Time is not just money — it's your most valuable and finite resource. This simulation plunges participants into a high-pressure financial environment where effective time management is the critical differentiator between success and failure.

Eisenhower Matrix

Time Boxing

The Pareto Principle (80/20 Rule)

Cognitive Load Management

Opportunity Cost of Time

Delegation and Communication

Workflow Batching

In the simulation, participants will:

Triage a dynamic inbox with emails of varying urgency and importance.

Build and modify financial models under tight deadlines.

Prepare executive summaries and client-facing presentations.

Respond to real-time "interruptions" from senior management (simulated).

Make strategic choices on which projects to advance, delay, or delegate to a virtual junior analyst.

Track their time allocation and receive a detailed efficiency report.

Balance long-term project goals against daily firefighting.

Develop a personalized and effective time management system for a high-pressure work environment.

Apply prioritization frameworks to quickly assess and rank competing tasks.

Enhance personal productivity and output quality by minimizing procrastination and context-switching.

Improve decision-making under pressure by understanding the tangible costs of poor time allocation.

Communicate more effectively with team members and superiors about workload, deadlines, and potential delays.

Analyze their own performance data to identify personal productivity pitfalls and strengths.

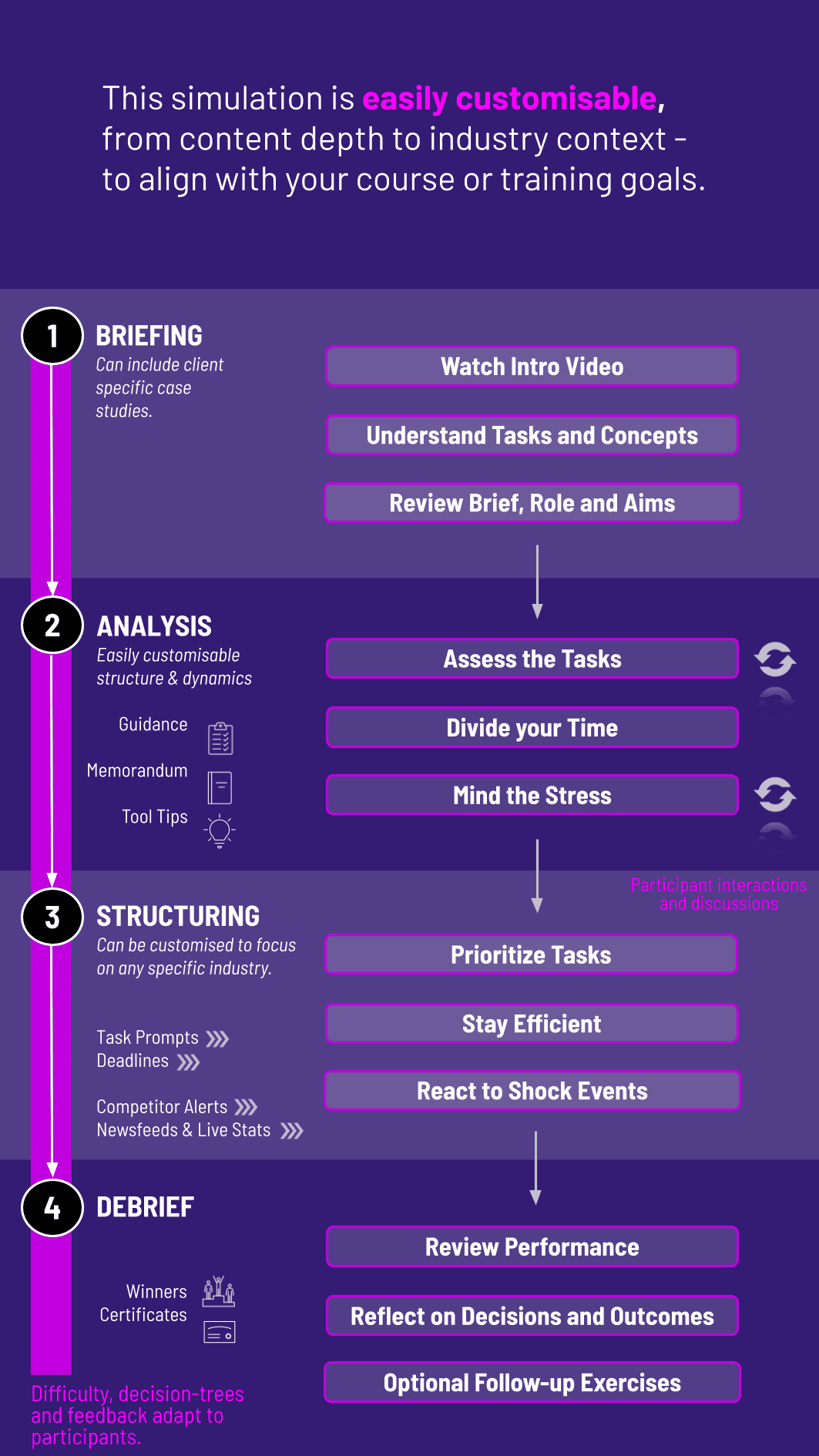

1. Introduction and Briefing Participants are introduced to their role as an analyst at a fictional asset management or investment banking firm.

2. The Simulation Hub They access a dashboard displaying their email, a to-do list, a calendar, and their energy meter.

3. Dynamic Scenario Unfolding Over several simulated days, tasks and requests are delivered in real-time. Each task has a stated deadline, importance level, and impact on the final score.

4. Strategic Execution Participants must decide what to work on, for how long, and in what order. Some tasks require deep focus, while others are quick wins.

5. Feedback and Scoring The platform provides a comprehensive Performance Report. This score is based not only on tasks completed but on the efficiency and strategic priority of their actions. Completing a low-priority task perfectly while missing a critical deadline results in a low score.

What is the duration of the simulation? The core simulation experience is designed to be completed in 2-3 hours, mimicking a few intense workdays. This can be integrated into a half-day or full-day workshop with the introduction and debrief.

Do I need prior finance knowledge? A basic understanding of financial concepts is helpful, as the tasks involve financial terminology. However, the primary focus is on time management strategy, not advanced financial modeling.

Is this simulation conducted in teams or individually? The standard format is individual participation, which allows for a personalized assessment of each participant's time management style. A team-based version can be explored for advanced corporate trainings.

What kind of technical support is provided? We provide comprehensive technical support throughout the simulation, including a pre-simulation tech check and live help during the session to ensure a seamless experience.

How is the simulation accessed? The simulation is 100% browser-based. Participants receive a unique login to access our secure online platform—no special software or downloads are required.

Can this simulation be customized for our specific company? Absolutely. We can customize the case background, company branding, and specific task types (underwriting vs. M&A tasks) to match your firm's unique environment.

What makes this different from a regular time management course? Traditional courses are theoretical. Our simulation provides hands-on, stressful, and realistic practice. You experience the consequences of your time management choices in a safe environment, leading to lasting behavioral change.

Efficiency Score

Priority Adherence Score

Quality Assurance Metric

Cognitive Load Report

Assessment may incorporate peer and self-review components, facilitator scoring, and debrief discussion. Results may feed into grades, executive feedback, certification or development plans.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.