In this hands-on Startup Exit Strategy Simulation, participants act as founders and investors navigating acquisition, IPO, or merger paths - balancing valuation, timing, negotiation, and stakeholder expectations under uncertainty.

Exit strategy evaluation: IPO, M&A, secondary sales

Valuation drivers and market timing

Investor and founder alignment

Negotiation tactics in high-stakes deals

Stakeholder management: boards, employees, acquirers, and regulators

Legal and compliance considerations in exits

Trade-offs between liquidity, control, and growth

Communication strategy during exit planning

Role of market cycles and investor sentiment

Long-term strategic positioning post-exit

Analyze financial performance and market comparables

Debate IPO vs acquisition strategies under changing conditions

Negotiate term sheets and deal structures

Manage competing stakeholder interests (founders, employees, VCs)

Respond to regulatory, legal, or reputational challenges

Communicate decisions through board presentations, press releases, or investor memos

By the end of the simulation, participants will be able to:

Evaluate the advantages and risks of different exit strategies

Understand valuation mechanics and timing implications

Balance stakeholder objectives in exit negotiations

Apply negotiation frameworks in high-pressure deal environments

Communicate effectively with boards, employees, and investors

Recognize legal and compliance issues in exit planning

Anticipate post-exit strategic and cultural challenges

Adapt strategy in response to market signals

Collaborate across founder, investor, and management perspectives

Build resilience in decision-making under uncertainty

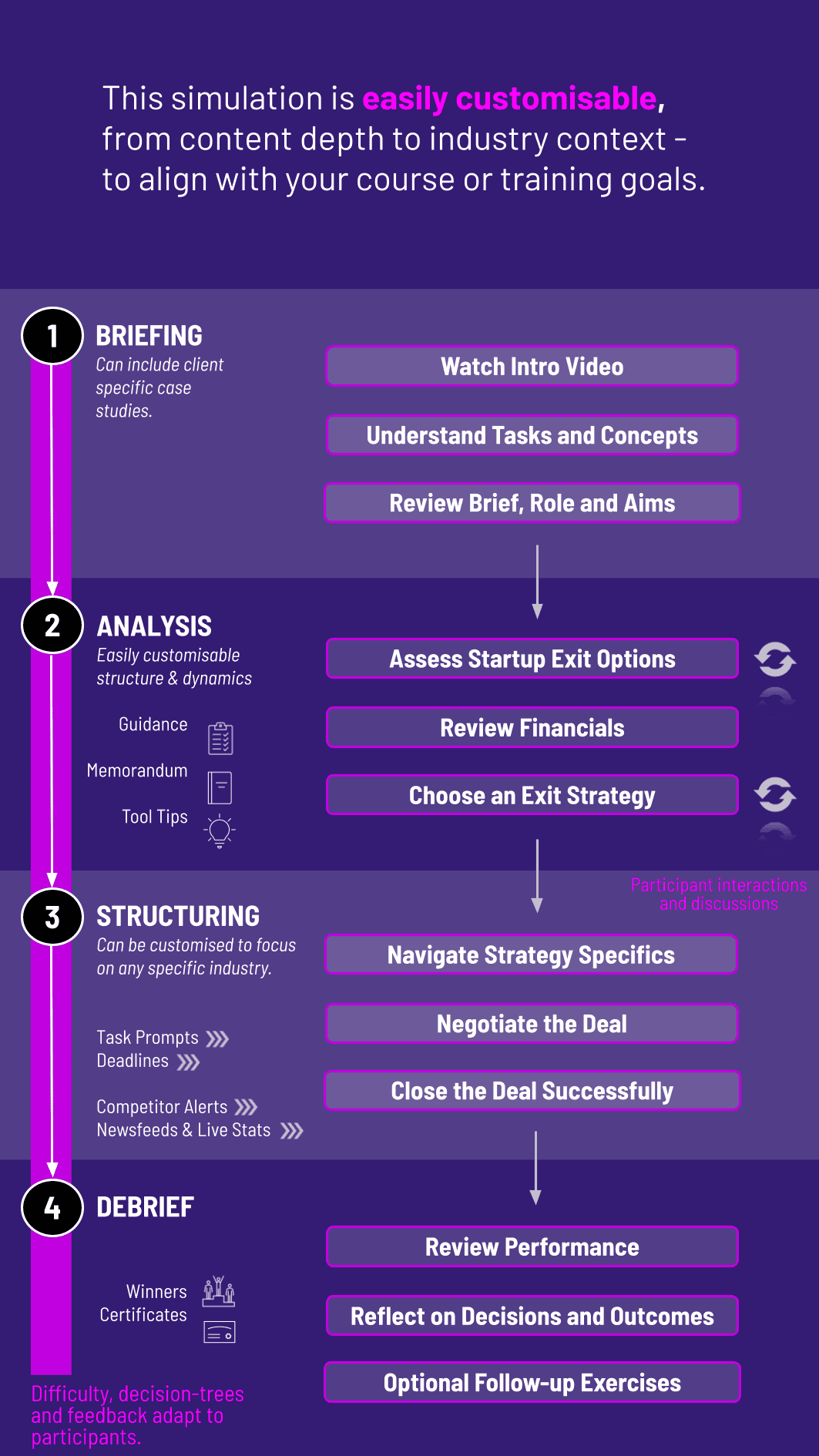

The simulation’s flexible structure ensures that these objectives can be calibrated to match the depth, duration, and focus areas of each program, whether in higher education or corporate learning.

The simulation works equally well in academic or corporate contexts and can run individually or in teams. Each cycle reflects a stage of the exit process.

1. Receive a Scenario or Brief: Participants are given a startup profile, investor dynamics, and exit options. The scenario sets objectives and context for decision-making.

2. Analyze the Situation: They review financials, market conditions, competitor exits, and regulatory landscapes to frame their choices.

3. Make Strategic Decisions: Participants decide whether to pursue an IPO, acquisition, or merger, and negotiate terms, valuation, and timing.

4. Collaborate or Negotiate: Teams role-play as founders, VCs, or acquirers - balancing perspectives and debating trade-offs.

5. Review Results and Reflect: Feedback reveals valuation outcomes, stakeholder sentiment, and reputational effects. Participants reflect on both quantitative and qualitative outcomes.

6. Iterate and Advance: Subsequent rounds introduce new shocks - market downturns, rival offers, or regulatory changes—forcing participants to adapt strategies.

Do participants need prior startup experience? No. The simulation is designed to be accessible but challenging for all levels.

What exit paths are included? IPO, M&A, secondary sales, and strategic mergers can all be explored.

Can the simulation reflect specific industries? Yes. It can be tailored to reflect tech, fintech, consumer, or healthcare contexts.

Is there a negotiation element? Yes. Participants negotiate term sheets, deal structures, and valuations with stakeholders.

Can it be run in teams? Yes. Teams can take on founder, investor, and acquirer roles to mirror real-world dynamics.

How long does it run? It can be a short 2-hour exercise or extended into multi-day sessions.

Does it cover cultural or post-exit issues? Yes. Scenarios include employee morale, cultural integration, and leadership changes post-exit.

Can universities use it in entrepreneurship courses? Absolutely. It fits seamlessly into entrepreneurship, venture capital, and strategy programs.

How is success measured? By valuation outcomes, stakeholder alignment, and post-exit strategic sustainability.

Is it suitable for corporate training? Yes. It’s highly relevant for innovation teams, corporate venture units, and intrapreneurs.

Quality of exit strategy evaluation and justification

Valuation outcomes and timing decisions

Effectiveness in negotiations and stakeholder alignment

Communication clarity in investor or board updates

Responsiveness to market shocks and new information

Peer/self-assessments for collaboration and leadership

You can also include memo writing and debrief presentations as part of the assessment structure. Additionally, you can also add a built-in peer and self-assessment tool to see how participants rate themselves. This flexibility allows the simulation to be easily integrated by professors as graded courses at universities and by HR at assessment centres at companies.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.