In the high-stakes world of finance, a company's true worth is not just a number but a strategic argument. This simulation provides a realistic environment for participants to bridge the gap between theoretical finance and practical application.

Intrinsic vs. Relative Valuation

Free Cash Flow to the Firm calculation.

Weighted Average Cost of Capital.

Terminal Value (Perpetuity Growth vs. Exit Multiple approaches).

Selection of an appropriate peer group.

Calculation and normalization of trading multiples (P/E, EV/EBITDA, EV/Sales).

Benchmarking and applying multiples.

Identifying relevant M&A transactions.

Analyzing control premiums and deal-specific multiples.

Financial Statement Analysis.

Sensitivity and Scenario Analysis.

In the simulation, participants will:

Analyze a detailed company and industry case pack.

Build a three-statement financial model to forecast future performance.

Construct a full DCF valuation from the ground up, including WACC calculation.

Conduct a Comparable Company Analysis by researching and selecting a peer group.

Perform a Precedent Transactions analysis using a provided deal database.

Reconcile the valuation ranges from the three methods to establish a target equity value.

Prepare a professional "Valuation Committee" presentation to defend your assumptions and final valuation.

Participate in a peer review and challenge session, simulating a real deal team debate.

Construct a robust, three-statement financial model to forecast a company's performance.

Calculate a company's intrinsic value using a DCF model, including defensible estimates for WACC and terminal value.

Execute a relative valuation using both trading and transaction comps, justifying peer selection and multiples.

Synthesize the outputs of DCF, Comparables, and Precedent Transactions into a coherent valuation range and recommendation.

Develop professional judgment by making and defending key valuation assumptions.

Communicate complex valuation findings effectively in a written report and oral presentation.

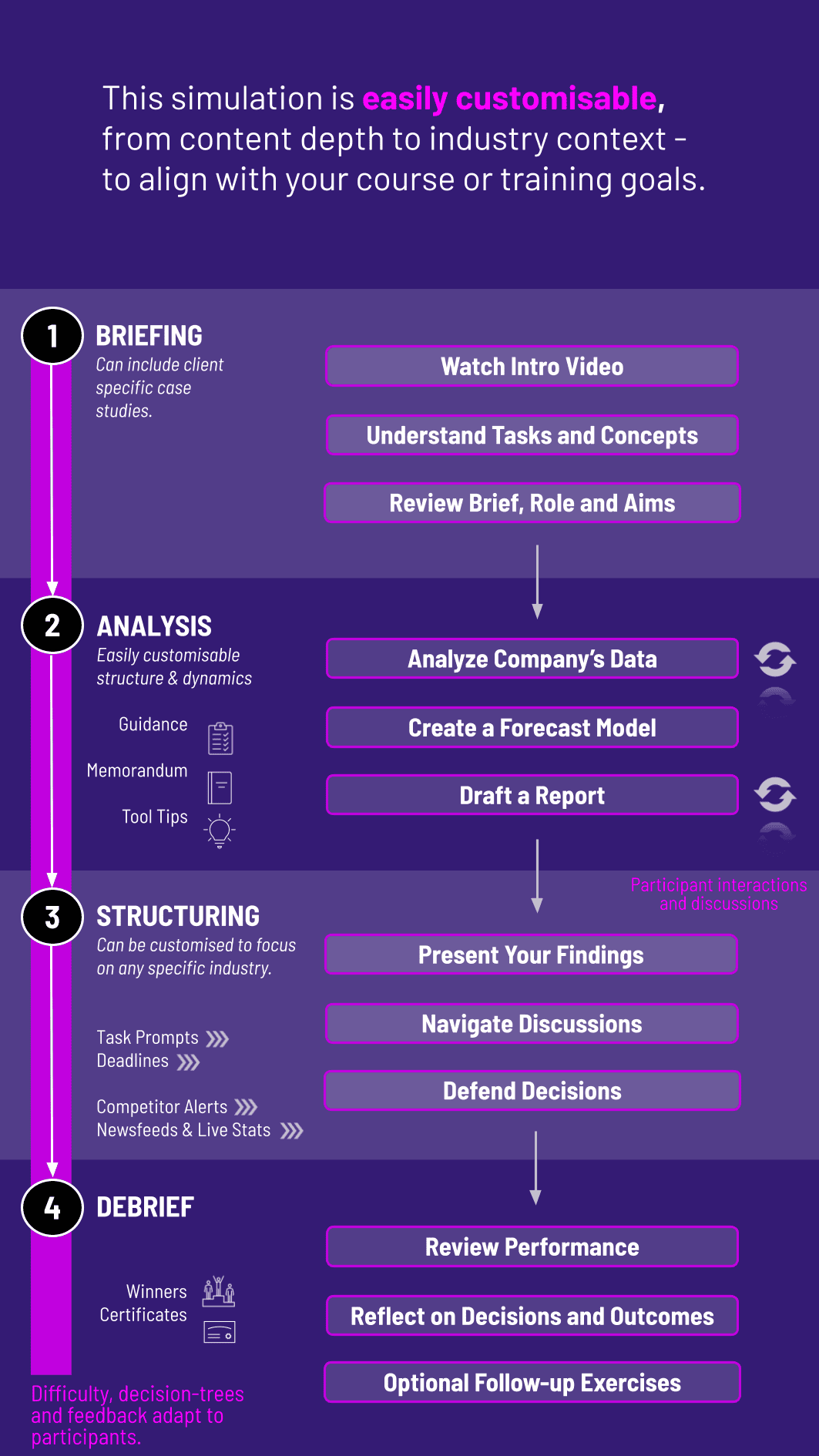

1. Preparation and Onboarding Participants receive the simulation case pack and access to our platform with refresher info on core valuation concepts.

2. Financial Modeling Phase Participants build the financial model based on historical data and provide management guidance.

3. Valuation Phase Participants work through the three core valuation methodologies in dedicated modules, inputting their analysis into a structured template.

4. Synthesis and Reporting The individual valuation outputs are consolidated into a final valuation range. Participants draft a summary report.

5. The Final Pitch Teams (or individuals) present their valuation to an "Investment Committee" (instructors or peers), defending their assumptions and facing challenging questions.

6. Debrief and Feedback A comprehensive debrief session is held, comparing different approaches and highlighting key learning takeaways. Personalized feedback is provided on the valuation model and report.

Is this valuation simulation suitable for beginners in finance? Yes. The simulation is designed with modular learning in mind. We provide foundational e-learning materials that cover the basics of financial statements, Excel, and valuation theory, making it accessible for motivated beginners while still challenging for those with more experience.

How long does it take to complete the full simulation? The simulation is designed to be flexible. For a university course, it can span 4-6 weeks. For corporate training, it can be run as an intensive 2-3 day workshop. Self-paced participants typically complete it in 20-30 hours.

Do we work individually or in teams? The simulation can be configured for either. We find that team-based participation (3-4 people) best replicates the collaborative environment of an actual investment banking deal team.

What kind of companies do we value in the simulation? We provide a library of case studies across different industries (e.g., Technology, Consumer Retail, Industrials) to keep the content relevant and engaging. This allows us to rotate cases and prevent answer-sharing. However, the simulation can be altered to tailor your specific industry.

How is the WACC calculated? Participants are guided through the full WACC calculation, including estimating Beta, Cost of Equity using CAPM, Cost of Debt, and the appropriate capital structure. The simulation provides real-world data sources (like Bloomberg terminal outputs) to inform these estimates.

Is there a "right" answer in the valuation simulation? Valuation is an art as much as a science. Therefore, there is a reasonable range for the company's value. Participants are assessed on the defensibility of their assumptions, the accuracy of their calculations, and the professionalism of their final output, not on hitting a single "correct" number.

Can this simulation be customized for our specific corporate training needs? Absolutely. We frequently customize the case company, industry focus, and valuation complexities to align with the specific learning objectives of corporate clients, such as focusing on valuation for M&A or for venture capital portfolio companies.

Accuracy, structure, and integrity of the DCF and comparable analyses.

Depth and logic of scenario analysis

Clarity and synthesis of the three valuation methods into a coherent investment thesis.

Ability to persuasively communicate key assumptions and defend the valuation under questioning.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.