The Scenario and Sensitivity Analysis Simulation immerses learners in a dynamic environment where they model financial outcomes, stress-test assumptions, and make strategic decisions under variable conditions.

Scenario Analysis vs. Sensitivity Analysis

Identifying key value and risk drivers

Building flexible, scenario-ready financial models

Monte Carlo simulation principles

Interpreting output distributions and confidence intervals

Risk-adjusted decision making

Communicating findings to stakeholders

In the simulation, participants will:

Build an integrated financial model (income statement, balance sheet, cash flow) in Excel or provided software.

Define and input assumptions for multiple strategic and economic scenarios.

Run sensitivity analysis on critical variables (e.g., price, volume, cost of capital).

Perform Monte Carlo simulations to assess probability-weighted outcomes.

Create dynamic dashboards and tornado charts to visualize impact.

Recommend a course of action based on scenario and sensitivity results.

Present analysis to a simulated management or investment committee.

Differentiate between scenario planning and sensitivity testing.

Identify the key business drivers that merit deep analysis.

Construct financial models that accommodate multiple scenarios.

Quantify and rank variables by their impact on outcomes.

Interpret probabilistic output to support decision-making under uncertainty.

Communicate complex analyses in clear, executive-ready formats.

Apply scenario and sensitivity techniques to valuation, budgeting, and capital allocation.

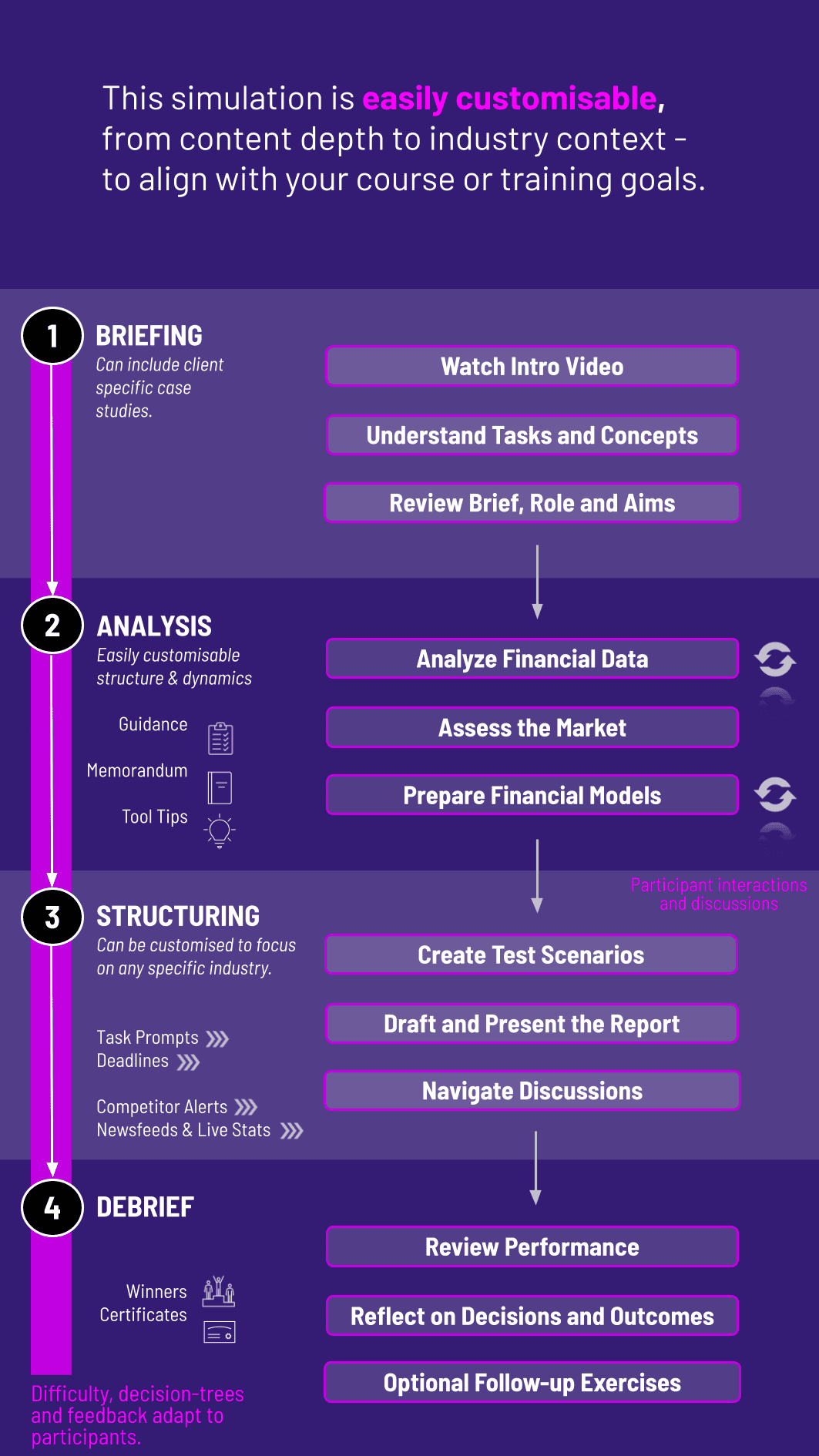

1. Introduction and Case Background Receive a business case (for example, a new product launch, a project investment, or a M&A target).

2. Model Building Develop a baseline financial model with clearly defined input assumptions.

3. Scenario Development Define 3–5 distinct scenarios, altering multiple inputs in tandem to reflect realistic alternative futures.

4. Sensitivity Testing Use one-way and two-way data tables to isolate the impact of individual variables.

5. Probabilistic Simulation Apply Monte Carlo techniques to generate outcome distributions and probabilities.

6. Reporting and Decision Synthesize results into a dashboard and management summary.

Who is this simulation perfect for? Finance professionals, business analysts, consultants, MBA students, and anyone involved in budgeting, forecasting, valuation, or strategic planning.

Do I need advanced Excel skills? Basic proficiency is required. The simulation will guide you through advanced functions like data tables, goal seek, and add-ins for Monte Carlo, enhancing your technical toolkit.

Can the simulation be used for corporate training? Yes. It’s highly effective for FP&A, treasury, and strategy teams to standardize and improve their planning and risk assessment processes.

What kind of scenarios will we analyze? Typical scenarios include market expansion, economic downturn, supply chain disruption, competitive entry, and regulatory changes, tailored to the case company.

How long does the simulation take to complete? Approximately 4–8 hours, depending on depth. It can be run in one intensive workshop or split across multiple sessions.

Correct model structure, appropriate scenario selection, error-free sensitivity setups.

Quality of insight drawn from scenario comparisons and sensitivity outputs.

Ability to explain probabilities, confidence intervals, and downside risks.

Effectiveness in visualizing and communicating recommendations.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.