Participants manage supplier relationships, working capital, and financing decisions across global trade networks in our Supply Chain Finance Course.

Working Capital Management: Managing payables, receivables, and inventory

Trade Credit Terms: Net terms, early payment discounts, and deferred payment structures

Supply Chain Financing Tools: Reverse factoring, dynamic discounting, and supplier financing

Cost of Capital and Liquidity: Evaluating trade-offs between cash preservation and supplier support

Supplier Risk Assessment: Creditworthiness, concentration, and geographic exposure

Bank and Fintech Partnerships: Structuring third-party solutions

ESG and Resilience Considerations: Balancing cost, ethics, and supplier health

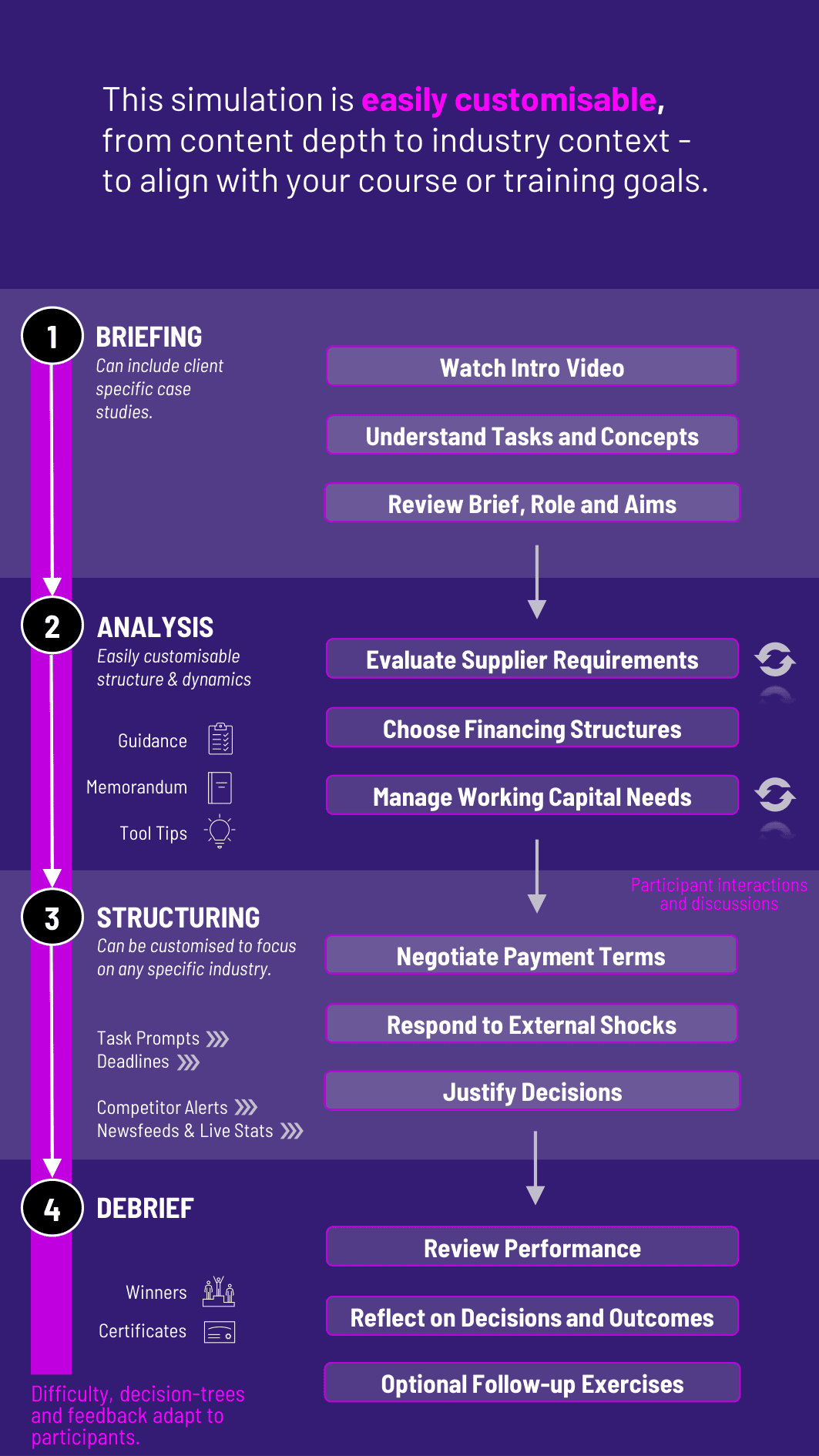

Evaluate supplier needs, liquidity positions, and strategic importance

Negotiate payment terms and financing arrangements with suppliers and banks

Choose between self-funded or third-party financing structures

Respond to external shocks (e.g. raw material shortages, currency devaluation, or supplier insolvency)

Optimize working capital while maintaining supplier health and relationships

Justify decisions in board memos or supplier review meetings

This course teaches participants how finance and operations decisions interconnect. Participants learn to:

Manage liquidity not just internally, but across the entire supply chain

Structure financing arrangements that support both buyer and supplier

Weigh cost of capital against supplier reliability and continuity

Apply ethical and strategic thinking to supplier relationships

Collaborate across functions to align procurement, treasury, and strategy

Communicate trade-offs and results clearly to financial and operational stakeholders

Do participants need background knowledge in supply chain or finance? No prior specialization is needed. A basic understanding of working capital and supplier dynamics is helpful, and all key concepts are introduced in the course.

What types of suppliers are included? The course includes domestic and international suppliers with varied financial health, strategic importance, and pricing power.

Does the course include ESG or sustainability considerations? Yes. Participants must consider how their financing and negotiation decisions impact supplier resilience, local communities, and sustainability commitments.

Are participants exposed to multiple financing instruments? Yes. The course includes reverse factoring, dynamic discounting, bank credit lines, and self-funded early payment models.

Is this course team-based or individual? Both formats are available. Team-based play allows participants to divide roles (e.g. procurement lead, treasury officer, finance analyst) and negotiate strategies together.

Can this be customized for specific industries (e.g. retail, manufacturing)? Yes. Instructors can choose industry-specific supplier chains with relevant cash cycles, pricing terms, and operational challenges.

How long does the course take? 5 to 6 hours for a standard session. Longer formats can be used to simulate full-quarter decision cycles and long-term supplier outcomes.

How is participant performance measured? Based on working capital optimization, supplier retention, cost of capital, and the quality of rationale in stakeholder reports or presentations.

Does it involve negotiation or communication tasks? Yes. Participants must justify payment terms and financing choices in memos, supplier calls, or stakeholder updates - building soft skills alongside technical ones.

Can it be integrated into finance, operations, or ESG-focused courses? Absolutely. The course is cross-functional by design and works well in corporate finance, supply chain strategy, and sustainable business programs.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the course.

or

Book a 15-minute Zoom demo with one of our experts to explore how the course can benefit you.