The Secondary Offering Simulation immerses participants in the process of managing a secondary equity offering, providing hands-on experience in complex capital markets activities beyond an initial public offering.

Secondary equity offerings and market impact

Role of underwriters and syndicates

Pricing strategies for secondary offerings

Investor demand assessment and bookbuilding

Regulatory compliance and disclosure requirements

Equity dilution and shareholder value considerations

Timing market conditions and competitive positioning

Communication strategies with investors and media

In the simulation, participants will:

Analyze client business fundamentals and market environment

Develop secondary offering structure and size

Collaborate on pricing and allocation strategies

Manage investor relations and bookbuilding exercises

React to market feedback and adjust offering approach

Prepare and deliver investor pitches and public communications

Coordinate with regulatory and compliance teams

Debrief and reflect on offering outcomes and learning points

Understand the mechanics and roles in secondary equity offerings

Apply strategic decision-making to optimize offering size and pricing

Evaluate market sentiment and investor appetite effectively

Navigate regulatory frameworks impacting secondary offerings

Manage the trade-off between raising capital and shareholder dilution

Communicate complex financial information to diverse stakeholders

React adaptively to dynamic market conditions and investor feedback

Build confidence in real-world capital markets transactions

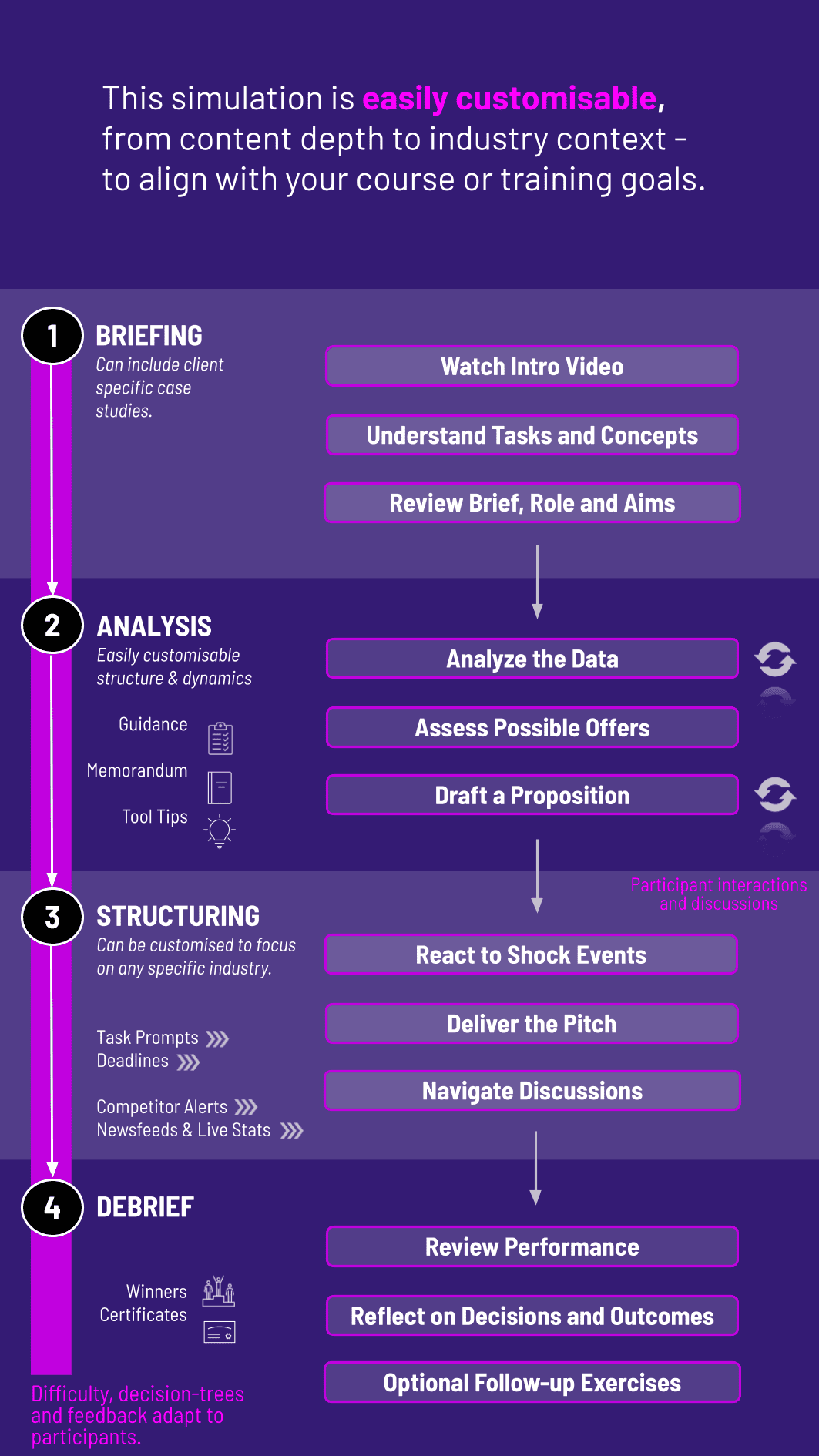

1. Setup and briefing Participants are assigned roles (issuer, underwriting banks, legal/compliance, investor relations) and receive a market scenario, corporate context, and objectives for the secondary offering. Data includes current stock volatility, trading liquidity, and relevant regulatory considerations.

2. Analysis and planning Teams review baseline financials, existing capital structure, and market conditions. They determine offering type, size, pricing range, and timing. They simulate various scenarios including price volatility, demand shifts, and potential over-allotment options.

3. Structuring the deal Choosing Offering type (secondary offering vs. additional primary issuance), with or without greenshoe. Sizing as a percent of outstanding shares and the impact on dilution. Underwriting syndicate composition, fee structure, and allocation policy.

4. Investor engagement and pricing Roadshows or virtual presentations are conducted; investor feedback is translated into a final pricing decision. Roadshow materials, press releases, and Q&A scripts are prepared to address common investor inquiries.

5. Execution and risk controls Final pricing, book-building outcomes, and allocation decisions are executed. Potential risk events (underpricing, volatility spikes, unfavorable demand) trigger contingency plans and alternate timelines.

6. Post-deal review Immediate post-deal performance analysis compares expected versus actual proceeds, dilution, and market reaction. Team debriefs identify learnings for future transactions and update the learning objectives accordingly.

What is a secondary offering simulation? A training tool that simulates the process of conducting a secondary equity offering to teach strategic, financial, and operational skills.

Who should participate in a secondary offering simulation? Business students, finance professionals, investment bankers, and corporate strategists looking to deepen equity capital markets knowledge.

How long does the simulation take? Typically between 2 to 4 hours, adjustable based on program needs.

Can the simulation be customized? Yes, modules can be tailored for specific markets, industries, or learning objectives.

** Is prior finance experience required?** No, the simulation includes instructional support for all experience levels.

Timeliness and accuracy in preparing and communicating a secondary offering plan, including regulatory disclosures, prospectus updates, and pricing mechanics.

Choice of offering type (primary vs. secondary, with/without over-allotment options), allocation strategy, and alignment with issuer objectives

Adherence to securities laws, disclosure requirements, and exchange rules; handling of risk factors, legal opinions, and underwriting agreements

Assessment of market windows, investor demand signals, pricing discipline, and execution risk under volatility; use of roadshows and investor meetings

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.