While technical prowess is the entry ticket, it's soft skills—communication, negotiation, and leadership—that define success in the fast-paced world of finance.

Persuasive Communication

Advanced Negotiation

Constructive Conflict Resolution

Giving and Receiving Feedback

Influence without Authority

Executive Presence and Boardroom Presentation

Emotional Intelligence

Cross-Functional Collaboration

In the simulation, participants will:

Role-play as Associates, VPs, or Directors in various high-stakes finance scenarios.

Deliver persuasive pitches to a mock "board of directors".

Engage in live, multi-issue negotiations with other teams, balancing relationship and outcome.

Draft clear and impactful emails and memos to communicate complex ideas.

Analyze peer performance and provide structured, constructive feedback.

Make critical strategic decisions where interpersonal dynamics are as important as the financials.

Reflect on their own communication style and its effectiveness through scored rubrics and debriefs.

Articulate complex financial concepts clearly and persuasively to both expert and non-expert audiences.

Develop and execute a negotiation strategy that achieves key objectives while preserving important relationships.

Demonstrate active listening and empathy to better understand client and colleague motivations.

Constructively manage disagreement and conflict within a team or with external partners.

Enhance their professional presence and ability to influence decisions at a senior level.

Critique their own and others' interpersonal approaches, identifying specific areas for improvement.

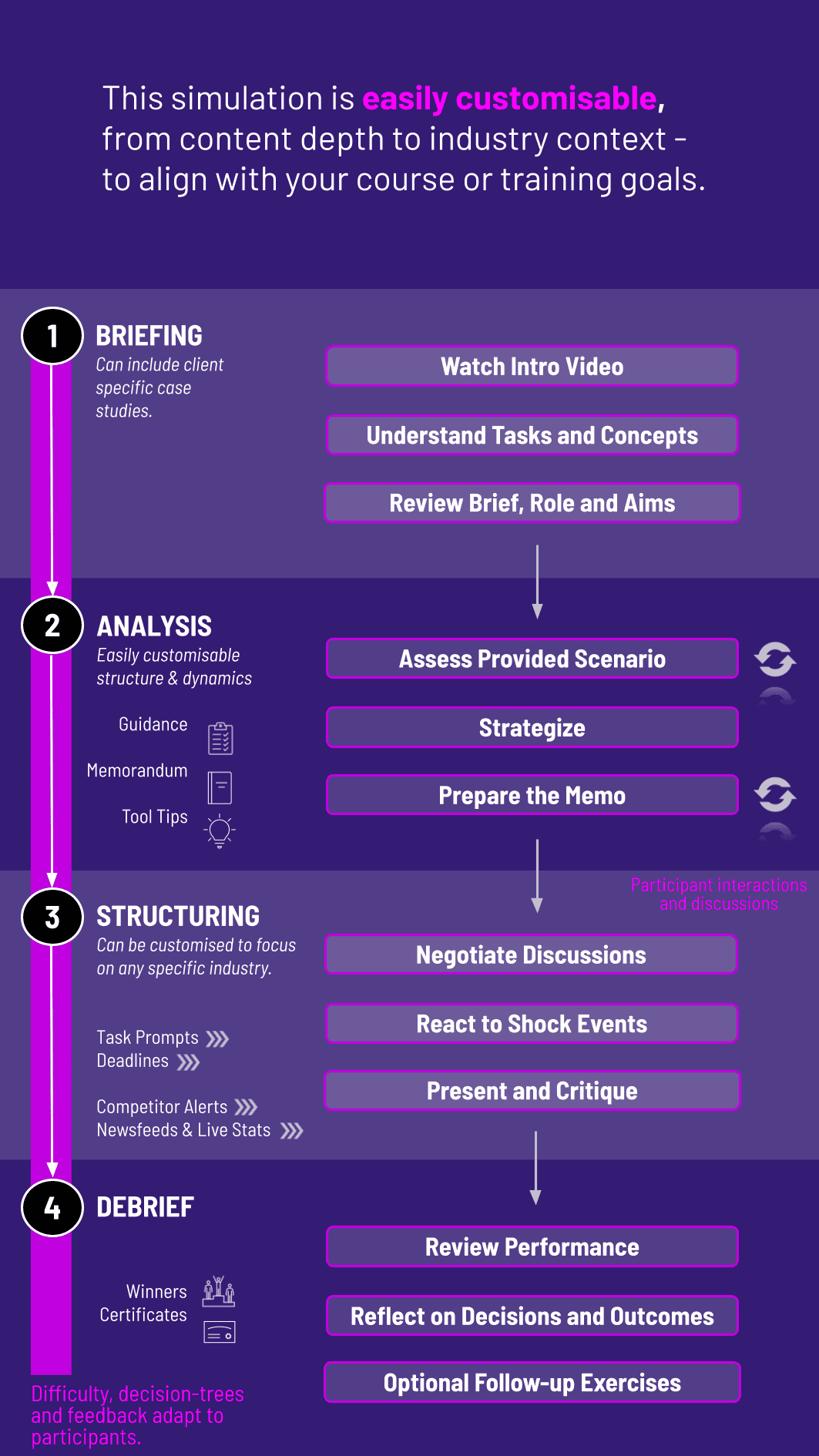

1. Setup and Introduction Participants are assigned to teams and roles. The simulation platform and core scenarios are introduced.

2. Scenario Release Each round, a new scenario is released ("Client Demands Lower Fees", "Internal Resource Conflict", "M&A Deal Jeopardy").

3. Preparation Teams review briefing materials, define their strategy, and prepare their communication points.

4. Execution Teams engage in the live simulation—this could be a negotiation with another team, a presentation to the mock "board," or a collaborative problem-solving session.

5. Debrief and Reflection A guided debrief session helps teams analyze what worked, what didn't, and how to apply these lessons in the next round and in their careers.

What is the ideal team size? We recommend teams of 3-5 participants to ensure everyone has an active role and a voice in each scenario.

Do we need prior finance knowledge? A basic understanding of financial concepts is helpful, as the scenarios are set in a finance context. However, the primary focus is on the behavioral and communication skills, not complex financial modeling.

What is the time commitment? Typically between 2 to 4 hours. It can be shortened or expanded to fit class schedules or training blocks.

How is this different from a case study? Unlike a static case study, this is dynamic and interactive. Your decisions and communication style directly trigger reactions from other human participants, creating a unique, unpredictable learning experience every time.

What soft skills are most important for a career in finance? The most critical soft skills for finance professionals include effective communication, negotiation skills, leadership, emotional intelligence, and resilience. Our simulation is specifically designed to target and develop these competencies in a realistic, risk-free environment.

Portfolio Quality and Risk Management

Simulation Outcomes

Peer Evaluation

Individual Reflection Submissions

Final Capstone Presentation

Assessment may incorporate peer and self-review components, facilitator scoring, and debrief discussion. Results may feed into grades, executive feedback, certification or development plans.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.