The Venture Capital Analyst Simulation plunges participants into the competitive and high-risk world of venture capital. Move beyond theory and learn what it truly takes to identify, evaluate, and invest in the next unicorn.

Venture Capital Financing Lifecycle

Startup Valuation Methodologies (Scorecard, Risk Factor Summation, Berkus Method, VC Method)

Financial Modeling and Projection Analysis

Term Sheet Structuring and Key Clauses (Liquidation Preference, Participation Rights, Anti-dilution)

Capitalization Table (Cap Table) Management

Due Diligence Process

Portfolio Strategy and Diversification

Deal Sourcing and Pipeline Management

Exit Strategies (IPO, M&A, Secondary Sale)

In the simulation, participants will:

Evaluate a constant stream of startup applications to identify those fitting your fund's thesis.

Dive deep into a startup's financials, market size, competitive landscape, technology, and team.

Apply multiple valuation methods to determine a fair pre-money valuation for potential investments.

Build financial models to project startup performance under various growth and market conditions.

Draft and negotiate key economic and control terms with startup founders.

Make investment decisions to construct a diversified portfolio and manage your fund's capital.

Model the impact of your investment and subsequent funding rounds on ownership stakes.

Decide when and how to exit investments to realize returns for your fund's Limited Partners.

Analyze a startup's potential from an investor's perspective, assessing its team, technology, market, and financials.

Apply common pre-money valuation techniques to early-stage companies with limited financial history.

Interpret and structure a venture capital term sheet, understanding the implications of key clauses.

Construct a basic financial model to project a startup's funding needs and potential valuation at exit.

Develop a coherent investment thesis and build a diversified venture portfolio aligned with that strategy.

Communicate investment recommendations persuasively, justifying the risk-reward profile to partners.

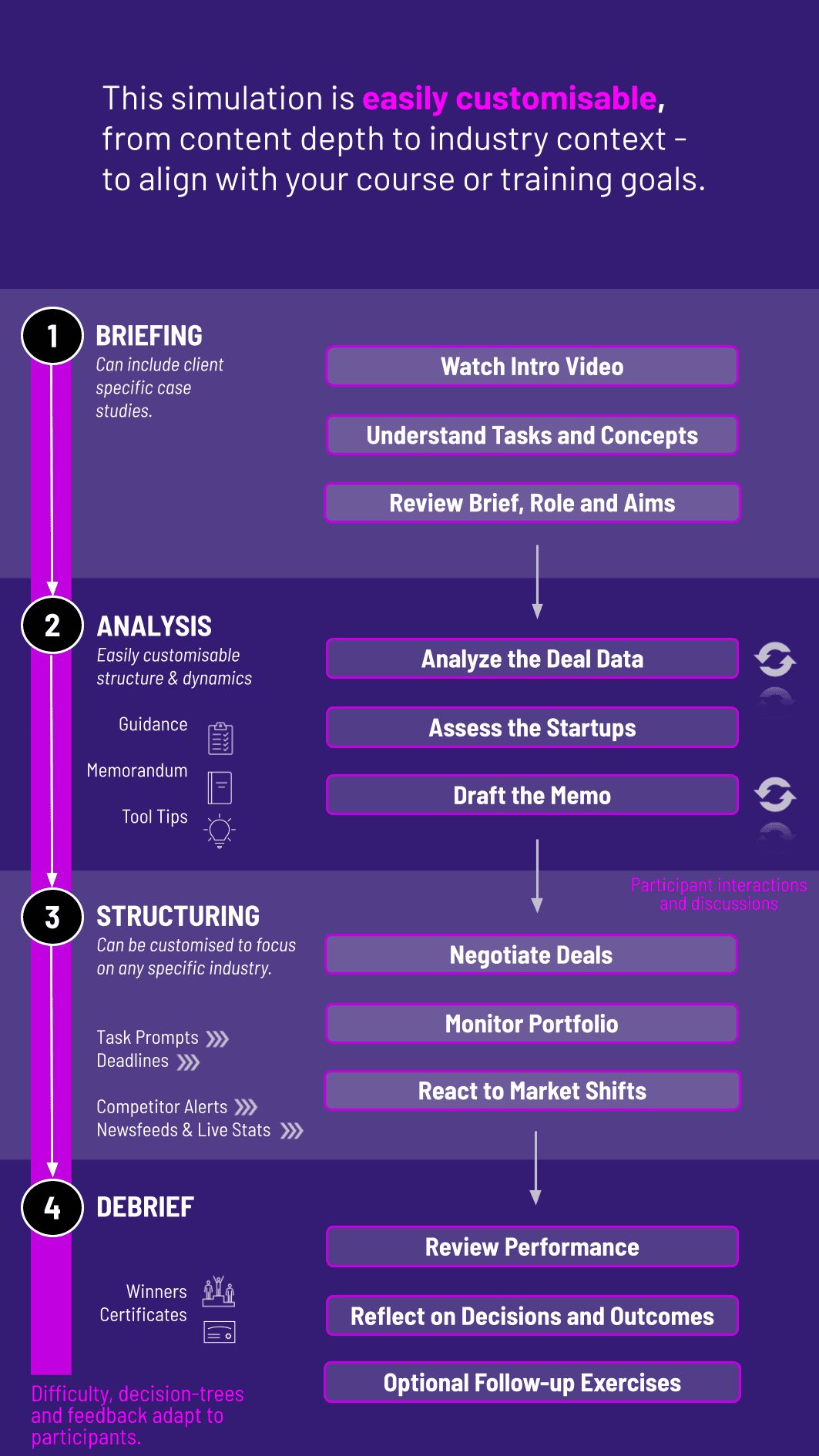

1. Team Formation Participants are grouped into VC firms, each with a fixed amount of capital.

2. Deal Sourcing The platform provides a dynamic deal flow with detailed startup profiles.

3. Screening and Analysis Teams screen startups, shortlist the most promising, and conduct in-depth due diligence using provided data rooms.

4. Investment Proposal Teams create a formal investment memo, including valuation, term sheet, and investment rationale.

5. Negotiation and Execution Teams negotiate terms (mock founder, controlled by facilitator) and formally "invest".

6. Portfolio Management As the simulation progresses through rounds, teams monitor their portfolio, decide on follow-on investments, and react to new company performance data.

Who is the Venture Capital Simulation designed for? It is ideal for MBA students, finance undergraduates, aspiring venture capitalists, entrepreneurs seeking to understand the investor mindset, and professionals in corporate venture or startup ecosystems.

Do I need prior finance or VC experience? While helpful, prior experience is not mandatory. The simulation includes foundational training on key concepts like valuation and term sheets, making it accessible to motivated learners with a strong interest in the field.

What is the time commitment for the simulation? The core simulation can be completed in an intensive 1-2 day workshop or spread over 2-4 weeks for a university course, typically requiring 10-20 hours of total participant engagement.

Is this a useful venture capital certification? Yes. Completing this simulation provides demonstrable, hands-on experience that is highly valued by VC firms. It shows you understand the practical workflow of an analyst, far beyond theoretical knowledge, making it a powerful addition to your resume and LinkedIn profile.

How does this VC simulation compare to a real-world VC internship? The simulation compresses years of deal experience into a short timeframe. While it doesn't replace the networking and mentorship of an internship, it provides a comprehensive, risk-free environment to apply the core analytical and decision-making skills required of a VC analyst.

What kind of startups will we be evaluating? The simulation features a diverse pipeline of startups across sectors like SaaS, FinTech, BioTech, and Deep Tech, reflecting the variety of deals a real VC fund would see.

Do we need to be good at financial modeling? Basic Excel proficiency is beneficial. The simulation is designed to help you improve your financial modeling skills in the context of startups, with guided templates and instructional support.

How is the winning team determined? Performance is primarily measured by the financial return (IRR) of your fund's portfolio. Judges may also consider the quality of your investment memos and the strategic coherence of your overall portfolio.

The final Internal Rate of Return (IRR) and Multiple on Invested Capital (MOIC) of your fund.

Quality of analysis, valuation justification

Clarity of recommendation for a selected investment.

Ability to secure favorable and fair terms during negotiations.

Contribution to your team's overall effort and strategy.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.