Navigate the delicate balance between performance and burnout. Learn to identify your stress triggers, apply real-time coping techniques, and observe the direct impact of your composure on both outcomes and team morale.

Cognitive Load and Decision Fatigue

Physiological Effects of Stress

Emotional Regulation and Self-Awareness

Biases Under Pressure

Priority Management and Delegation

Crisis Communication

Team Cohesion in High-Stress Environments

Resilience and Post-Stress Recovery

In the simulation, participants will:

Execute time-sensitive financial analyses with shifting deadlines.

Manage a portfolio or deal flow amidst simulated market shocks and breaking news.

Respond to urgent, conflicting demands from mock senior management and clients.

Make critical investment or strategic decisions with incomplete information.

Collaborate with team members while under collective pressure.

Engage in guided reflection sessions to debrief on their performance and stress responses.

Identify their personal physical and mental triggers for stress in a professional context.

Apply practical, in-the-moment techniques to regulate their stress response during critical tasks.

Differentiate between optimal and impaired decision-making patterns under pressure.

Develop a personalized toolkit of preventative and reactive stress management strategies.

Enhance their communication and leadership effectiveness during a crisis.

Build greater personal resilience and a mindset for sustained high performance.

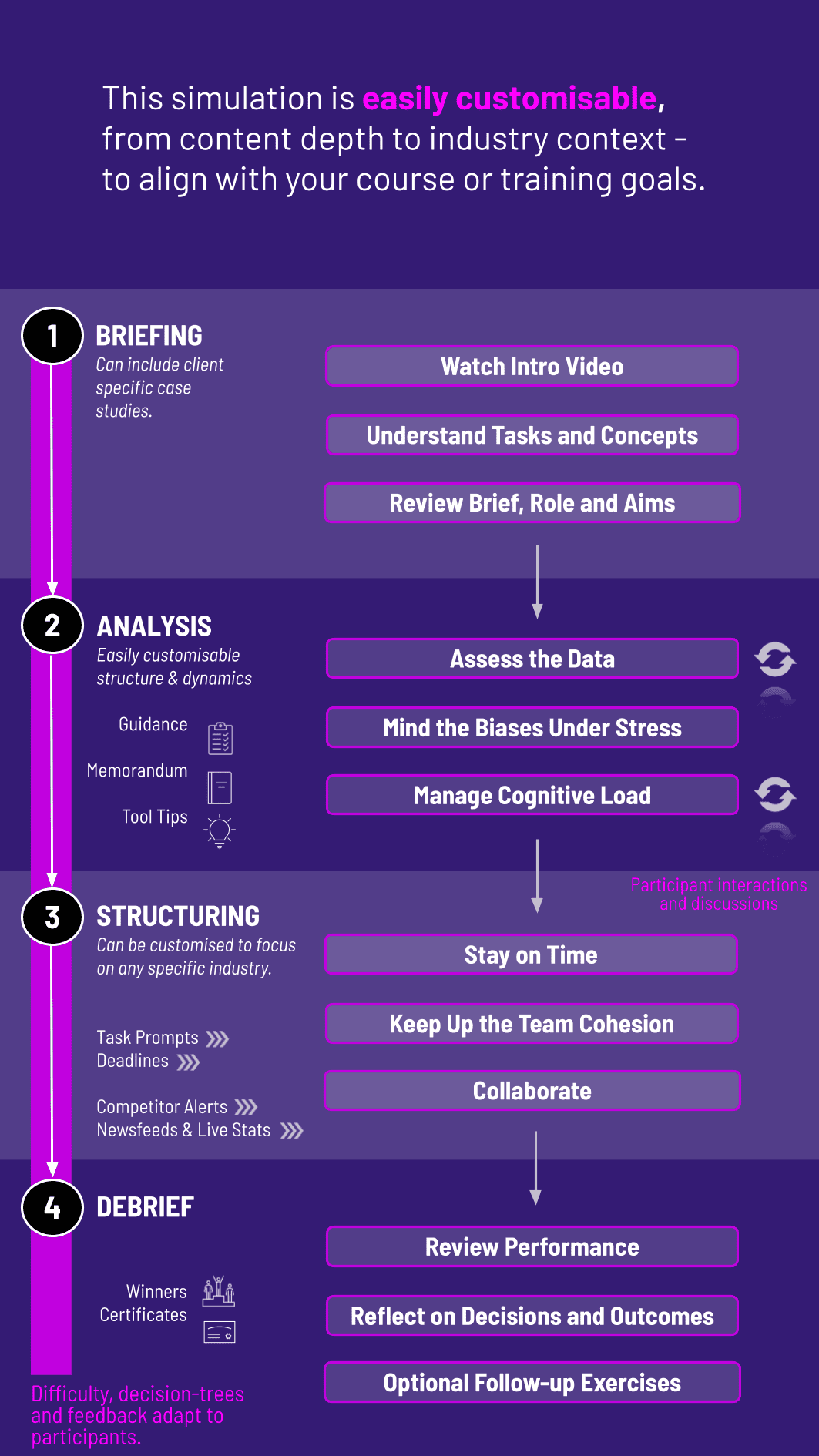

1. Introduction and Baseline Assessment Participants are introduced to the simulation platform and complete a baseline assessment of their stress perceptions and coping styles.

2. Role Assignment and Briefing Teams are formed and assigned roles within a realistic financial scenario.

3. The Simulation Rounds The experience is divided into multiple rounds, each representing a period. Each round introduces new data, unexpected crises, and tightening deadlines, escalating the cognitive and emotional load.

4. Real-Time Feedback Participants receive feedback not only on their financial decisions but also on their management of the situation. This can include metrics on communication clarity, error rates, and (if used) physiological data.

5. Guided Debriefing and Reflection This is the most critical component. After each round, facilitators guide participants through a structured debrief to connect their in-simulation actions to stress management concepts, fostering powerful self-awareness and learning.

Is this simulation a replacement for therapy? No. This is a professional development tool designed to enhance performance and resilience in high-pressure work environments. It is not a substitute for clinical therapy or treatment for anxiety disorders.

What makes this different from a regular finance simulation? While traditional simulations focus solely on financial outcomes, this simulation adds a critical second layer: the meta-analysis of how decisions are made under stress. Learning is as much about the process as it is about the result.

Do I need a finance background to benefit? The core principles of stress management are universal. However, the scenarios are finance-specific, making it most beneficial for those in or preparing for finance, consulting, or other high-stakes corporate roles.

How is stress actually measured during the simulation? Stress is measured through a combination of self-reporting, observed behavioral metrics, and, in advanced setups, optional wearable technology that tracks heart rate variability.

**Is this simulation confidential? Absolutely. All individual performance and stress response data are kept completely confidential and are used solely for the participant's personal development and learning.

Can this simulation be run remotely? Yes. The platform is designed to be delivered virtually, allowing teams in different locations to participate in the same high-fidelity, stressful scenario.

What is the time commitment? The core simulation experience typically ranges from a 3-hour intensive workshop to a multi-day program, depending on the depth of integration and debriefing required.

Measure changes in participants' self-reported confidence in managing stress and their knowledge of relevant techniques.

Quantitative analysis of decision quality, error rates, and communication effectiveness as pressure increases.

Participants provide and receive feedback on team collaboration and leadership under stress.

Each participant concludes the experience by creating a concrete plan to apply their learned strategies in their daily work.

Assessment may incorporate peer and self-review components, facilitator scoring, and debrief discussion. Results may feed into grades, executive feedback, certification or development plans.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.