Confront realistic corporate tax scenarios, manage compliance deadlines, and make strategic decisions that directly impact the company's financial health and strategic goals.

Effective Tax Rate Management

Tax Provision and Financial Statement Impact

Intercompany Transactions and Transfer Pricing

Permanent vs. Temporary Differences

Tax Credits and Incentives

International Taxation

M&A Tax Strategy (Asset vs. Stock Deals, NOLs)

State & Local Tax Compliance

Tax Risk Management and Audit Defense

In the simulation, participants will:

Calculate the company’s quarterly tax provision under ASC 740.

Analyze the tax implications of proposed mergers, acquisitions, and internal restructuring.

Develop and document a transfer pricing policy for intercompany services.

Research and apply for relevant R&D and other tax credit programs.

Prepare and file simulated federal and state tax returns, ensuring accuracy and timeliness.

Respond to a tax audit notice, gathering supporting documentation and formulating a defense strategy.

Advise the executive team on the tax impact of key business decisions.

Monitor legislative changes and adapt the company’s tax strategy accordingly.

Interpret and apply core corporate tax principles to real-world business situations.

Calculate key tax metrics, including current and deferred tax expenses, and articulate their impact on the income statement and balance sheet.

Formulate tax-efficient strategies for domestic and international business operations.

Evaluate the tax consequences of mergers, acquisitions, and divestitures.

Manage the end-to-end corporate tax compliance cycle, from provision to return filing.

Communicate complex tax concepts and recommendations effectively to non-tax finance professionals and executives.

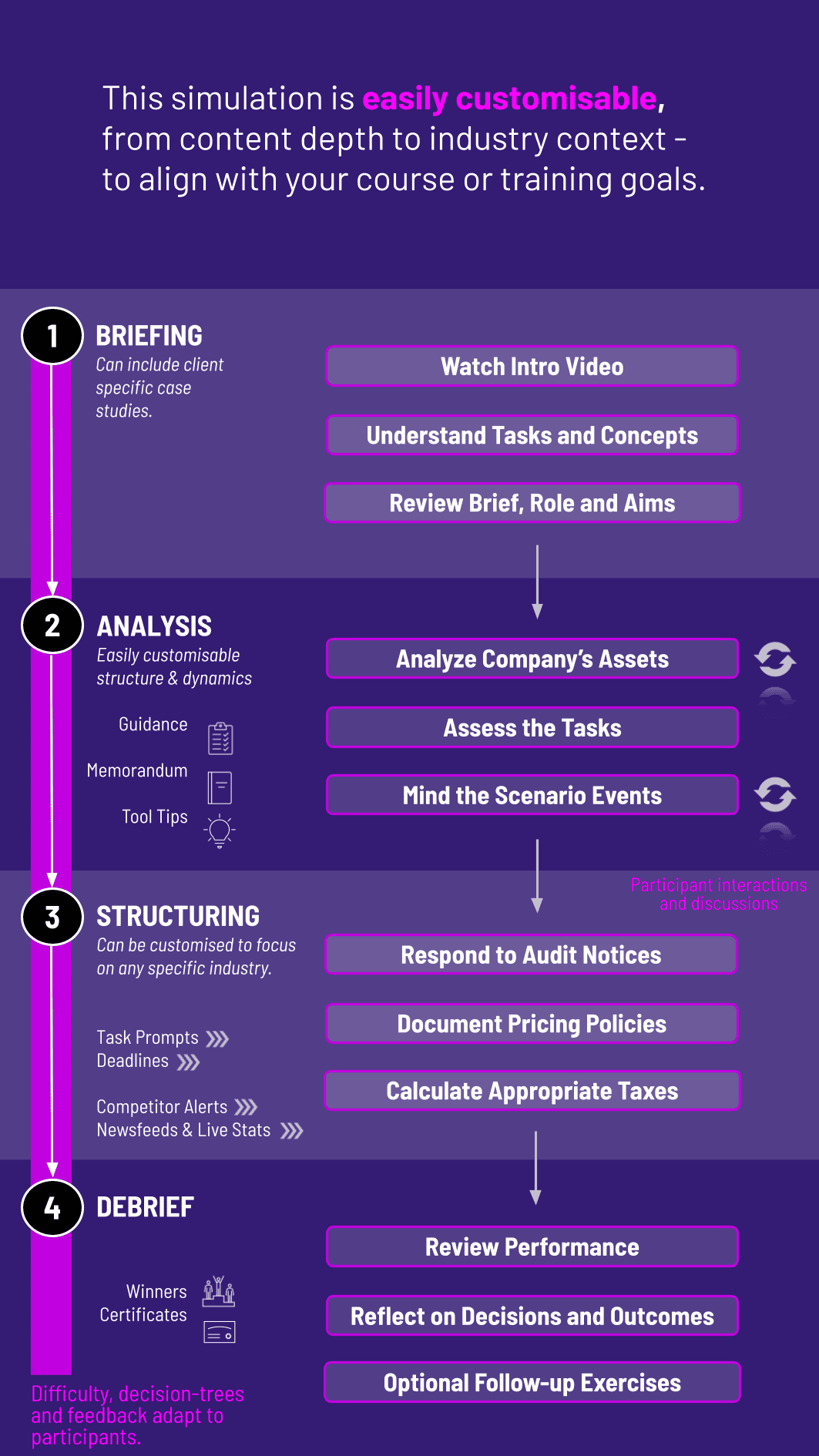

1. Introduction You receive a welcome package detailing the fictional company's current financials, tax profile, and strategic objectives.

2. Decision Rounds Each round represents a business quarter. You are presented with a new business event and a set of tax tasks.

3. Analysis and Input You analyze the scenario, perform necessary calculations (tax provision, projected liability), and input your strategic decisions into the platform.

4. Feedback and Results The simulation engine processes your inputs, producing a detailed report showing your company's new financial position, tax expense, cash flow impact, and any compliance risks or penalties incurred.

5. Progressive Complexity As the simulation progresses, scenarios become more complex, introducing international operations, M&A opportunities, and changing tax laws, requiring you to integrate and apply all learned concepts.

6. Debrief and Ranking A comprehensive final report summarizes your performance over all rounds, including your success in lowering the ETR, managing cash taxes, and avoiding penalties, with a ranking against your peers.

Who is the target audience for the Tax Analyst Simulation? This simulation is ideal for undergraduate and graduate students in accounting, finance, and MBA programs, as well as early-career professionals in corporate tax or public accounting looking to gain practical, strategic experience.

What are the technical requirements to participate? Participants only need a standard web browser and an internet connection. No specialized software or downloads are required.

Is prior tax knowledge required? A foundational understanding of basic accounting and corporate taxation is recommended. The simulation is designed to apply and deepen existing knowledge, though supplementary resources are provided for context.

How long does a typical simulation session last? A full simulation can be run over a multi-week academic course or condensed into an intensive 1-2 day workshop, depending on the depth of coverage and debriefing.

Can this simulation be customized for our specific curriculum? Absolutely. We can work with you to tailor certain business scenarios, adjust the difficulty level, or emphasize specific learning objectives to fit your course syllabus perfectly.

How does the simulation assess participant performance? Performance is quantitatively measured through a balanced scorecard including the company's Effective Tax Rate, cash tax savings, compliance accuracy, and successful defense of tax positions.

Do participants work individually or in teams? The simulation is flexible. It can be configured for individuals to foster deep personal understanding or for teams to encourage collaboration and debate, mirroring a real-world tax department structure.

Is this simulation relevant for CPA or other professional certification preparation? Yes. The simulation provides practical application of topics covered in the REG section of the CPA exam and other professional tax qualifications, enhancing retention and understanding of complex standards like ASC 740.

Ability to legally minimize the company's Effective Tax Rate and cash taxes paid over the simulation period.

Correct calculation and reporting of the quarterly tax provision, including deferred tax assets and liabilities.

Timely and accurate filing of all returns, along with successful management of audit triggers and penalties.

Quality of written justifications for key tax strategies and recommendations provided to the "executive team".

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.