In the Small Business Finance Simulation, participants step into the role of entrepreneurs and financial managers of a small business, navigating financial decisions that shape the company’s growth, sustainability and strategic flexibility.

Financial statements for small businesses (income statement, balance sheet, cash-flow statement)

Budgeting and working capital management

Cash-flow forecasting and liquidity planning

Capital structure: debt, equity and hybrid financing for small businesses

Cost of capital and small business investment appraisal (NPV, IRR, payback)

Risk management: operational risk, financial risk, market risk for small firms

Growth strategy vs. cash preservation trade-offs

Pricing, margin management, cost control

External financing decisions

Business valuation in the context of small enterprises

Scaling up: when and how to invest in growth, hire, expand, or export

Exit planning (sale, merger, IPO in miniature) for SMEs

In the simulation, participants will:

Review a business brief, identifying the industry, size of company, initial financial condition and strategic options

Prepare a budgeting and forecast model, estimating revenues, costs, and cash-flow over the next period

Decide on financing strategy, choosing debt or equity, set terms, negotiate with virtual lenders or investors

Set inventory levels, credit terms, cash reserves, supplier payments

Launch a new product line, expand to a new market, upgrade technology, or restructure operations

Monitor performance, tracking key metrics and adjusting strategy accordingly

Pitch to internal stakeholders or investors on progress, strategy, and required financing

Understand how small business financial statements interrelate and drive business decisions

Construct and interpret cash-flow forecasts and understand their importance for SME health

Evaluate financing options available to small businesses and assess their impact on risk, flexibility and growth

Manage working capital proactively and understand the implications of poor liquidity management

Make investment decisions in a small business context, using appraisal techniques appropriate to SMEs

Understand the trade-offs between growth initiatives and maintaining financial stability

Respond effectively to financial shocks, and adjust strategy mid-course

Communicate small business financial performance and strategy to stakeholders (investors, banks, management)

Develop judgment in balancing profitability, growth and risk in a small-business setting

Build confidence in non-financial and financial decision-making as entrepreneurs or managers

The simulation’s flexible structure ensures that these objectives can be calibrated to match the depth, duration, and focus areas of each program, whether in higher education or corporate learning.

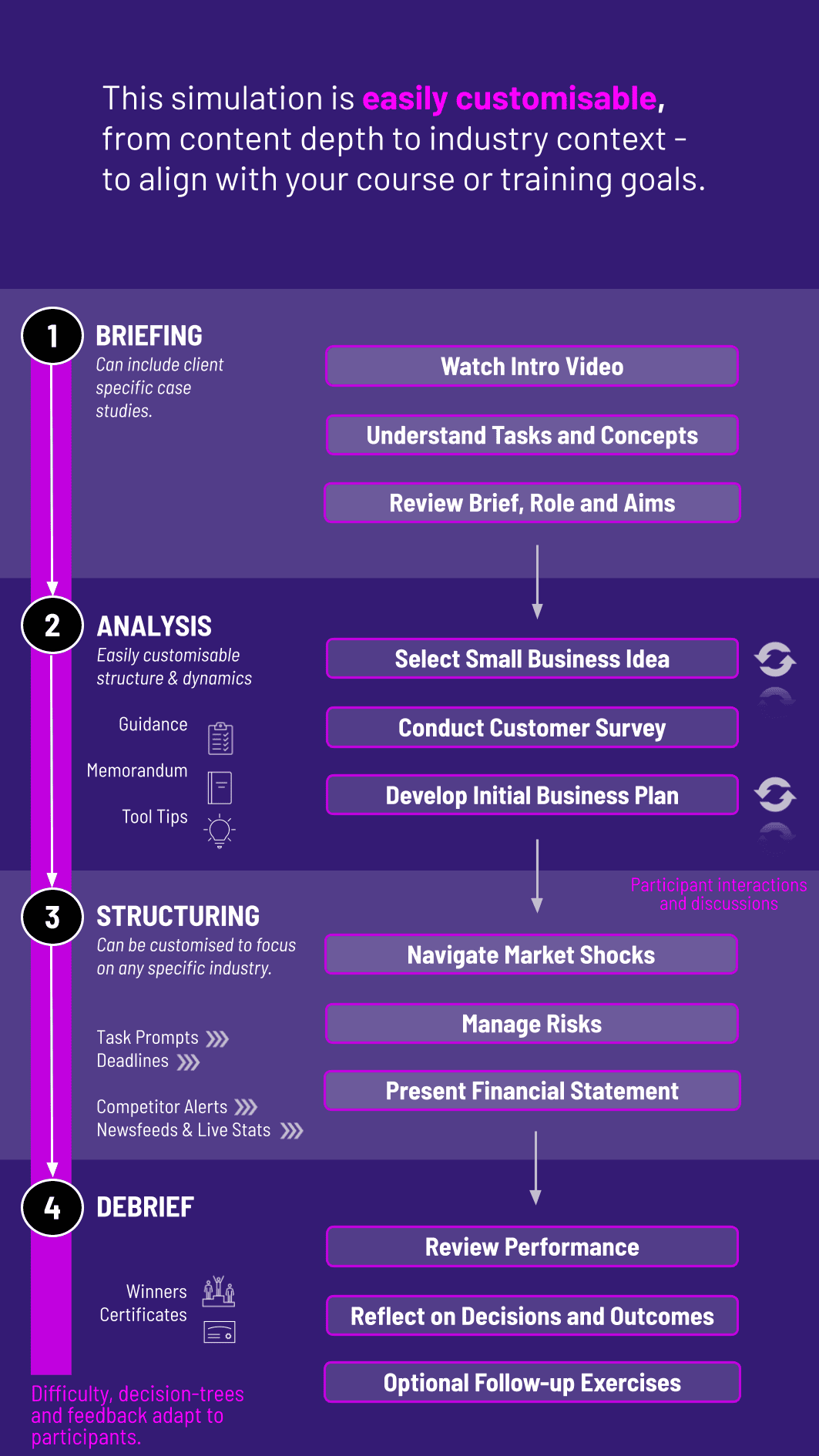

1. Scenario Briefing Participants receive background information about the small business: industry sector, size, starting financials, market conditions and strategic choices.

2. Situation Analysis Teams review the business’s initial financials, market outlook, funding constraints and strategic options.

3. Decision Round Teams make a set of decisions—budget allocation, financing choice, investment plan, working capital tactics, pricing and growth moves.

4. Events and Feedback The system injects a simulated shock or market development (e.g., supplier disruption, demand drop, interest-rate hike). The model updates business performance accordingly.

5. Performance Review Teams receive key performance indicators (cash flow, profitability, debt coverage, liquidity, growth metrics) and compare outcomes against peers or benchmarks.

6. Repeat Cycle The simulation proceeds through multiple rounds (e.g., 3-4 rounds or more), allowing teams to adapt their strategy, learn from outcomes, and iterate decisions.

Successful Financial Performance (cash flow, profitability, growth, debt management)

Logic of investment and financing decisions, adaptation to shocks, realism of the plan

Effectiveness of managing the business working capital, debt service and liquidity under stress

Clarity and persuasiveness of business updates, investor/lender pitches or team memos

Ability to learn from one round to the next, modify strategy and improve outcomes

Collaboration, division of work, integration of roles, and final coherence

Assessment may incorporate peer and self-review components, facilitator scoring, and debrief discussion. Results may feed into grades, executive feedback, certification or development plans.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.