In this hands-on Risk Modeling with Python Simulation, participants apply Python to build financial risk models - analyzing data, testing scenarios, and communicating insights while balancing technical accuracy with practical decision-making.

Python basics for financial modeling

Probability distributions and risk factors

Monte Carlo simulations and scenario analysis

Value at Risk (VaR) and Conditional VaR

Credit scoring and default risk modeling

Portfolio diversification and risk-return trade-offs

Data cleaning, visualization, and automation in Python

Communicating technical results to business leaders

Stress testing financial models

Integrating risk models into strategic decision-making

Import, clean, and analyze financial datasets

Build risk models using Python libraries

Run Monte Carlo simulations to test scenarios

Evaluate model outputs for accuracy and bias

Present findings to boards, regulators, or investment committees

Reflect on model limitations and practical applications

By the end of the simulation, participants will be able to:

Apply Python to financial risk modeling problems

Understand key risk measures like VaR and stress tests

Build and interpret Monte Carlo simulations

Identify strengths and weaknesses in risk models

Communicate technical outputs to non-technical stakeholders

Manage trade-offs between model complexity and usability

Apply coding best practices to finance problems

Translate data insights into strategic risk decisions

Collaborate on technical and business perspectives

Build confidence in Python for real-world finance contexts

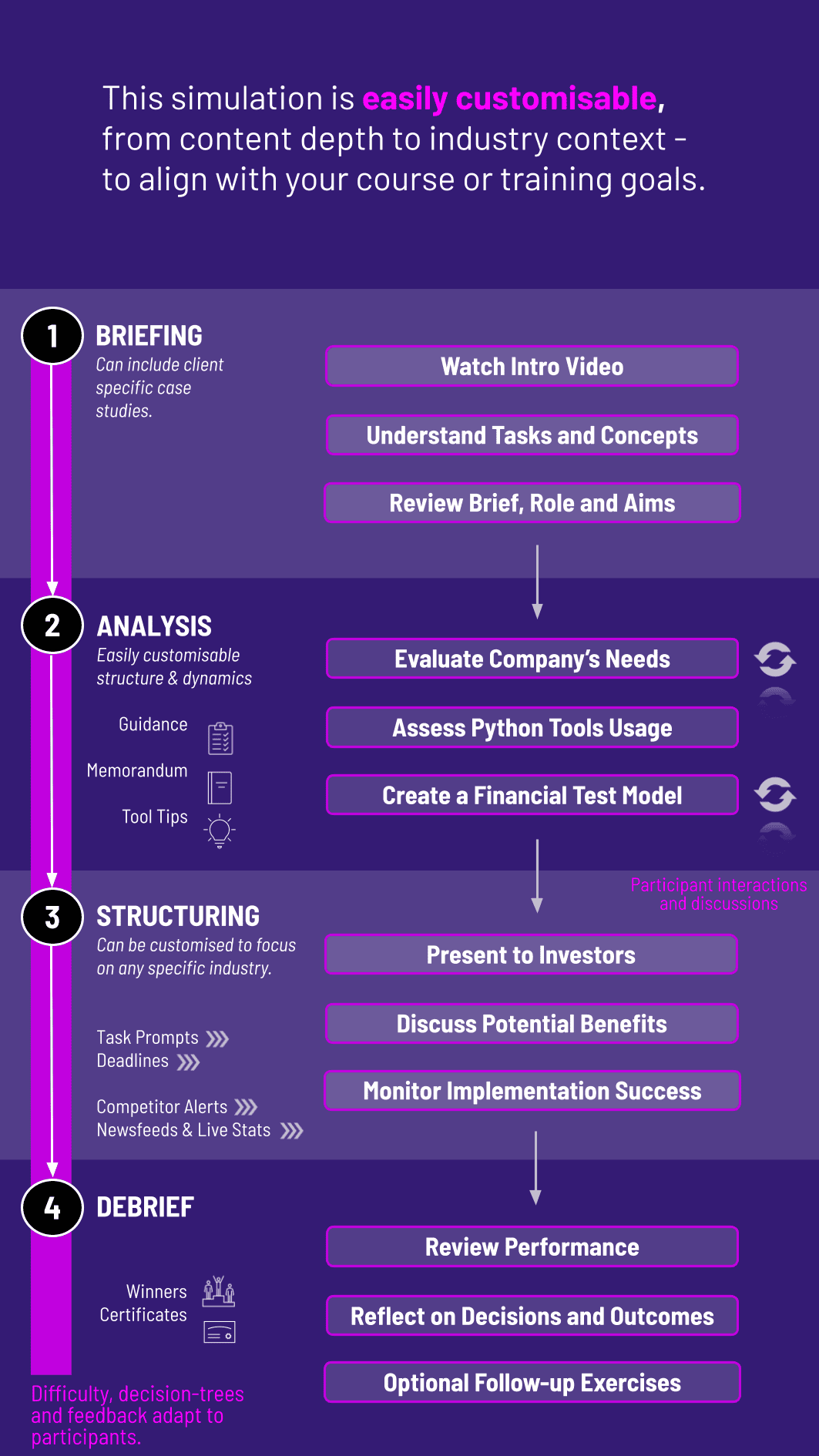

The simulation’s flexible structure ensures that these objectives can be calibrated to match the depth, duration, and focus areas of each program, whether in higher education or corporate learning.

The simulation can run individually or in teams in classrooms, coding bootcamps, or corporate training. Each cycle represents a stage of risk modeling.

1. Receive a Scenario or Brief: Participants are introduced to a risk challenge (e.g., portfolio stress test or credit scoring).

2. Analyse the Situation: They review data inputs, market context, and modeling objectives.

3. Build Risk Models in Python: Participants write Python code to construct and test models.

4. Collaborate Across Roles: Teams may divide into coders, analysts, and communicators to align insights.

5. Communicate Outcomes: Participants present findings through reports, memos, or presentations.

6. Review and Reflect: Feedback highlights technical accuracy, business impact, and clarity. Participants refine models across rounds.

Do participants need prior Python knowledge? Basic familiarity helps, but the simulation includes guided coding examples.

What Python libraries are used? Commonly used ones such as NumPy, Pandas, and Matplotlib.

Is this simulation only technical? No. It emphasizes both coding skills and communication with non-technical stakeholders.

Can it be customized? Yes. Scenarios can focus on credit risk, portfolio risk, or market risk.

Does it cover Monte Carlo simulations? Yes. Scenario testing is a key component.

Is this simulation suitable for corporate training? Yes. It’s highly relevant for finance, risk, and data science teams.

How long does it run? It can be run as a 3-hour workshop or extended over multiple sessions.

Is teamwork included? Yes. Teams can collaborate on coding, analysis, and communication.

Can it run online? Yes. The simulation supports in-person, hybrid, and digital delivery.

How is success measured? By coding accuracy, risk insights, and clarity of communication.

Accuracy and robustness of Python models

Interpretation of outputs for business impact

Responsiveness to new datasets or scenarios

Clarity in communicating technical findings

Collaboration in team-based coding and analysis

You can also include memo writing and debrief presentations as part of the assessment structure. Additionally, you can also add a built-in peer and self-assessment tool to see how participants rate themselves. This flexibility allows the simulation to be easily integrated by professors as graded courses at universities and by HR at assessment centres at companies.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.