Step into the world of leveraged finance with our Syndicated Loan Simulation: a high-intensity, real-world training scenario where participants act as lead arrangers, syndicate banks, and corporate borrowers.

Credit analysis and borrower risk assessment

Syndicate formation and roles

Loan structuring

Security and collateral

Covenants

Pricing and risk premia

Debt capacity and leverage ratios

Default risk, events of default, and remedies

Syndicated loan documentation and intercreditor agreements

Secondary trading and loan market liquidity

Relationship management between borrower and lenders

Negotiation dynamics among banks

In the simulation, participants will:

Conduct due diligence on the borrower and the underlying transaction.

Structure the initial loan facility.

Create the Information Memorandum to market the deal to potential lenders.

Propose pricing and underwrite the deal.

Actively syndicate the loan by pitching to and negotiating with Participant Banks.

Manage the book-building process and final allocation.

Analyze the credit risk of the borrower and the deal structure.

Assess the market-clearing price and the terms of the loan.

Negotiate with the Lead Arranger on pricing and allocation.

Decide on commitment levels based on risk-return appetite and relationship with the arranger.

Manage internal credit committee approvals.

Understand how syndicated loans are structured and underwritten.

Analyze borrower credit risk and determine appropriate leverage levels.

Negotiate and design loan covenants and documentation.

Coordinate a lending syndicate and balance risk among participating banks.

Price a loan facility appropriately, balancing yield and risk.

Assess and manage default risk, including covenant triggers, waiver decisions, and restructuring options.

Appreciate intercreditor dynamics and how banks align incentives.

Communicate complex loan terms clearly to both lenders and borrowers.

Reflect on the trade-offs between borrower needs and lender risk.

Build confidence in leveraged finance decision-making in a multi-stakeholder environment.

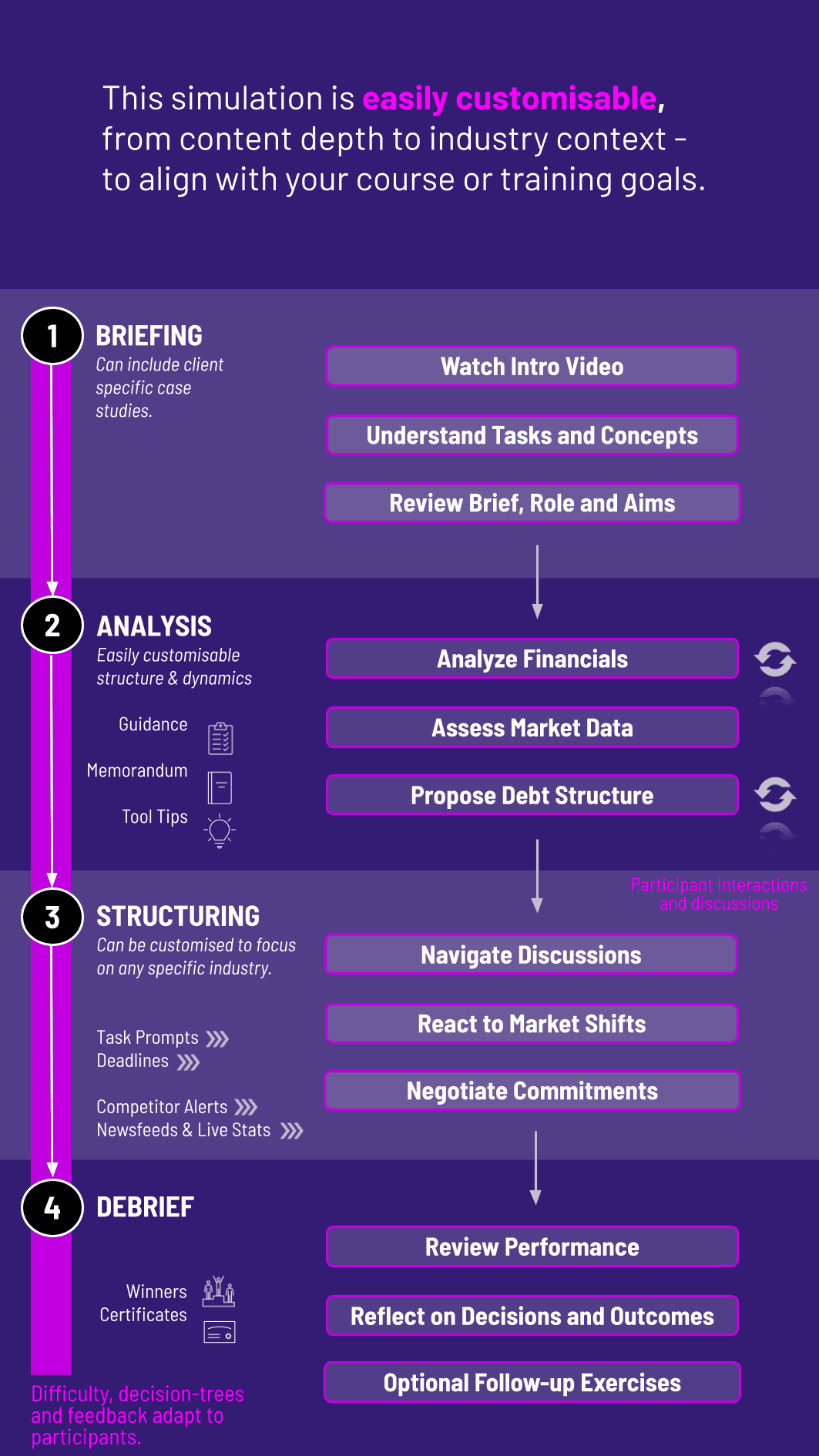

1. Setup and Briefing Participants are grouped into teams, assuming roles such as lead arranger, co-arranger, participant bank, or borrower. Each team receives detailed documentation: borrower financials, business plan, market context, and risk parameters.

2. Analysis Phase Teams perform credit analysis, forecast cash flows, and determine debt capacity.

3. Syndicate Formation The lead arranger proposes a syndication strategy and invites other banks to join.

4. Structuring and Pricing Teams collaboratively design loan structure, covenants, collateral, tenor, and price the loan.

5. Negotiation Banks negotiate commitments, fees, covenants, and documentation terms.

6. Documentation and Commitments Finalize the term sheet; banks commit their portion and sign intercreditor agreements.

7. Stress Testing The simulation presents stress scenarios (e.g., financial downturn, covenant breach) requiring decisions on waivers, amendments, or restructuring.

8. Closing Teams finalize the deal and submit a term sheet and a deal memo.

Who is this simulation designed for? This simulation is ideal for students in MSc, MBA, or advanced BSc finance programs, as well as early-career banking professionals interested in leveraged finance, credit analysis, and syndicated lending.

Do participants need prior experience in banking or credit analysis? No prior specialized experience is required. The simulation includes onboarding materials and guided tasks, although a basic understanding of financial statements and corporate finance helps.

How long does the Syndicated Loan Simulation take? Typically, the simulation runs for 3–5 hours, depending on the depth of structuring, negotiation, and stress-testing phases.

Is the simulation individual or team-based? It is primarily team-based. Participants play different roles to mirror real-world syndication dynamics.

Can the simulation be customized to different learning goals? Yes. Instructors can tailor scenarios to emphasize credit risk, covenant design, syndication strategy, negotiation, or stress-testing, depending on course objectives.

What kind of assessment is provided? Assessment covers credit analysis quality, structure and pricing logic, negotiation performance, documentation robustness, and stress-response strategies. The simulator provides real-time feedback and scoring.

Are real-world or historical data used in the simulation? The simulation uses realistic, anonymized case data, designed to reflect real-world financials, market conditions, and corporate profiles.

What roles does this simulation prepare participants for? Participants gain experience relevant to careers in investment banking, credit risk, corporate banking, debt syndication, and structured lending.

Deal Structuring Quality

Accuracy and depth of cash-flow forecasts, leverage assessment, and default risk.

Was the loan priced to reflect risk appropriately; how fees and spreads were balanced.

Success in recruiting participants, achieving alignment, and managing intercreditor relationships.

Favorability of terms achieved via negotiation (covenants, documentation).

Performance under stress-test scenarios; decisions on waivers, amendments, or restructuring.

Clarity and completeness of the final term sheet and deal memo.

Ability to reflect on the deal process, justify decisions, and adapt strategies in subsequent rounds.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.