strategies

Respond to market shocks and changing investor sentiment

Prepare investor updates and pitch presentations

Reflect on investment outcomes and strategy effectiveness

Understand the venture capital investment process and lifecycle

Apply financial valuation methods tailored to startups

Structure venture capital deals and term sheets

Assess startup risks and manage a diversified portfolio

Develop negotiation and investor communication skills

Respond adaptively to market and startup ecosystem volatility

Integrate legal and regulatory considerations into decisions

Recognize venture capital’s role in innovation and economic growth

Build confidence in venture funding decision-making under uncertainty

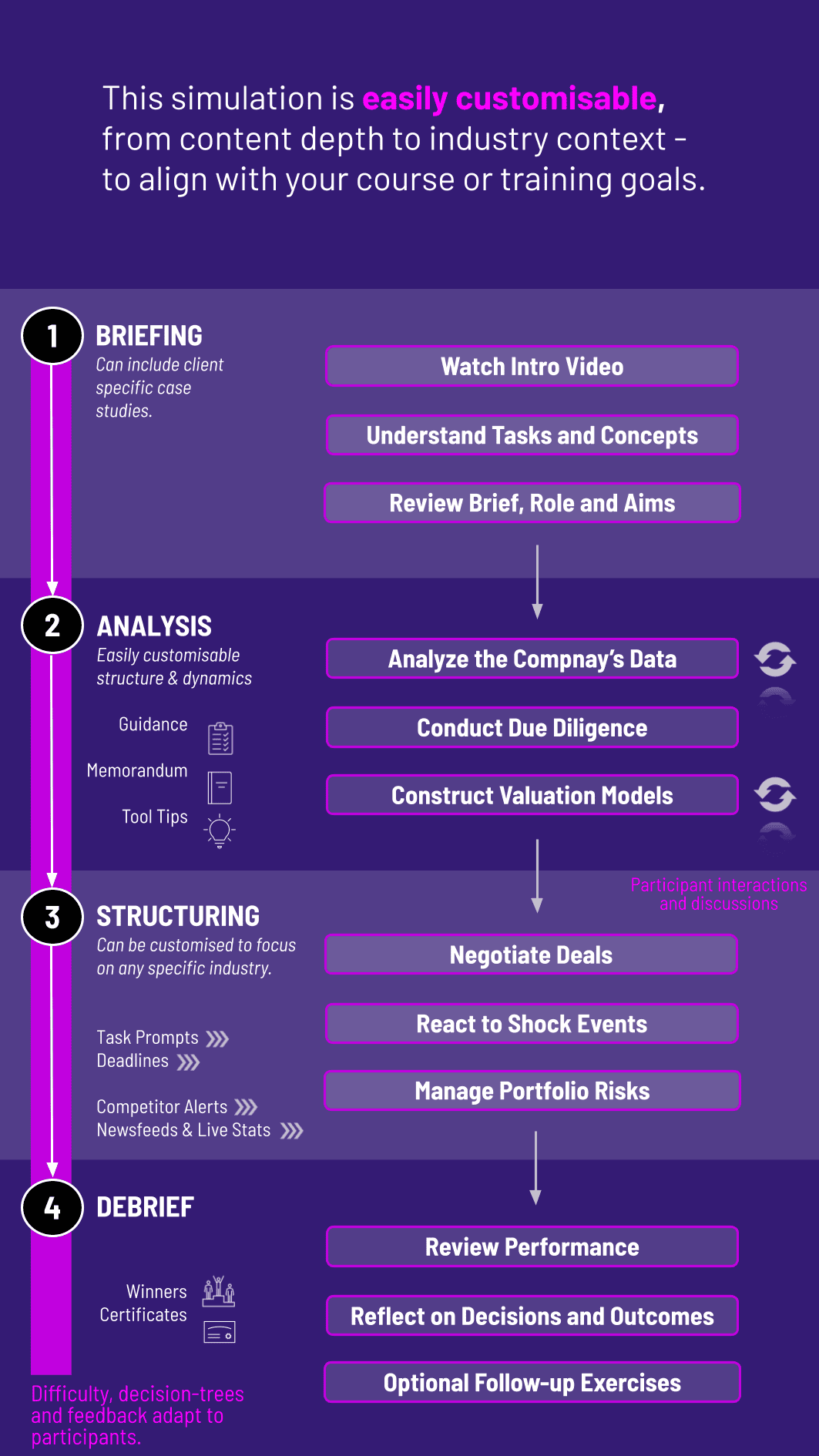

1. Scenario Introduction Participants receive detailed startup and market scenario briefs

2. Situation Analysis Teams analyze startup business models, financial projections, and market data

3. Strategic Decision-Making Participants decide on investment amounts, deal structures, and portfolio allocation

4. Collaboration and Negotiation Teams negotiate terms with simulated founders and competing investors

5. Communication Participants prepare investor memos and pitch updates.

6. Feedback and Reflection The simulation provides feedback on financial performance, risk exposure, and negotiation outcomes, shaping strategy evolution in subsequent rounds

Do participants need prior experience with venture capital or finance? No, the simulation includes instructional content suitable for all experience levels.

How long does the simulation typically run? A full session typically takes 3-4 hours but can be customized for shorter or extended formats.

Can this simulation be done individually or in teams? Both individual and team formats are supported, simulating realistic venture capital collaboration dynamics.

What key skills will participants develop? Startup evaluation, financial modeling, deal structuring, negotiation, portfolio management, and investor communication.

Are real or simulated data used? Simulated but realistic market and startup data based on historical trends are used.

Can instructors customize the simulation? Yes, scenarios, sectors, and focus areas can be tailored to learning objectives.

Quality and thoroughness of startup evaluation and due diligence

Effectiveness and creativity in deal structuring and negotiation

Ability to manage a diverse portfolio balancing risk and reward

Responsiveness to changes in market conditions and startup performance

Clarity and persuasiveness in communicating investment decisions to stakeholders

Collaboration and adaptability in team-based deal discussions

Application of valuation methods and financial modeling relevant to venture investing

Strategic thinking regarding exit timing and returns maximization

Incorporation of ESG (Environmental, Social, Governance) considerations in investment decisions

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.