Navigate the high-stakes world of early-stage finance. The Seed Funding Simulation immerses participants in the roles of ambitious founders and discerning investors, providing a hands-on understanding of the capital-raising process.

Startup Valuation

Capitalization Tables

Pitch Deck Development

Financial Modeling and Burn Rate

Term Sheets

Due Diligence Process

Equity Dilution

Convertible Notes and SAFE Agreements

Founder-Investor Dynamics

Portfolio Strategy for VCs

In the simulation, participants will:

Develop a robust business plan and financial model.

Create and refine a persuasive investor pitch deck.

Communicate their vision and traction to multiple investor teams.

Manage their company's burn rate and runway.

Analyze and negotiate term sheets from competing VCs.

Understand the impact of funding deals on founder ownership.

Source and screen a pipeline of startup opportunities.

Perform financial and strategic due diligence on target companies.

Build a diversified investment portfolio.

Model potential returns based on different valuation scenarios.

Draft and negotiate term sheets to protect their investment.

Compete with other VC firms for access to the most promising deals.

Structure a startup's financials and cap table from the ground up.

Evaluate a startup's potential from both a founder's and an investor's perspective.

Construct a compelling valuation argument supported by financial and market data.

Negotiate key terms in a seed funding term sheet.

Analyze the long-term implications of funding decisions on ownership and control.

Articulate the strategic rationale behind an investment or funding choice.

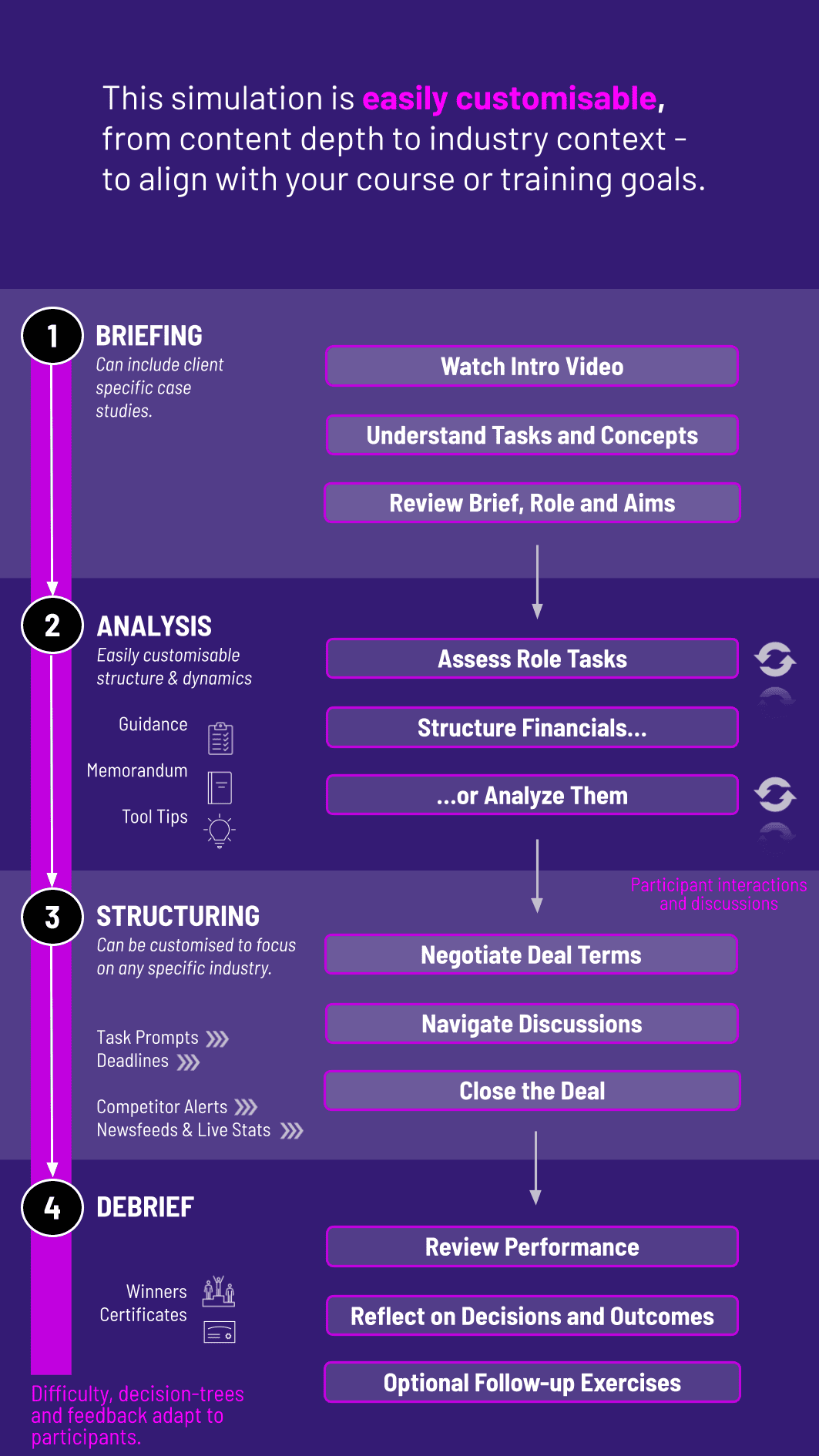

1. Setup and Role Assignment Participants are assigned to teams as either Founders or Investors and receive their initial briefing materials.

2. Team Formation Participants review their tasks and assign roles inside the teams.

3. Preparation Phase Founder teams build their company profile, financials, and pitch deck. Investor teams set their fund strategy and review initial startup profiles.

4. Pitching and Due Diligence Founders pitch their startups in a "demo day" format. Investors ask probing questions and request additional data for due diligence.

5. Term Sheet and Negotiation Interested investors issue term sheets to startups. Founder teams review multiple offers and enter into one-on-one negotiations to finalize a deal.

6. Closing and Analysis Deals are closed, and the platform updates cap tables and portfolio valuations. A debriefing session led by the facilitator explores the outcomes, strategic decisions, and key learnings.

What is the main goal of the Seed Funding Simulation? The primary goal is to provide a realistic, hands-on understanding of the entire seed funding process, from crafting a pitch to negotiating a term sheet, for both entrepreneurs and investors.

Who is the target audience for this simulation? This simulation is ideal for MBA students, aspiring entrepreneurs, early-career professionals in venture capital, and corporate innovators looking to understand startup financing.

Do participants need a finance background to succeed? No prior finance background is strictly required. The simulation includes tutorial materials and guides on key concepts like cap tables and valuation, making it accessible while still challenging for those with more experience.

How long does a typical simulation session last? A full simulation can be run as an intensive one-day workshop or spread over multiple sessions (e.g., 3-4 sessions of 3-4 hours each), depending on the depth of analysis and debriefing desired.

Is the simulation competitive? Yes, the simulation is highly competitive. Startup teams compete for limited investment capital, and VC teams compete to secure the best deals for their fund, creating a dynamic and engaging market environment.

What specific financial models are used in the simulation? Participants work with integrated financial statements (income statement, cash flow) and a dynamic cap table model that automatically updates based on funding rounds and terms like employee stock option pools.

For Founder Teams — Successfully securing funding at a favorable valuation, maintaining an optimal level of founder ownership, and achieving a high post-money valuation.

For Investor Teams — Generating the highest Internal Rate of Return (IRR) for their fund portfolio, demonstrated through a well-diversified and strategic set of investments.

Active and constructive contribution during team discussions, pitching sessions, and negotiation rounds, as evaluated by peers and the facilitator.

Team's strategy, key decisions made during negotiations.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.