The Share Repurchase Simulation immerses participants into the strategic decision-making process of corporate share buybacks. It enables them to understand the financial, market, and investor implications of executing share repurchase programs.

Share repurchase methods: open market, tender offers, Dutch auctions

Impact on earnings per share and stock price valuation

Corporate signaling and investor perception

Capital structure and financial flexibility

Regulatory compliance and governance in buybacks

Market liquidity and timing considerations

Shareholder base concentration and activism risks

Optimization of repurchase execution strategies

In the simulation, participants will:

Analyze company financials and stock market conditions

Choose appropriate share repurchase methods and timing

Model the financial and market effects of repurchase decisions

Manage communication strategies to investors and stakeholders

Respond to competitor actions and market volatility

Adjust strategies in real-time based on incoming data and feedback

Understand the rationale and mechanics of corporate share repurchases

Evaluate the effects of buybacks on company valuation and shareholder returns

Develop skills in financial modeling and strategic decision-making

Apply principles of capital structure management and investor relations

Balance regulatory, market, and reputational risks in buyback programs

Gain experience in real-time strategic adjustment under market uncertainties

Communicate complex financial strategies effectively to stakeholders

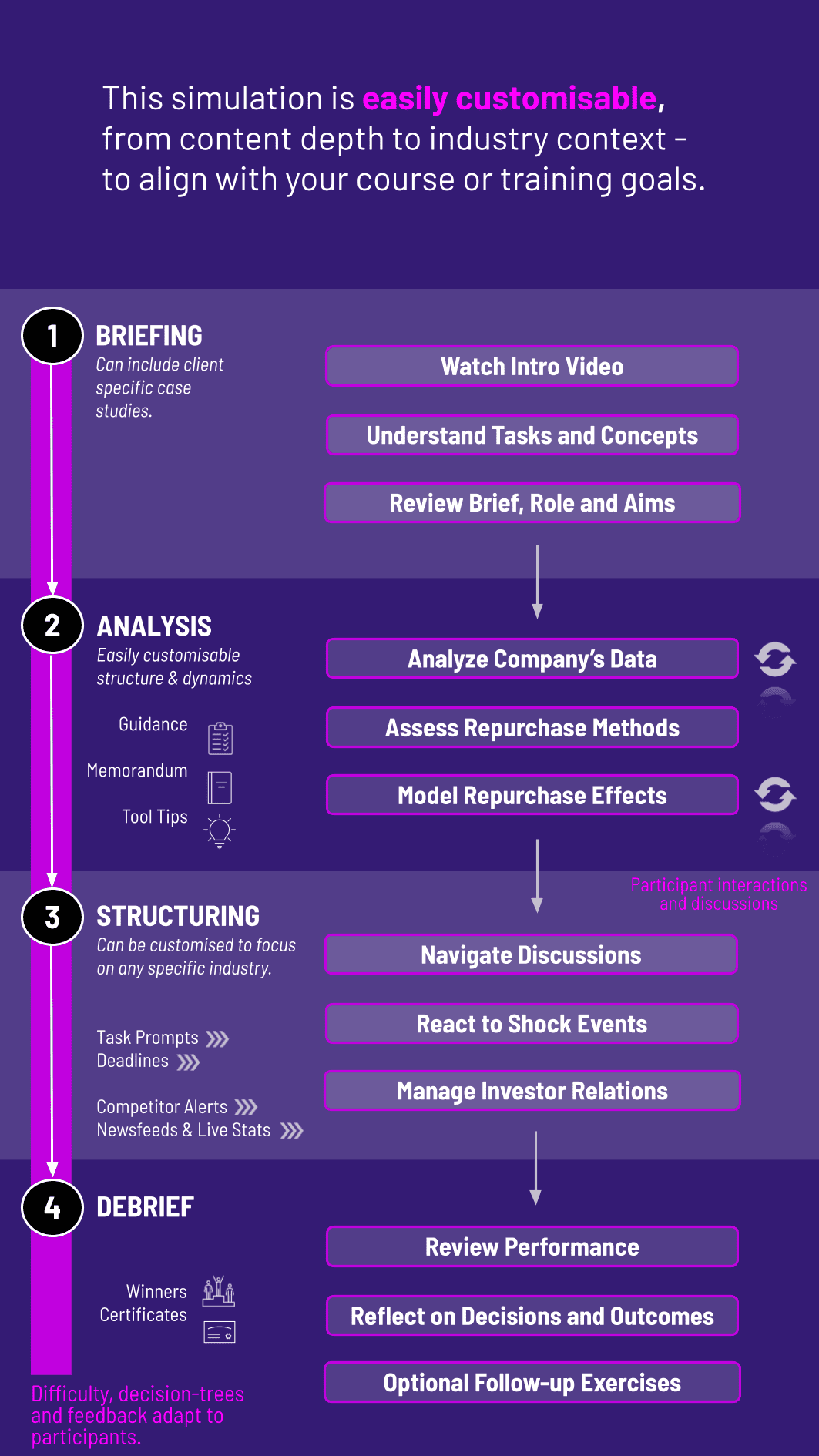

1. Receive a Detailed Brief Participants begin by receiving a scenario describing the company’s current capital structure, market conditions, and objectives for the share repurchase program.

2. Analyze Key Data They review financial statements, stock performance metrics, cash flow positions, and market trends to understand the environment and constraints.

**3. Collaborate or Compete Work individually or in teams acting as angel investors negotiating co-investment terms or competing for deals.

4. Develop a Repurchase Strategy Participants decide on the timing, volume, and financing of share repurchases. They weigh options such as using cash reserves, issuing debt, or other funding sources while considering regulatory and market impacts.

5. Execute Decisions and Manage Portfolio They implement their repurchase plan in simulated market conditions, adjusting dynamically in response to price movements, liquidity, and shareholder reactions.

6. Collaborate Across Roles Teams may include finance officers, legal counsel, and investor relations roles to reflect real corporate collaboration and negotiation.

7. Report and Communicate Outcomes Participants prepare and deliver investor communications explaining their repurchase rationale, strategy adjustments, and financial impacts.

**How does the simulation reflect real market conditions? It uses dynamic data and scenarios that include market volatility, investor behavior, and regulatory factors to create realistic decision-making environments.

Do I need prior finance experience? No. The simulation includes instructional content suitable for beginners and advanced learners.

How long does the simulation take? Typically 3-4 hours but can be adjusted for shorter or extended sessions.

Can instructors tailor the simulation? Absolutely, the session can be customized to focus on specific industries, financing constraints, or strategic objectives.

What roles does this prepare participants for? Prepares for roles in corporate finance, treasury, investor relations, equity research, and financial strategy.

Is it team-based or individual? Both formats are supported to reflect corporate decision-making dynamics.

How is performance evaluated? Based on financial impact, strategy effectiveness, risk management, and communication quality.

Strategic use of available capital and financing methods for repurchases.

Impact on key financial metrics such as EPS, ROE, and share price.

Ability to manage regulatory and compliance risks associated with buybacks.

Quality and clarity of investor communication and rationale explanation.

Responsiveness and adaptability to market shocks or evolving shareholder sentiment.

Collaboration and decision-making in team settings.

Overall risk management and alignment with corporate financial strategy.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.