Students take on the role of sustainable finance professionals, evaluating ESG data, allocating capital, and balancing impact with returns under real-world pressures with our sustainable finance simulator.

The Sustainable Finance Simulation empowers students to navigate the intersection of finance and sustainability, simulating the challenges of aligning investment and capital allocation decisions with environmental, social, and governance (ESG) objectives.

Students take on the role of financial professionals in investment firms, development banks, or corporate finance teams, where they must analyze opportunities, manage stakeholder expectations, and evaluate impact alongside financial returns.

It’s designed to give learners a grounded understanding of how sustainability is reshaping global finance, preparing them for roles in ESG investing, green finance, corporate sustainability, and beyond.

Who should take this sustainable finance simulation? It’s ideal for finance, sustainability, economics, and business students aiming to work in ESG, impact investing, or corporate responsibility roles.

Do I need prior ESG knowledge? No. The sustainable finance simulation provides guidance, definitions, and tools suitable for both beginners and advanced learners.

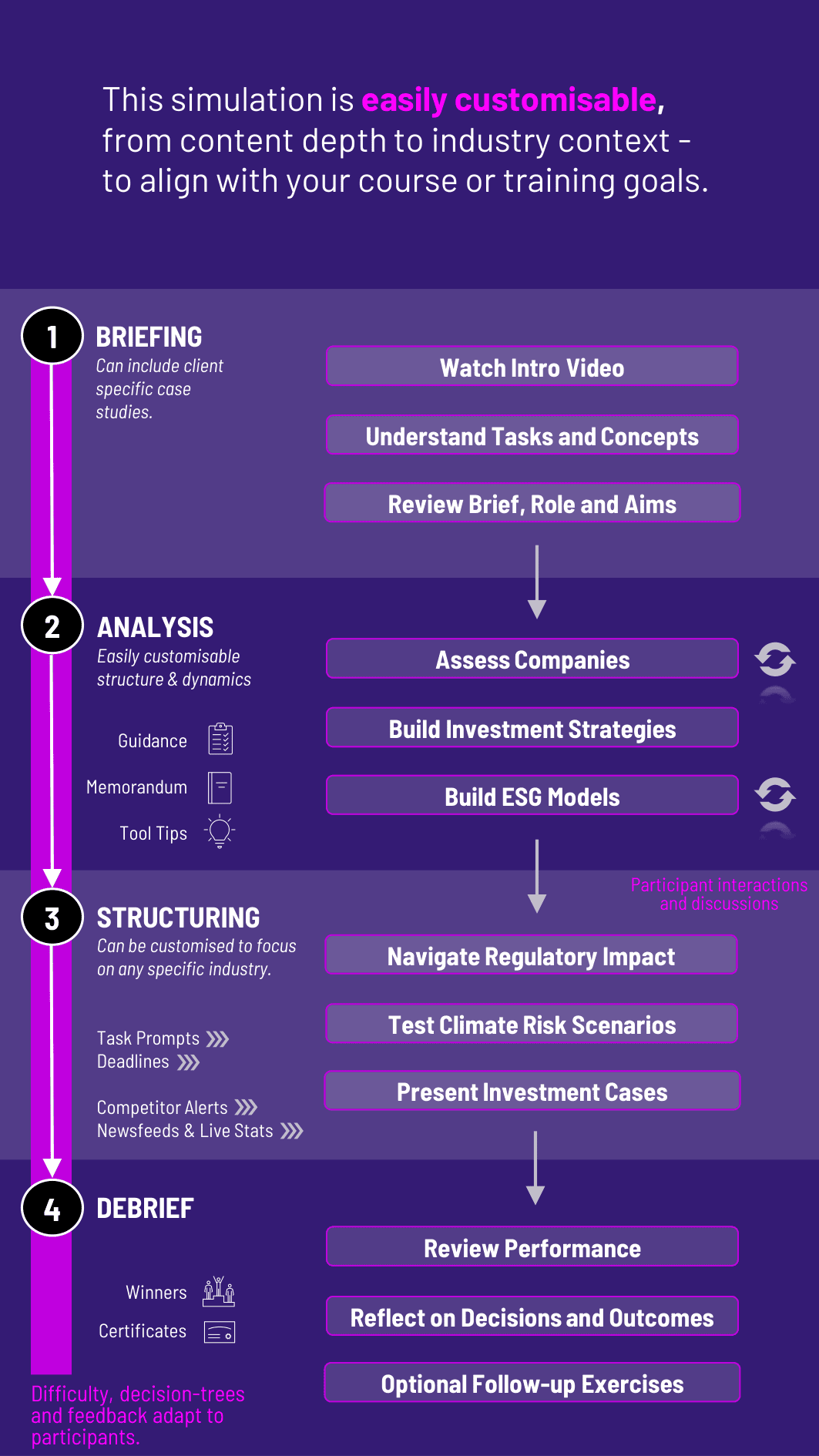

How long does the simulation last? Typically 4-6 hours, but it can be customized to shorter or extended formats based on curriculum needs.

Is this sustainable finance simulation data-driven? Yes. Participants work with ESG ratings, emissions data, and regulatory benchmarks.

Can this be used in sustainability-focused or finance-focused courses? Absolutely - it’s designed to bridge both areas and can be adapted to different academic goals.

**Does the sustainable finance simulation involve team collaboration?Yes, it can be run individually or in teams, promoting real-world negotiation and consensus-building.

What are the assessment components? Students are evaluated on capital allocation logic, ESG integration, communication, and impact measurement.

Is any coding or software required? No. The sustainable finance simulation is entirely web-based with an intuitive user interface.

Can instructors customize the industry or region focus? Yes. Instructors can choose from different sectors (e.g., energy, real estate) and regional case studies.

What careers does this support? The simulation prepares students for ESG investing, corporate sustainability, sustainable banking, development finance, and public-private partnerships.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the sustainable finance simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the sustainable finance simulation can benefit you.