Navigate the intricate world of international trade, mitigate risks, and finance global supply chains in this dynamic, hands-on simulation.

Incoterms

Letters of Credit

Documentary Collections

Supply Chain Finance and Receivables Discounting

Bank Guarantees and Standby LCs

Bill of Lading and Other Shipping Documents

Country and Counterparty Risk Analysis

UCP 600 and International Rules

Trade-based Money Laundering

Working Capital Cycle

In the simulation, participants will:

Evaluate requests from importers and exporters, assessing their creditworthiness and the risks of the transaction.

Decide whether to issue a Letter of Credit, provide a loan, or use documentary collections.

Interact with virtual clients to negotiate fees, interest rates, and collateral.

Scrutinize Bills of Lading, commercial invoices, and insurance certificates to ensure compliance with LC terms.

Build and manage a book of trade finance transactions, balancing risk and return.

Handle unexpected events like shipping delays, document discrepancies, and political turmoil.

Ensure all deals adhere to international standards and anti-money laundering protocols.

Explain the role and mechanics of key trade finance instruments in facilitating international trade.

Differentiate between the risks and responsibilities of importers, exporters, and their banks under different Incoterms and payment methods.

Structure appropriate trade finance solutions for a variety of real-world scenarios.

Analyze the credit, country, and documentary risks inherent in a cross-border transaction.

Apply the principles of UCP 600 to examine shipping and commercial documents for discrepancies.

Develop a strategic approach to managing a profitable and compliant trade finance portfolio for a bank.

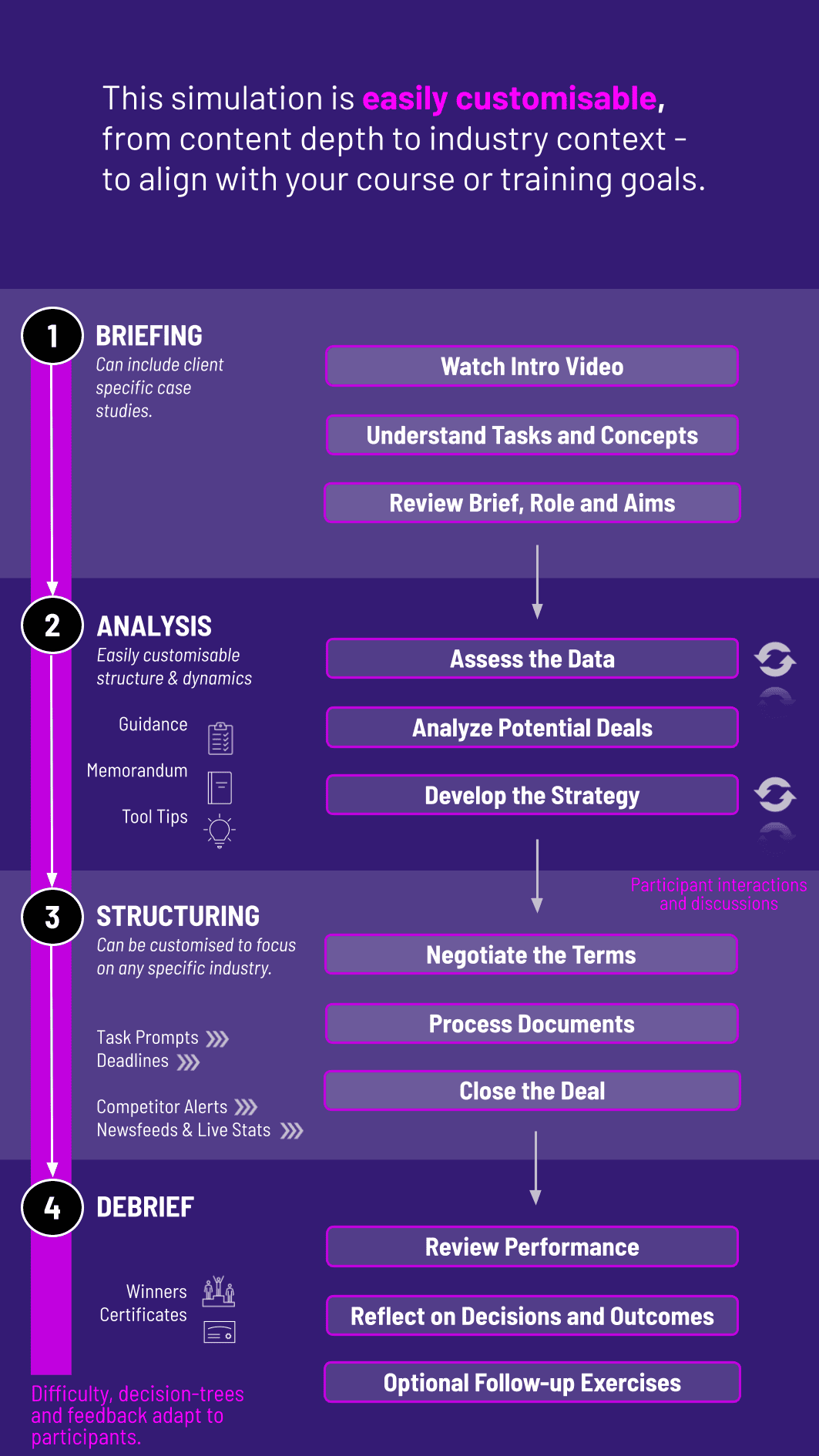

1. Brief and Role Introduction Participants are assigned the role of a Trade Finance Officer. Participants receive their objectives and an overview of the simulation platform. Brief, focused modules introduce core concepts like LCs and Incoterms, preparing participants for the deals ahead.

2. Deals Release The simulation presents participants with a dynamic pipeline of deals from various industries and countries. Participants must analyze each one.

3. Analysis Stage For each deal, participants choose the right instrument, negotiate terms, and approve the transaction. Participants will process documents and manage discrepancies.

4. Real-Time Shock Events The simulation includes a changing economic environment and random events that test participant’s risk management skills.

5. Final Deliverable Participants consolidate their findings, resolve outstanding issues, and prepare a final presentation for the mock committee, defending their opinion and key judgments.

What are the technical requirements? The simulation is 100% web-based and runs on any modern browser (Chrome, Safari, Firefox) with an internet connection. No special software is required.

Do I need prior experience in trade finance? No prior experience is necessary. The simulation includes foundational learning modules and is designed to build competency from the ground up.

How long does the simulation take to complete? The core simulation can be completed in 2-4 hours, but additional optional deals and advanced modules can extend the experience.

Is this simulation relevant for professionals? Absolutely. Understanding trade finance is critical for supply chain managers who need to ensure the smooth and financed flow of goods across borders. This simulation provides that essential cross-functional knowledge.

How does this help with a career in Commercial Banking? Trade finance is a fundamental and highly profitable service offered by commercial banks. Mastery of these skills makes a candidate exceptionally strong for relationship manager and product specialist roles within commercial banking.

Can this simulation be customized for a corporate training program? Yes, we offer customizations to reflect specific geographic regions, industries, and internal bank policies. Please contact us for a tailored proposal.

Profitability Score

Risk Management Index

Compliance and Accuracy Score

Portfolio Diversification

Assessment may incorporate peer and self-review components, facilitator scoring, and debrief discussion. Results may feed into grades, executive feedback, certification or development plans.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.