Navigate the high-stakes world of corporate finance.Step into the role of a CFO and management team to execute a strategic share repurchase program. Make critical decisions to maximize shareholder value and signal strength to the market.

Capital Allocation Strategy

Earnings Per Share Accretion/Dilution

Return on Equity Impact

Undervaluation and Market Signaling

Funding Methods (Cash vs. Debt)

Buyback Methods: Open Market, Tender Offer, ASR

Impact on Financial Ratios (P/E, Debt/Equity)

Wealth Transfer and Agency Problems

Market Reaction and Investor Perception

Corporate Governance and Ethical Considerations

In the simulation, participants will:

Analyze the company's financial statements and valuation multiples.

Determine the optimal size of the share repurchase program.

Decide on the funding source: using idle cash, issuing new debt, or a hybrid approach.

Select the execution method and set the offer price if applicable.

Announce the buyback program to the market and manage the communication.

Execute the buyback over multiple periods, adjusting strategy based on stock price movements.

Compete against other teams managing rival companies.

Present their final strategy and results, justifying their decisions based on financial outcomes and shareholder value creation.

Evaluate the financial and strategic rationale for initiating a share repurchase.

Analyze the impact of a buyback on a company's financial statements and key performance indicators.

Compare and contrast different buyback methods and funding options, understanding the trade-offs of each.

Articulate how buybacks signal information to the market and influence investor perception.

Develop a comprehensive capital allocation strategy that balances buybacks with other investment opportunities.

Defend buyback decisions in the context of corporate governance and stakeholder management.

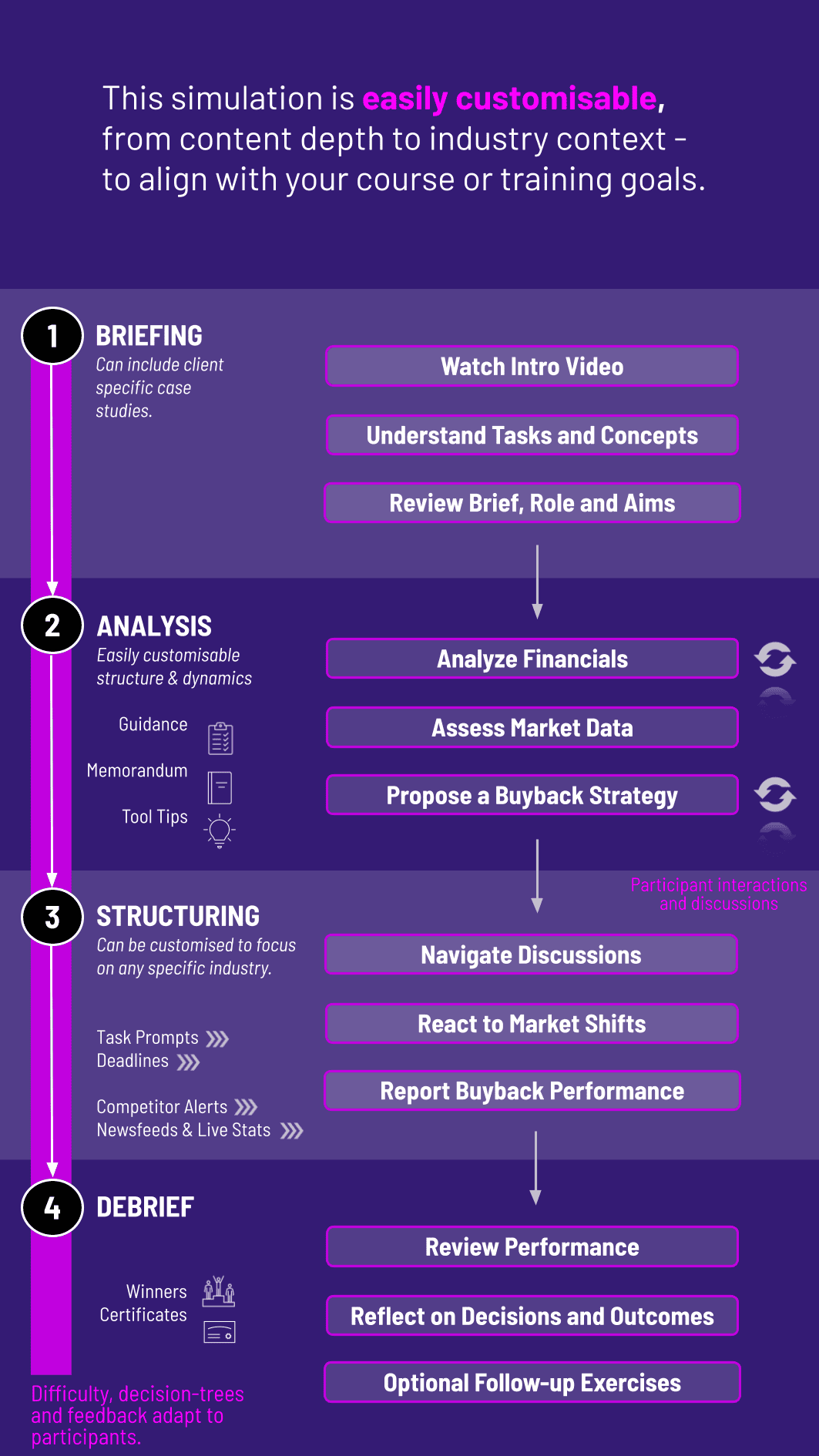

1. Introduction and Company Assignment Teams are assigned a publicly-traded company case study with a specific financial profile and strategic position.

2. Initial Analysis and Strategy Formulation Teams analyze their starting financials, market valuation, and peer data to draft their initial buyback plan.

3. Decision Rounds Each round represents a fiscal quarter, during which teams submit their buyback decisions: amount, funding, and method. The simulation engine processes all decisions, incorporating random market events (economic data, competitor buyback announcements). The stock price reacts dynamically based on the teams' actions and market events.

4. Feedback and Reporting After each round, teams receive an updated income statement, balance sheet, and market data dashboard showing the impact of their decisions.

5. Final Review and Presentation After the final round, teams review their overall performance in terms of shareholder return, EPS growth, and strategic positioning. They then prepare a brief presentation for the "Board of Directors" (the instructor) summarizing their strategy and results.

Who is this simulation designed for? This simulation is ideal for MBA students, finance professionals, corporate executives, and anyone seeking to deepen their practical understanding of corporate finance, capital allocation, and investor relations.

Do I need prior finance experience? A basic understanding of financial statements (income statement, balance sheet) is helpful but not mandatory. The simulation includes reference materials and guides to key concepts, making it accessible to motivated learners.

How long does the simulation take to complete? The simulation is flexible. A typical in-class deployment runs over 3-4 hours, while an online module can be completed asynchronously over a week. It can be customized to fit your program's schedule.

Is this a competitive simulation? Yes. Teams compete to achieve the highest total shareholder return and most efficient capital allocation. This competitive element enhances engagement and mirrors real-world capital market pressures.

Can we see the direct impact of our decisions? Absolutely. The platform provides immediate feedback after each round, showing how your buyback decisions directly affected your stock price, EPS, book value, and other critical financial metrics.

What makes this simulation different from a lecture on buybacks? This is experiential learning. Instead of passively listening, you actively make decisions and see the consequences unfold in a dynamic market. This "learning by doing" approach leads to a much deeper and more lasting understanding.

How is success measured in the simulation? Success is measured by a combination of quantitative metrics (Total Shareholder Return, EPS growth, ROE improvement) and qualitative judgment (consistency of strategy, effectiveness of communication, and risk management).

Total Shareholder Return (TSR) vs. a benchmark index.

Achievement of EPS and ROE targets.

Efficient use of capital (value created per dollar spent on buybacks).

Rationale for funding choices.

Buyback methods.

Adaptability of the strategy in response to market events.

Coherency of the presentation of participants’ strategy.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.