Navigate the intersection of finance and technology. Deliver strategic IT solutions that drive value for major financial institutions.

IT Strategy and Digital Transformation

Business Requirements Gathering

Systems Analysis and Architecture

Cost-Benefit and ROI Analysis

Project Scoping and Phasing

Risk Management and Cybersecurity

Regulatory Compliance (e.g., GDPR, PSD2, Basel III)

Stakeholder Management and Presentation

Agile vs. Waterfall Methodologies

Vendor Selection and Management

In the simulation, participants will:

Conduct meetings to understand the client's pain points, strategic objectives, and operational bottlenecks.

Evaluate the client's existing IT infrastructure, data management, and software applications.

Create a detailed consulting proposal outlining your recommended solution, including architecture, implementation roadmap, and budget.

Justify the investment through rigorous financial analysis, projecting ROI, TCO, and key performance indicators.

Defend your strategy and recommendations in a high-pressure final presentation to the client's board (played by instructors or peers).

Respond to unexpected changes in client demands, budget cuts, and emerging technological risks.

Analyze complex business problems within financial institutions and translate them into technology requirements.

Design a coherent and practical technology strategy that aligns with business and regulatory goals.

Evaluate different technology solutions (e.g., Cloud Migration, AI/ML, Blockchain, API integration) based on cost, risk, and strategic fit.

Construct a compelling business case and financial model to secure client buy-in for a proposed IT investment.

Demonstrate effective client communication, teamwork, and executive presentation skills.

Understand the critical role of cybersecurity and data governance in financial technology projects.

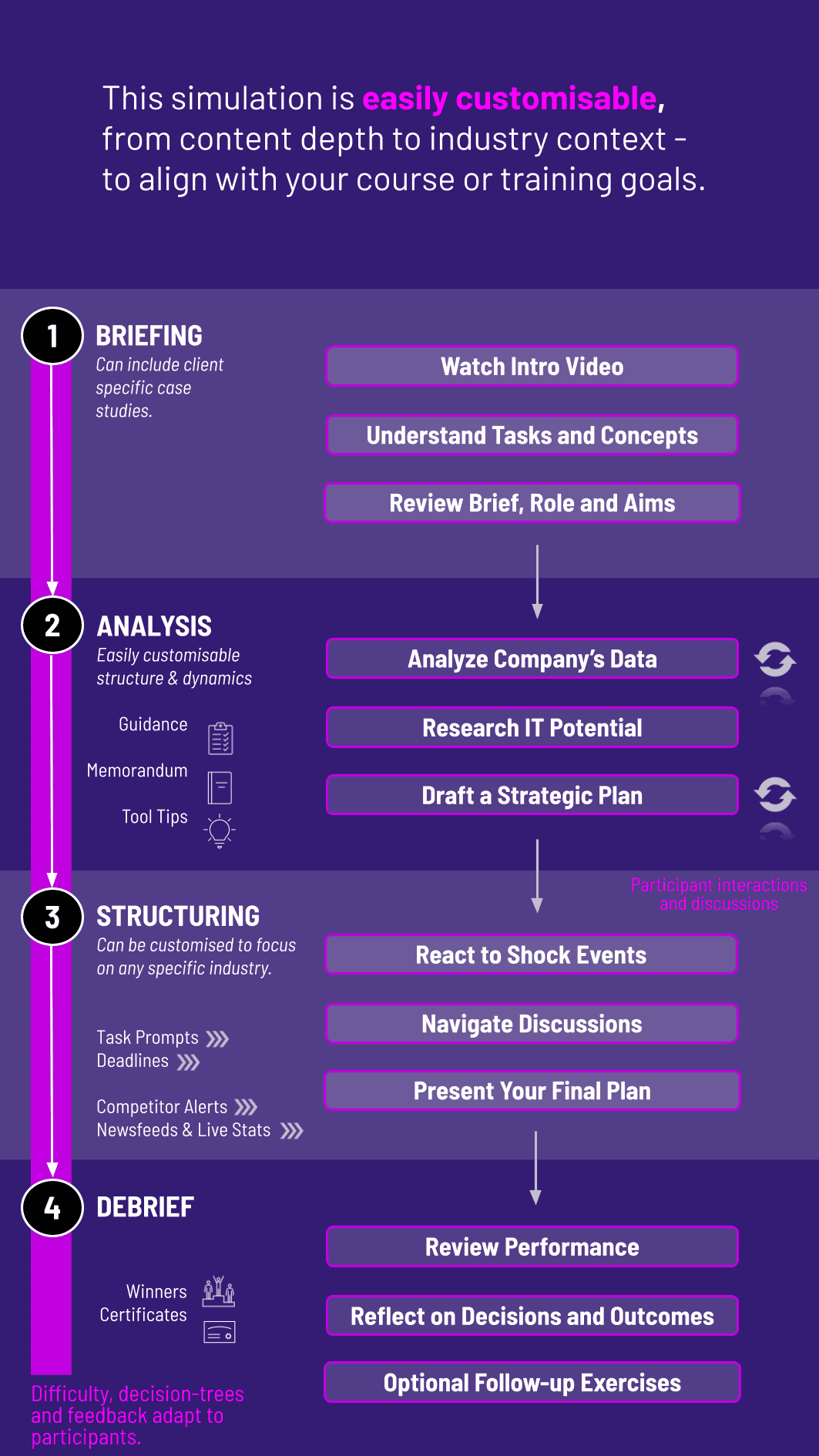

1. Team Formation and Briefing Participants are divided into consulting teams and receive a detailed case study of their financial client.

2. Initial Analysis Phase Teams research the client and industry, then conduct a simulated client meeting to gather initial requirements.

3. Strategy Development Phase Using the simulation platform, teams analyze data, evaluate technology options, and build their strategic proposal and financial model.

4. Proposal Submission Teams submit a formal proposal document outlining their solution, implementation plan, and budget.

5. Client Presentation and Q&A Each team presents their strategy to the "client board," followed by a rigorous Q&A session defending their recommendations.

6. Debrief and Feedback Instructors provide comprehensive feedback on the strategic, financial, and presentation aspects of each team's performance.

What makes this technology consulting simulation unique for finance? Unlike generic consulting simulations, this program is hyper-focused on the financial services industry, incorporating real-world regulatory pressures, legacy system challenges, and the specific technological drivers (like fintech disruption) that are unique to banks and asset managers.

Do I need a strong programming or IT background to participate? Not at all. The simulation is designed for business, finance, and management students. The focus is on strategic thinking, business analysis, and financial justification, not on coding or deep technical implementation.

What kind of financial institutions will we be consulting for? The simulation features a variety of cases, which may include a retail bank needing a digital transformation, an investment bank requiring a new risk analytics platform, or an insurance company looking to implement AI for claims processing.

How long does the simulation typically last? The simulation is highly flexible. It can be run as an intensive one-day workshop or extended over several weeks as part of a regular course curriculum.

Is this simulation relevant for careers outside of pure technology consulting? Absolutely. The skills learned are vital for anyone pursuing a career in fintech, investment banking (especially in fintech M&A), corporate IT leadership, product management, or any role where business and technology intersect.

How is the simulation delivered? Is it software-based? The simulation is completely web-based and doesn’t require any specific tools apart from a modern web-browser (Safari, Mozilla, Chrome).

Performance in the Technology Consulting in Finance Simulation is evaluated across multiple dimensions to reflect the multifaceted nature of consulting work.

Comprehensiveness, feasibility, and clarity of the proposed technology solution and implementation roadmap.

Accuracy of cost-benefit analysis, ROI/TCO calculations, and the financial justification for the investment.

Professionalism, structure, persuasiveness, and effective use of visual aids during the presentation.

Ability to think on foot, handle objections, and defend strategic choices under pressure from the "client".

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.