Become the master of Financial Engineering and Securitization. Learn to create, analyze, and trade complex securities like Collateralized Debt Obligations and Mortgage-Backed Securities.

Securitization and SPVs

Tranching: Equity, Mezzanine, and Senior Notes

Credit Enhancement Techniques

Cash Flow Waterfall Structures

Credit Default Swaps and Synthetic Structures

Yield, Duration, and Convexity

Prepayment Risk and Default Modeling

Credit Ratings and Agency Interactions

Portfolio Theory and Diversification

Mark-to-Market vs. Hold-to-Maturity Accounting

In the simulation, participants will:

Source and Analyze a pool of underlying assets (corporate bonds, mortgages).

Design the Capital Structure by creating multiple tranches with different risk/return profiles.

Price the Tranches based on their seniority, credit enhancement, and target investor appetite.

Interact with Credit Rating Agencies to seek ratings for your structured notes.

Trade Securities in a live market, reacting to economic data and news events.

Manage a Portfolio of structured products, making strategic buy/sell/hold decisions.

Analyze Performance using key metrics like IRR, NPV, and default rates.

Compete against other teams to achieve the highest risk-adjusted returns.

Explain the end-to-end process of securitization and the role of each participant.

Design a viable capital structure for a pool of assets, defining the rights of each tranche.

Evaluate the risk and return characteristics of different structured finance products.

Apply credit enhancement techniques to improve a tranche's rating and marketability.

Analyze the impact of economic changes (interest rates, default rates) on structured product performance.

Synthesize complex financial information to make informed investment and structuring decisions.

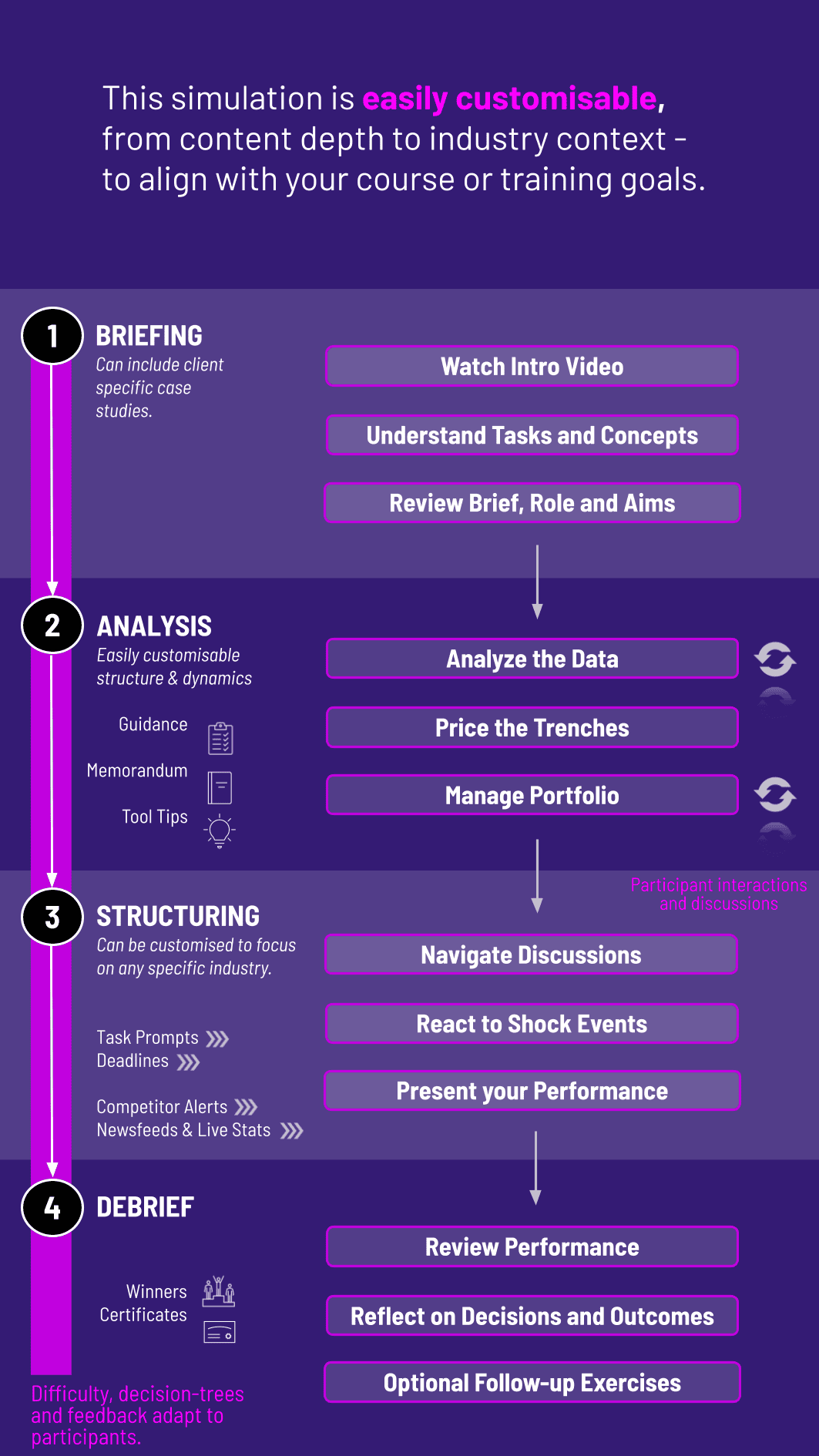

1. Setup and Asset Sourcing Participants are divided into teams, each running their own structured finance desk. They receive initial capital and a mandate. In each round, teams review and bid on pools of underlying assets available in the market.

2. Structuring Using the simulation's intuitive interface, teams design their securities, setting the size, priority, and coupon for each tranche.

3. Pricing and Issuance Teams must price their tranches attractively to sell them to the simulated investor community.

4. Trading and Management A live market opens where teams can trade their own and others' securities, managing their portfolio based on live news feeds and economic data.

5. Reporting and Analysis At the end of each round, detailed performance reports are generated, showing cash flows, defaults, and mark-to-market valuations.

What is structured finance in simple terms? Structured finance involves bundling various financial assets (like loans) together and then slicing this bundle into new securities that are sold to investors. Each slice has a different level of risk and return.

Do I need prior experience in structured finance? While a basic understanding of finance is helpful, it is not required. The simulation includes preparatory materials and is designed to be a learning-by-doing experience for all levels.

What is the duration of the simulation? The simulation can be tailored to run from a single intensive 4-hour session to a multi-week module integrated into a full semester course.

What kind of assets are used in the simulation? The simulation features a variety of asset classes, including residential mortgages, commercial mortgages, and corporate loans, allowing participants to explore different types of securitization.

How are credit ratings determined in the simulation? The simulation's algorithm acts as a rating agency, analyzing the credit enhancement, subordination levels, and asset pool quality to assign a rating to each tranche.

Is this a competitive simulation? Yes, teams compete to achieve the highest risk-adjusted return on their structured finance portfolio, creating an engaging and motivating environment.

Can this simulation be customized for corporate training? Absolutely. We can customize the simulation's parameters, assets, and complexity to match the specific learning objectives of your organization or executive education program.

Portfolio Quality and Risk Management

Team Portfolio Performance

Individual Quizzes.

Final Team Report and Presentation

Peer Evaluation

Assessment may incorporate peer and self-review components, facilitator scoring, and debrief discussion. Results may feed into grades, executive feedback, certification or development plans.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.