This simulation places you at the helm of a dedicated Sustainability Services team. Compete to deliver the most effective and profitable ESG solutions to a diverse set of corporate clients, balancing financial returns with positive real-world impact.

ESG Integration

Green Bonds and Sustainability-Linked Bonds

Sustainability-Linked Loans

Carbon Markets and Carbon Credit Financing

Impact Investing and Measurement

ESG Risk Assessment and Due Diligence

EU Sustainable Finance Disclosure Regulation and Taxonomy

Task Force on Climate-related Financial Disclosures

Socially Responsible Investing

Greenwashing vs. Authentic Impact

In the simulation, participants will:

Assess the ESG performance and risks of various corporate clients across different industries.

Design and price tailored sustainable finance products to meet client-specific needs.

Develop and deliver compelling proposals to a simulated client board, justifying the financial and sustainability merits.

Ensure all proposed solutions comply with evolving global sustainability reporting standards and regulations.

Allocate the team's budget for research, marketing, and deal execution to maximize profitability and market share.

Define and track key performance indicators to measure the success of implemented solutions.

Analyze the ESG profile of a company and identify key financial risks and opportunities.

Differentiate between various sustainable finance instruments and their appropriate applications.

Structure a basic term sheet for a sustainable finance product, linking financial terms to ESG performance targets.

Evaluate the credibility of corporate sustainability claims to mitigate the risk of greenwashing.

Articulate the business case for sustainable finance to both clients and internal stakeholders.

Interpret the core requirements of major sustainability frameworks and regulations.

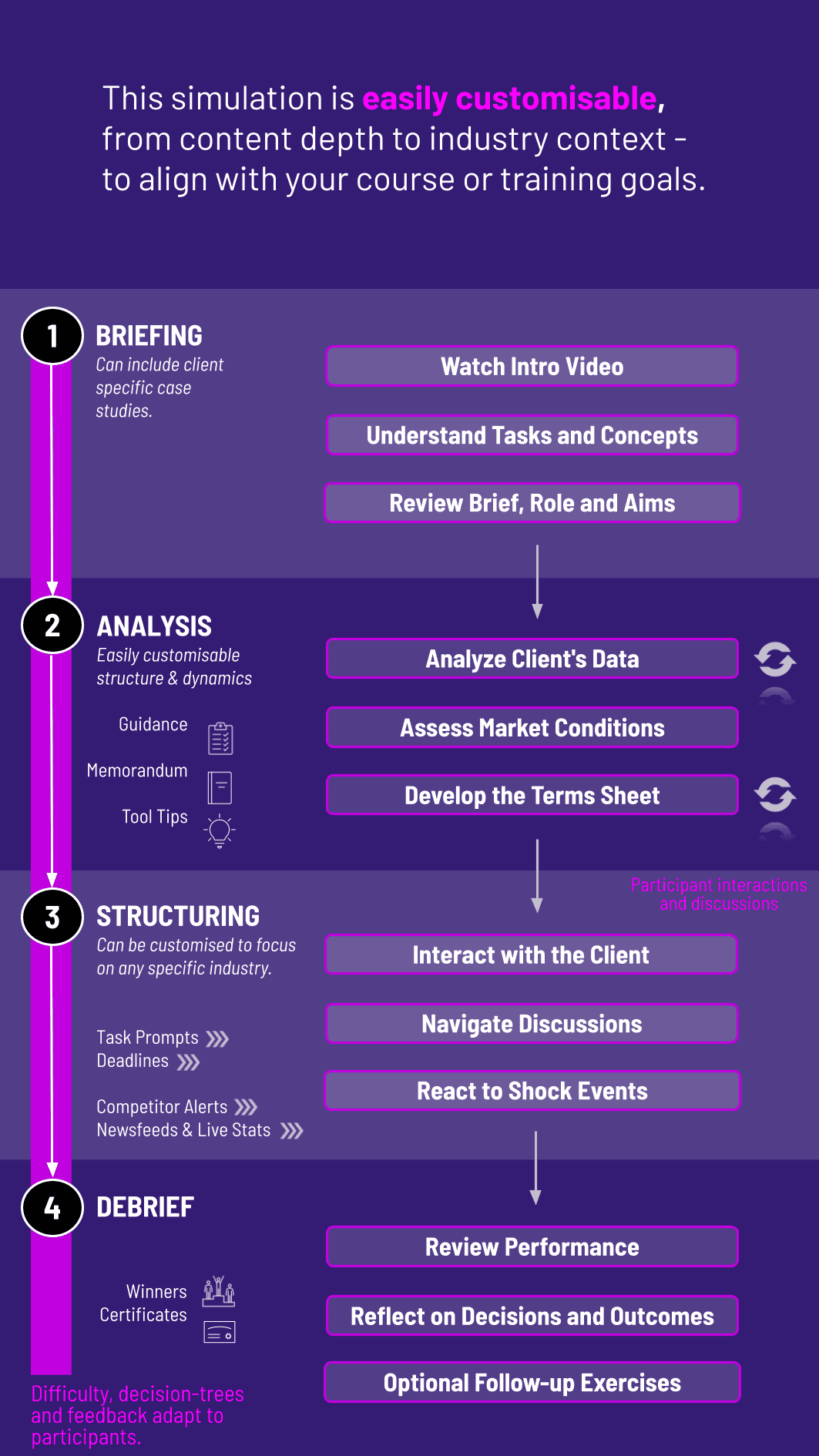

1. Setup Teams are formed and given a virtual budget and initial market data.

2. Client Rounds Each round, a new set of client RFPs (Request for Proposals) is released. Clients vary in industry, size, and sustainability maturity.

3. Analysis and Strategy Teams analyze the clients, research market conditions, and decide which mandates to pursue. They must allocate their limited resources wisely.

4. Solution Design For each chosen client, teams design a detailed proposal, selecting the right financial instrument, setting terms, and linking them to specific ESG KPIs.

5. Pitching and Scoring Teams submit their proposals. The simulation engine, combined with peer assessment or facilitator evaluation, scores the proposals based on Financial Soundness, ESG Impact, Strategic Fit, and Regulatory Compliance.

6. Results and Feedback A round debrief shows team rankings, profitability, and detailed feedback on their proposals, allowing them to refine their strategy for the next round.

Who is the target audience for this finance simulation? This simulation is ideal for MBA students, finance professionals, investment bankers, corporate bankers, and anyone in asset management or consulting looking to gain practical, hands-on experience in the rapidly growing field of sustainable finance.

What prior knowledge of ESG or sustainable finance is required? No prior expertise is needed. The simulation includes foundational learning materials on key ESG concepts and financial instruments, making it accessible for beginners while providing depth for those with more experience.

How does this simulation differ from a traditional finance simulation? Unlike traditional simulations focused purely on profit, this program introduces a dual mandate: achieving financial returns while generating verifiable positive environmental and social impact, mirroring the complex trade-offs in today's market.

What sustainable finance instruments are covered in the simulation? Participants will engage with major instruments including Green Bonds, Sustainability-Linked Loans, and strategies for carbon credit trading and impact investing portfolios.

How is "impact" measured and scored within the simulation? Impact is scored based on the alignment of proposals with recognized frameworks, the ambition and measurability of set ESG targets, and the overall credibility of the sustainability strategy to avoid greenwashing.

Can this simulation be used for corporate training? Absolutely. It is an excellent tool for upskilling teams in commercial banks, investment banks, and asset management firms, ensuring they are equipped to meet client demand for sophisticated ESG-linked financial solutions.

What technical requirements are needed to run the simulation? The simulation is browser-based and requires only a stable internet connection. It is compatible with all modern web browsers on desktops, laptops, and tablets, ensuring easy accessibility for all participants.

The financial success of the team's Sustainability Services division.

The quality and authenticity of the environmental and social impact generated by the team's deals.

Ability to win mandates and build a trusted brand.

The strategic coherence, clarity, and compliance of submitted client proposals, often including peer evaluation components.

Ability to adapt and revise valuations in light of news shocks or changes.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.