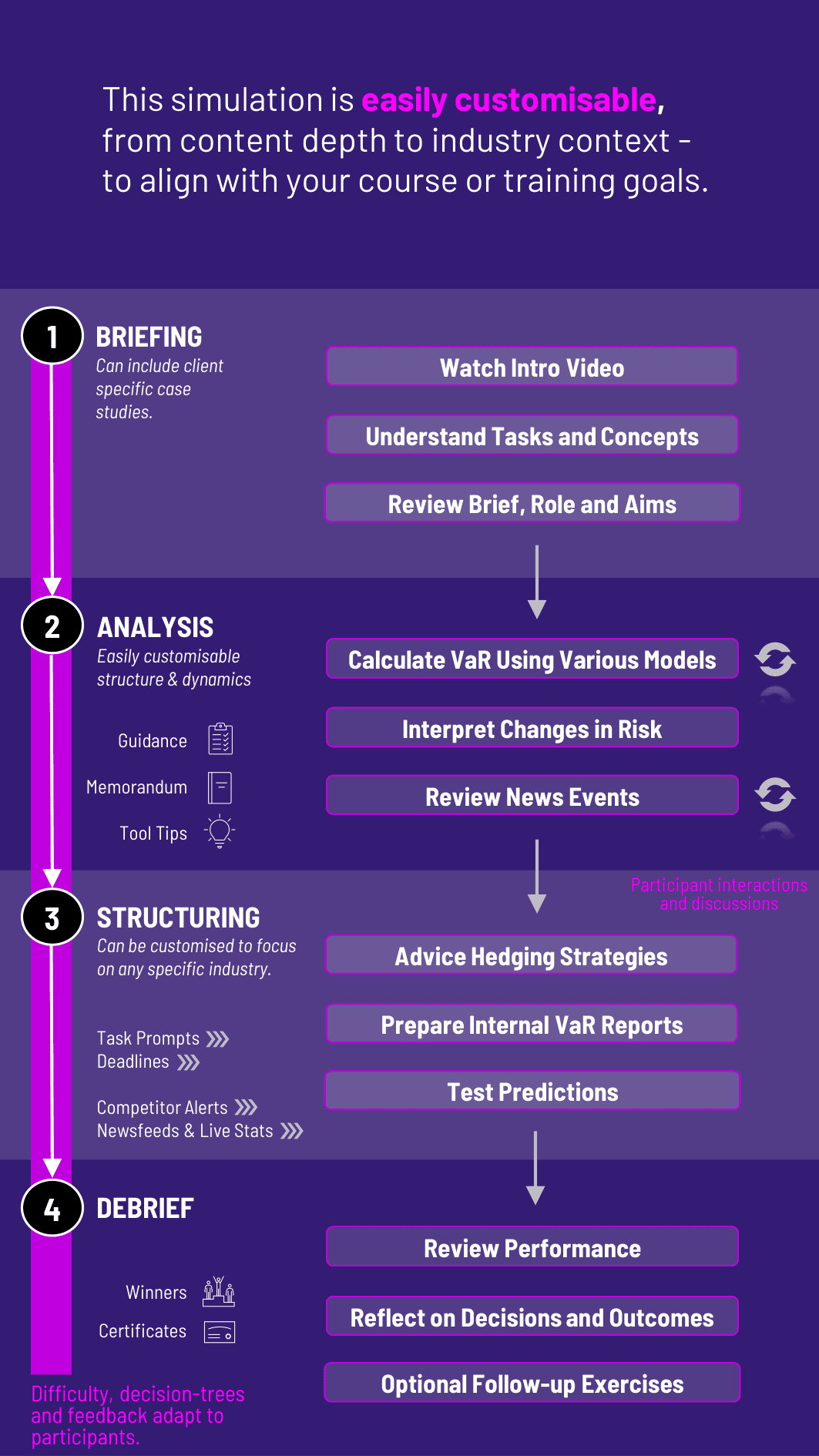

Students take control of portfolios under pressure - quantifying risk, stress-testing positions, and setting capital buffers - in our Value at Risk Simulation.

Value at Risk (VaR): Historical, variance-covariance, and Monte Carlo methods

Confidence Intervals and Holding Periods: Interpreting 95% vs 99% VaR

Portfolio Risk Aggregation: Diversification effects and correlation structures

Stress Testing: Evaluating the impact of extreme but plausible events

Capital Adequacy and Risk Limits: Setting limits and calculating economic capital

Backtesting VaR Models: Comparing predicted vs actual losses

Regulatory Context: Basel guidelines and internal model validation

Calculate VaR using different models and data sets

Interpret and explain changes in portfolio risk

Advise on hedging strategies or exposure reduction

React to news events and apply stress scenarios

Prepare internal VaR reports for simulated stakeholders (e.g., CRO, regulator)

Backtest VaR predictions against realized portfolio performance

This simulation transforms VaR from a static formula into a living risk management tool. Students will learn how to:

Understand and compare multiple VaR methodologies

Use VaR to identify vulnerable exposures in a portfolio

Make portfolio-level decisions under uncertainty

Justify capital buffers based on market volatility and correlation

Communicate technical results to non-technical audiences (boards, regulators)

Recognize the limitations and blind spots of VaR-based models

Do students need to know statistics or coding? Basic statistical concepts (mean, standard deviation, correlation) are useful. No coding is required - the simulation calculates models automatically and provides visual breakdowns.

Can instructors choose between different VaR models? Yes. You can choose historical, parametric (variance-covariance), or Monte Carlo simulation-based approaches depending on course depth.

How long does the simulation take? Typically 2–3 hours for a full VaR cycle, including stress tests and reporting. It can also be extended across multiple sessions for deeper analysis.

Group or individual play? Both are supported. Group play encourages role specialization (quant analyst, portfolio manager, compliance officer).

How is performance assessed? Based on accuracy of VaR calculations, effectiveness of responses to market events, and clarity of communication in risk reporting.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.