Navigate the high-stakes world of corporate strategy. The Spin-off Simulation places you in the boardroom, challenging you to plan, execute, and communicate the separation of a major business unit.

Strategic Rationale

Valuation Methodologies

Capital Structure Optimization

Legal and Regulatory Framework

Financial Modeling and Pro Forma Statements

Management and Incentive Alignment

Investor Communications

Post-Spin Performance Tracking

In the simulation, participants will:

Analyze the parent company's financials and operations to build a compelling strategic rationale for the spin-off.

Build a comprehensive financial model to value the separate entities and determine an equitable distribution of assets and liabilities.

Make Critical Decisions on capital structure, management teams, and corporate governance for the new spin-off company.

Draft key sections of the Information Memorandum (Form 10) to be filed with the SEC.

Develop a compelling investor presentation to articulate the value proposition of the spin-off to the market.

Present and Defend their spin-off plan to a simulated board of directors or investor panel, answering challenging questions.

Negotiate terms and resolve conflicts of interest between the Parent

Company and Spin-off Company teams.

Analyze the post-spin stock performance and assess the success of their strategy.

Evaluate a corporation's portfolio and determine when a spin-off is the optimal strategic alternative.

Construct a robust financial model to value a spin-off transaction and assess its value-creation potential.

Design a fair and efficient capital and organizational structure for both the parent and the spun-off company.

Interpret the key legal, regulatory, and tax considerations critical to a successful spin-off execution.

Formulate a persuasive communication strategy for both internal and external stakeholders.

Synthesize complex financial and strategic data into a coherent and compelling equity story.

1. Introduction and Team Formation Participants are introduced to the case study of a diversified conglomerate ("GlobalCorp") and are divided into teams representing the Corporate Development task force.

2. Analysis and Planning Teams analyze GlobalCorp's financials, assess its business units, and build the initial financial model for the spin-off. They submit their preliminary strategic rationale and valuation.

3. Structuring and Modeling Teams receive dynamic market feedback. They must refine their model, make critical decisions on debt allocation, pension liabilities, and management incentives. They prepare the first draft of their investor presentation.

4. Execution and Communication Teams finalize their spin-off plan and present their strategy in a live "Investor Day" session, defending their decisions against questions from instructors and peers.

5. Debrief and Assessment The simulation concludes with a detailed debrief. Instructors reveal the optimal path, compare team strategies, and facilitate a discussion on the key lessons learned. Teams receive a detailed performance report.

Who is the target audience for the Spin-off Simulation? The simulation is designed for MBA students, finance professionals in corporate development, investment banking, equity research, and anyone seeking to deepen their practical understanding of corporate restructuring and M&A.

What are the technical prerequisites to participate? A solid understanding of corporate finance and financial accounting is recommended. Proficiency in Excel is beneficial for the financial modeling component, but the platform is designed to be accessible.

How long does the simulation take to complete? The simulation is highly flexible. It can be run as an intensive one-day workshop or extended over several weeks as part of a full course curriculum.

Is this a competition? Yes, the simulation is typically structured as a competitive exercise where teams are ranked based on the robustness of their financial model, the persuasiveness of their strategy, and the value creation achieved in the simulation's market engine.

Do we need to be physically present in one location? No. Our platform is entirely cloud-based, allowing participants to collaborate seamlessly from anywhere in the world, making it ideal for both in-person and remote learning programs.

What makes this simulation different from a traditional case study? Unlike a static case study, our simulation is dynamic. Your decisions impact the outcome. Market conditions can change, and you receive iterative feedback, forcing you to adapt your strategy in real-time, just like in a real-world deal.

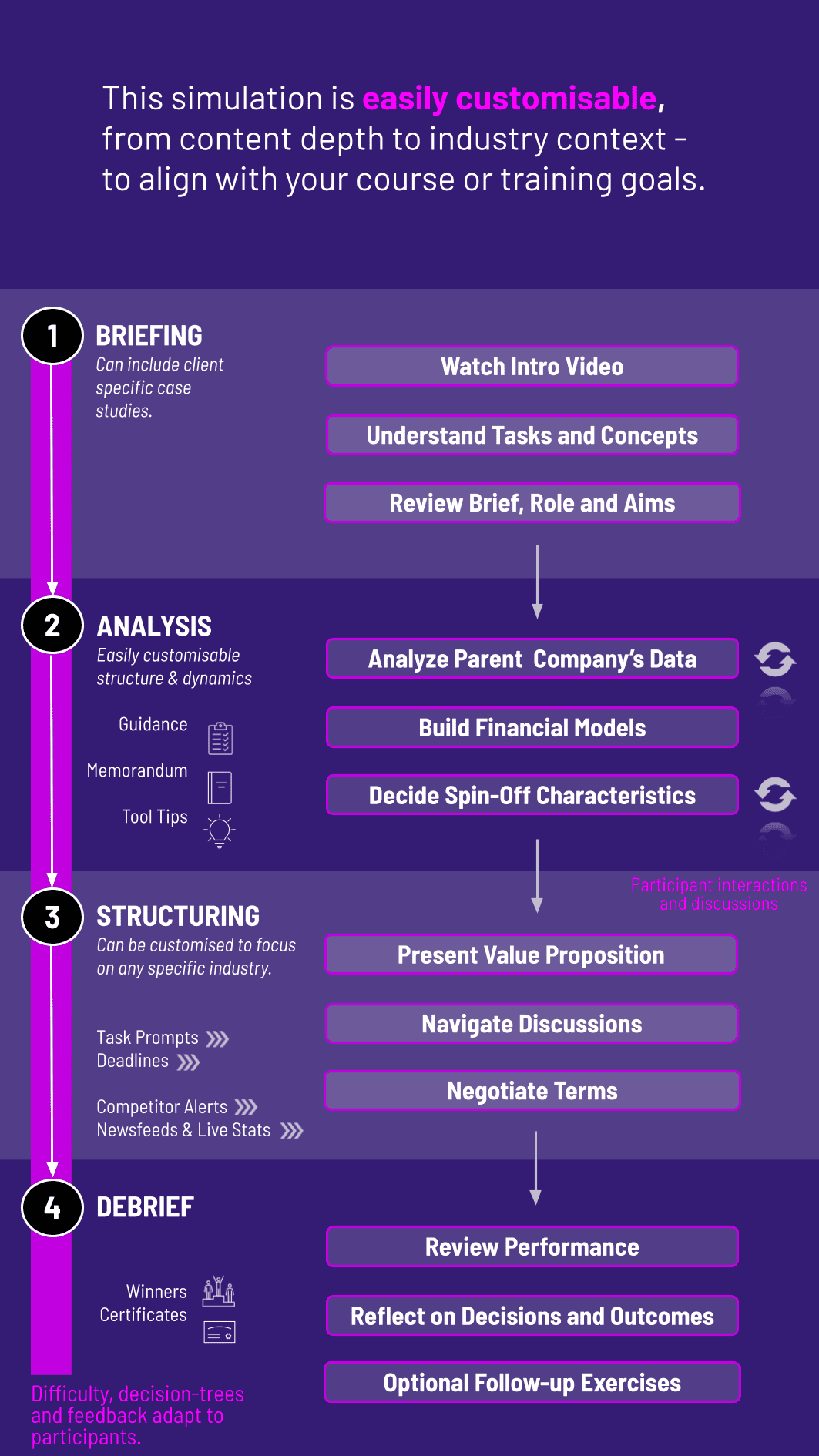

Can the simulation be customized for our specific corporate training needs? Absolutely. We specialize in tailoring the simulation's case study, financials, and industry focus to align with your company's specific learning and development objectives.

The technical precision of the sum-of-the-parts valuation, pro forma statements, and capital structure decisions.

The clarity, depth, and logic of the written justification for the spin-off and key structural choices.

The professionalism, persuasiveness, and clarity of the final team presentation delivered to the "board."

Feedback from teammates on collaboration, contribution, and professionalism.

A short test assessing the understanding of core spin-off concepts and terminology.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.