In this analytical Scenario Analysis Simulation, participants test financial and strategic outcomes under different assumptions. They learn how to assess uncertainty, model trade-offs, and guide better decision-making in high-stakes situations.

Scenario Thinking: Building structured what-if cases for complex business choices

Sensitivity vs. Scenario Analysis: Understanding the difference and when to use each

Key Drivers Identification: Selecting the most impactful variables to test

Financial Modeling: Linking assumptions to P&L, cash flow, and valuation

Decision-Making Under Uncertainty: Choosing strategies with the best risk-return balance

Strategic Flexibility: Planning for contingencies and response strategies

Data Communication: Presenting complex results to non-technical stakeholders

Iterative Learning: Adjusting scenarios as new information becomes available

Review a brief for an initiative - such as launching a product, entering a new market, or investing in a new facility

Identify key drivers of uncertainty and define possible scenarios

Build or adjust financial models to capture case-specific outcomes

Compare and interpret outputs under each scenario (base, best, worst)

Make and justify a recommendation to senior leadership or a board

Respond to new inputs or market shifts, refining the analysis dynamically

Collaborate with peers or functionally across teams, depending on the format

By the end of the simulation, participants will be more confident in:

Applying structured thinking to ambiguous business problems

Translating assumptions into financial outcomes

Using scenario and sensitivity analysis effectively

Communicating recommendations grounded in data

Understanding the risks and returns of each strategic path

Making decisions in environments of incomplete information

Balancing optimism and caution in forward-looking planning

Collaborating on decisions that cross finance, operations, and strategy

Adapting decisions in real time as new variables emerge

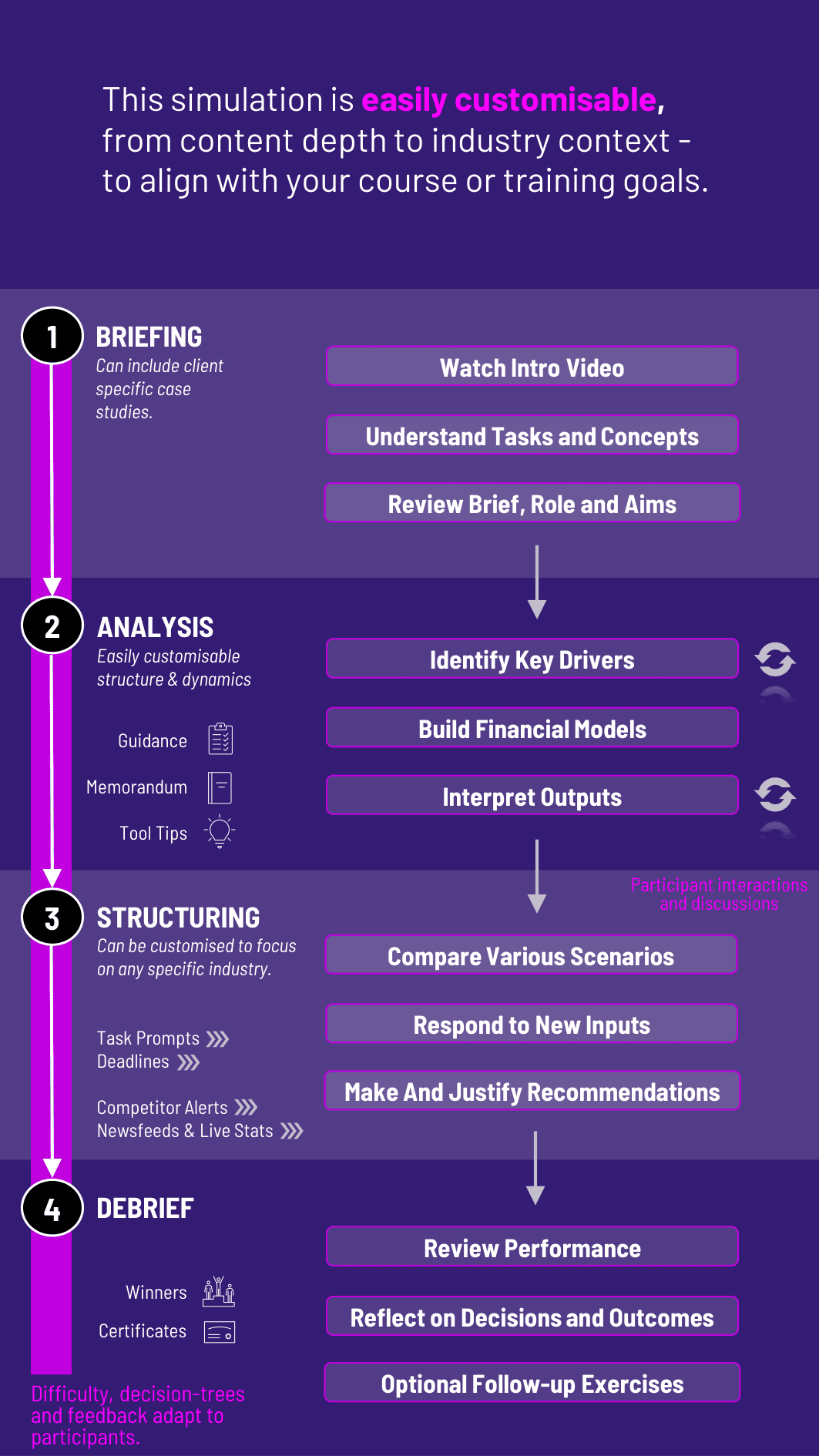

The simulation’s flexible structure ensures that these objectives can be calibrated to match the depth, duration, and focus areas of each program, whether in higher education or corporate learning.

1. Receive a Business Case or Brief Participants are given a high-stakes business initiative along with initial data and assumptions.

2. Identify Key Drivers and Build Scenarios They define the top variables that affect outcomes and model three or more scenarios - best-case, base-case, and worst-case.

3. Run Financial Models Using the simulation interface and spreadsheets, participants test different combinations of assumptions and explore the results.

4. Make a Recommendation Based on results, participants present a decision or strategy to senior stakeholders - explaining logic, risks, and expected returns.

5. Respond to New Information Additional rounds may introduce new data or surprise developments, requiring scenario revision or re-analysis.

6. Reflect and Debrief Teams or individuals review what drove success or failure, how assumptions changed outcomes, and how better modeling improves strategic thinking.

Is this suitable for students with no modeling experience? Yes. The simulation includes built-in support and can be tailored for beginner to advanced learners.

What tools are used? The simulation uses a built-in platform interface but also integrate Excel models where relevant.

Can it be customised for specific industries? Yes. Scenarios can reflect retail, tech, energy, banking, or any sector.

Does it require math-heavy analysis? Not necessarily. It focuses on logic, assumptions, and strategic decision-making - numbers support the thinking.

Can it be used in executive programs? Yes. It's well-suited for corporate leaders making capital allocation, growth, or restructuring decisions.

Is it individual or team-based? Both are possible. Teams can collaborate to reflect cross-functional dynamics.

Can it include external shocks like regulation or competitor moves? Yes. Additional rounds can introduce new variables that stress-test plans.

How long does it run? Typically 2 - 3 hours for one full cycle, or it can be extended into multi-session workshops.

Is visual presentation part of the task? Yes. Participants must often present scenario outcomes using charts or summaries to stakeholders.

How is performance measured? By clarity of assumptions, logic of recommendations, realism of analysis, and communication effectiveness.

Scenario structuring and assumption clarity

Depth and accuracy of financial impact modeling

Risk-awareness and contingency planning

Strategic quality of decision-making

Quality of presentation and stakeholder alignment

Peer and instructor review in multi-team formats

Adaptability as new inputs emerge during the simulation

You can also include memo writing and debrief presentations as part of the assessment structure. Additionally, you can also add a built-in peer and self-assessment tool to see how participants rate themselves. This flexibility allows the simulation to be easily integrated by professors as graded courses at universities and by HR at assessment centres at companies.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.