The ability to accurately value a business, an asset, or a project is the cornerstone of investment decisions. The Valuation Techniques for Investment Decisions Simulation is an immersive, hands-on learning platform that moves beyond textbook theory.

Intrinsic vs. Relative Valuation

Discounted Cash Flow Analysis

Comparable Company Analysis

Precedent Transaction Analysis

Leveraged Buyout Model

Cost of Capital

Terminal Value

Valuation Football Field

Due Diligence and Assumption Sensitivity

In the simulation, participants will:

Dive deep into historical income statements, balance sheets, and cash flow statements.

Construct a three-statement model to forecast future financial performance.

From unlevered free cash flow forecasting to terminal value calculation.

Research the market, select relevant peers and precedent transactions, and calculate valuation multiples.

Assess the feasibility of an acquisition under a leveraged buyout structure.

Create a comprehensive "football field" chart to present a compelling valuation range.

Present and justify your analysis, assumptions, and final investment recommendation to a simulated investment committee.

In some scenarios, teams may compete to acquire assets at the most accurate valuation, maximizing their simulated fund's returns.

Confidently apply the three core valuation methodologies to a real-world target.

Build a dynamic financial model to forecast a company's financial statements and free cash flows.

Critically assess the drivers of value within a business and identify the most sensitive assumptions in any model.

Calculate a company's cost of capital and understand its critical role in valuation.

Synthesize multiple, often differing, valuation outputs into a logical and defensible valuation range.

Develop the analytical and presentation skills necessary to communicate valuation findings effectively to senior management or clients.

Understand how different stakeholders view and calculate value.

Think and act like a professional investor or financial analyst, making decisions under uncertainty.

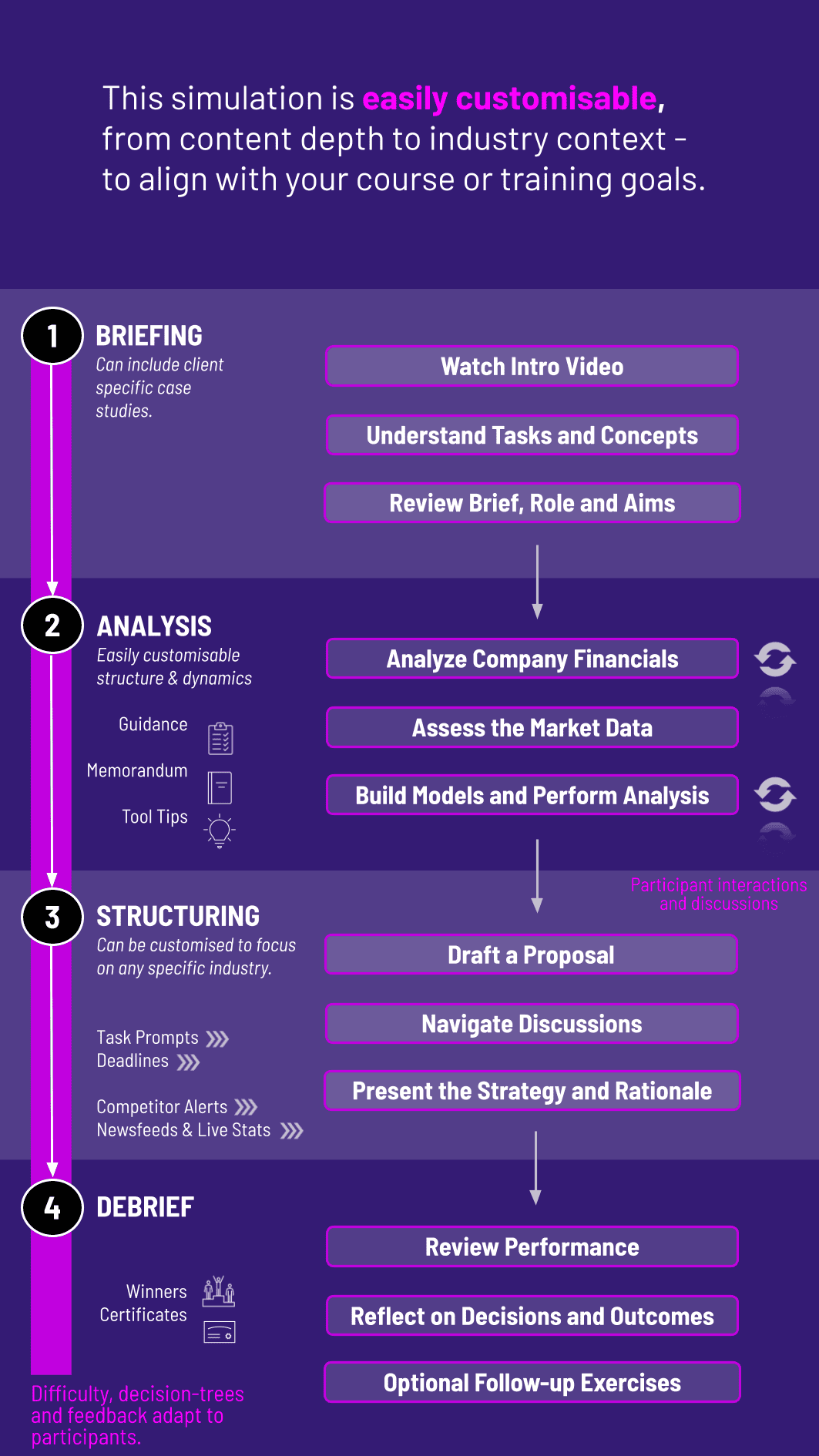

1. Team Formation and Briefing Participants are divided into analyst teams at a fictional investment firm. They receive a detailed case study, including company financials, industry reports, and market data.

2. Training and Toolkits Access is provided to our platform, which includes video tutorials, Excel templates, and a financial data engine to support the analysis.

3. The Analysis Phase Over several rounds, teams work collaboratively to analyze the provided data, build their financial models and perform DCF, Comparable, and Precedent Transaction analyses, input their assumptions, forecasts, and final valuation ranges into the simulation platform.

4. The Decision Phase Teams submit their final investment recommendation at a specific price based on their valuation range.

5. Debrief and Results The simulation concludes with a comprehensive debrief. The instructor reveals the "market outcome," compares team performances, and leads a discussion on the various valuation approaches, highlighting the strengths and weaknesses of each team's analysis.

What is the primary focus of this valuation simulation? This simulation provides a practical, hands-on experience in corporate valuation, specifically teaching participants how to value a company using Wall Street-standard techniques like DCF and Comparable Company Analysis for critical investment decisions.

Who is the target audience for this valuation training? It is ideal for MBA students, finance undergraduates, and professionals in roles such as investment banking, corporate development, private equity, and equity research who need to strengthen their valuation skills.

Do I need advanced Excel or finance experience to participate? While a basic understanding of finance and Excel is helpful, the simulation includes foundational training and templates to get all participants up to speed, regardless of their initial skill level.

What valuation methods are covered in the simulation? The simulation covers the three core methods: Discounted Cash Flow Analysis, Comparable Company Analysis, and Precedent Transaction Analysis. An introduction to LBO valuation is also often included.

How long does a typical simulation session last? Sessions can be tailored, but a typical program runs from 4 to 8 hours, which can be delivered in a single day or split across multiple sessions for deeper analysis.

Is this a competitive simulation? Yes, teams often compete to deliver the most accurate and well-supported valuation, mimicking the competitive nature of real-world investment firms and deal-making.

What kind of support materials are provided? Participants receive a comprehensive case study, financial data, Excel model templates, instructional videos, and access to a platform that facilitates the entire valuation process.

The technical soundness of the financial models and the logic behind the valuation calculations.

The quality of the research and rationale used to support key assumptions.

The ability to rationally reconcile different valuation outputs into a coherent and defensible range.

The clarity and persuasiveness of the final "buy" or "sell" recommendation and the proposed price.

Effectiveness in working as a team and communicating complex financial concepts clearly.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.