In this hands-on Share Buybacks Course, participants act as corporate finance executives navigating real-world decisions on repurchasing shares. They balance valuation, capital allocation, and market signaling in a dynamic business environment.

Share Buyback Strategies: Open market repurchases, tender offers, accelerated buybacks

Earnings Per Share (EPS) Impact

Cost of Capital vs. Opportunity Cost

Signaling Theory and Market Reactions

Balance Sheet Effects and Leverage

Investor Expectations and Communication

Valuation Metrics (P/E, P/B, Intrinsic Value)

Timing and Regulatory Constraints

Alternatives to Buybacks: Dividends, CapEx, M&A

Activist Investors and Capital Pressure

Review financial statements, valuation multiples, and liquidity positions

Decide whether to repurchase shares, and if so, how much and through what method

Compare buybacks to competing uses of capital (e.g., investment, dividends, debt reduction)

Analyze how repurchases affect EPS, leverage, and investor perception

Respond to evolving business scenarios—market downturns, activist pressure, cash windfalls

Draft communications to shareholders and the media to justify actions

Monitor feedback from analysts, the board, and institutional investors

Iterate decisions over multiple cycles based on outcomes and stakeholder sentiment

By the end of the course, participants will:

Understand the mechanics and strategic rationale behind share buybacks

Evaluate buybacks as one of many capital allocation tools

Analyze the impact of buybacks on financial metrics

Assess market timing and valuation considerations

Navigate internal and external stakeholder expectations

Balance financial flexibility with signaling goals

Communicate strategy clearly and credibly

Incorporate regulatory and legal considerations

Stress-test repurchase strategies under uncertainty

Experience the real-world complexity of corporate capital allocation

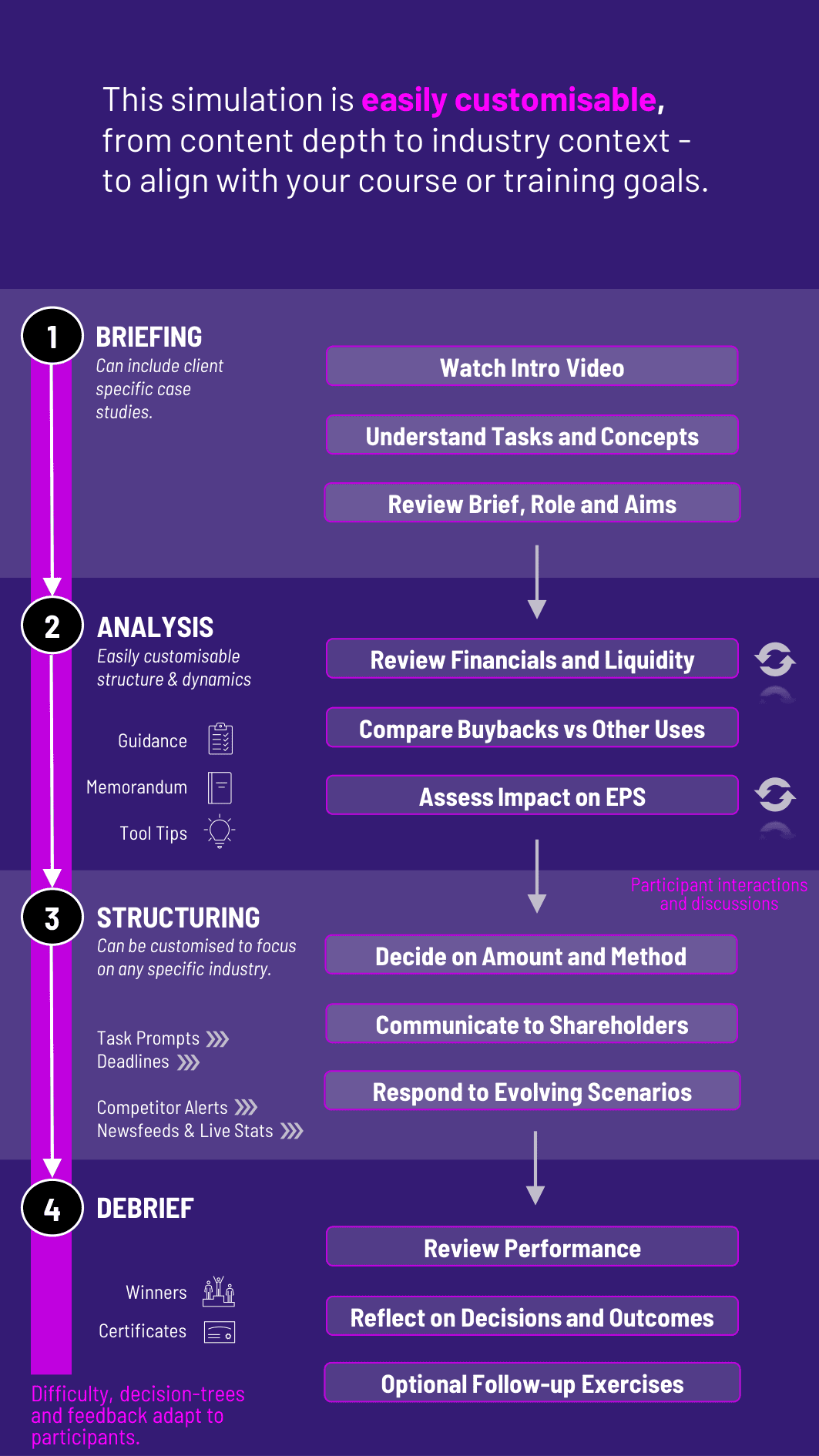

The course’s flexible structure ensures that these objectives can be calibrated to match the depth, duration, and focus areas of each program.

1. Receive Scenario Brief Each round opens with a business update - earnings reports, cash position, investor sentiment, or market movements. Participants must align their response with the company’s broader financial strategy.

2. Analyze Financial Position and Valuation Participants evaluate current stock price, financial statements, capital needs, and investment opportunities. They assess whether a buyback is the optimal choice given other strategic options.

3. Make Repurchase and Allocation Decisions Participants choose whether to initiate a buyback, how much to repurchase, and the repurchase method. They must also consider the timing and source of funds (e.g. debt, cash reserves).

4. Monitor Market and Stakeholder Reaction The course provides real-time feedback on share price movement, analyst commentary, and stakeholder sentiment based on the team's actions.

5. Draft Stakeholder Communications Participants prepare press releases, shareholder memos, or internal reports to justify and explain their decisions to the board, investors, and media.

6. Adapt to New Developments Subsequent rounds introduce fresh challenges like regulatory scrutiny, activist pressure, macroeconomic shifts, or earnings surprises. Participants adjust strategies accordingly.

Do participants need to understand EPS and valuation ratios? A basic understanding is helpful, but the course includes onboarding to explain all relevant metrics.

Can the course include real company case studies? Scenarios are based on real-world dynamics but anonymized and adaptable to any sector.

How long does the course take? It can run in 2 - 3 hours or be extended over multiple sessions for deeper integration.

Is this suitable for corporate course? Yes. It works well for upskilling finance teams, treasury departments, and corporate strategy units.

Does the course include debt financing for buybacks? Yes. Participants can choose to fund buybacks through internal cash or new debt.

Can this be used in valuation courses? Absolutely. The course integrates market ratios, discounting, and financial modeling.

Does it simulate market backlash? Yes. Poorly timed or overly aggressive buybacks can trigger negative stakeholder responses.

Can participants work in teams? Yes. Teams can role-play different departments: finance, investor relations, or strategy.

Is stakeholder communication part of the scoring? Yes. Quality of memos, press releases, or board reports contributes to participant evaluation.

Can we adapt it to a specific industry or company size? Yes. The structure is flexible and can model small firms, large corporates, or tech giants.

Strategic fit and timing of repurchase decisions

Impact on key financial and valuation metrics

Quality and clarity of stakeholder communications

Responsiveness to market conditions and investor sentiment

Alignment with long-term corporate objectives

Realism and sustainability of capital allocation approach

Ability to justify trade-offs between growth, leverage, and returns

Collaboration and consensus-building in team-based formats

Risk management under uncertainty

Final debrief, presentation, or investment memo

Additionally, you can also add a built-in peer and self-assessment tool to see how participants rate themselves. This flexibility allows the simulation to be easily integrated by professors as graded courses at universities.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the course.

or

Book a 15-minute Zoom demo with one of our experts to explore how the course can benefit you.