This simulation immerses participants in the strategic execution of a reverse merger, where a private company acquires a public shell to gain a stock market listing without a traditional IPO.

Reverse Merger vs. Traditional IPO

Public Shell Companies (Clean vs. Checkered Shells)

Due Diligence for Public Shells

Deal Structuring and Valuation (PIPE Financing)

Regulatory Filings (SEC Super 8-K)

Post-Merger Integration & Strategy

Investor Relations and Market Communication

Corporate Governance in a New Public Entity

In the simulation, participants will:

Analyze the private company's financials and strategic rationale for going public.

Identify and Evaluate potential public shell companies, assessing their cleanliness and compliance history.

Conduct thorough financial and legal due diligence on the target shell.

Structure the merger terms, including the exchange ratio and ownership percentage.

Model the pro-forma financials and capital structure of the new public entity.

Navigate a simulated regulatory filing process.

Develop a 100-day post-merger plan focusing on investor relations, governance, and growth strategy.

Respond to dynamic market events and shareholder concerns.

Understand the strategic advantages and disadvantages of a reverse merger compared to an IPO.

Identify the key steps and critical success factors in a reverse merger transaction.

Evaluate a public shell company for potential red flags and compliance issues.

Structure a reverse merger deal, including the valuation and ownership distribution.

Comprehend the core SEC reporting requirements for a reverse merger.

Develop a robust strategy for managing the post-merger entity to build market confidence and drive valuation.

1. Role Assignment and Briefing Participants are divided into teams and take on the role of the management team of "TechNovate Inc.", a high-growth private tech firm. They receive a detailed company profile, financial statements, and strategic goals.

2. Shell Company Analysis Teams are presented with a curated list of several public shell companies. Each shell has a unique history, financial status, and set of potential liabilities. Teams must analyze and select the most suitable target.

3. Due Diligence and Deal Room Teams access a virtual data room for their chosen shell, uncovering key information that will impact their valuation and deal structure.

4. Financial Modeling and Structuring Using a provided Excel-based template, teams model the pro-forma capitalization table and financial statements post-merger. They must negotiate and finalize the merger terms.

5. Regulatory Hurdle Teams must complete a simplified version of a critical regulatory filing, ensuring all necessary disclosures are made to avoid future legal pitfalls.

6. Post-Merger Scenario After the "merger" is complete, teams face a series of real-world challenges, such as a skeptical analyst report, a volatile stock price, or an activist investor, requiring them to implement their post-merger plan.

Who is this simulation designed for? It is ideal for MBA students, finance professionals, corporate developers, and anyone seeking to understand the practical mechanics of alternative public listing strategies beyond the traditional IPO.

Do I need prior experience in M&A or investment banking? While helpful, it is not required. The simulation is designed with learning modules and guidance to bring participants up to speed on the core concepts before they begin making critical decisions.

What is a public shell company? A public shell is a company that is registered with the SEC and has a stock ticker but has no significant assets or operations. It exists primarily as a vehicle for a private company to become public through a reverse merger.

How long does the simulation take to complete? The core simulation can be completed in approximately 3 to 4 hours. However, this can vary based on the depth of analysis and team discussion. It is often run over a 1-2 week period in academic settings.

Is PIPE (Private Investment in Public Equity) financing covered? Yes, a core part of the simulation involves modeling and securing a concurrent PIPE financing round, which is often critical to fund the merger and provide working capital for the new public company.

What makes this simulation different from a standard M&A simulation? This simulation focuses specifically on the unique challenges of a reverse merger: shell due diligence, specific SEC regulations (like the Super 8-K), and the intense focus on post-merger credibility and communication that is distinct from a merger of two operating companies.

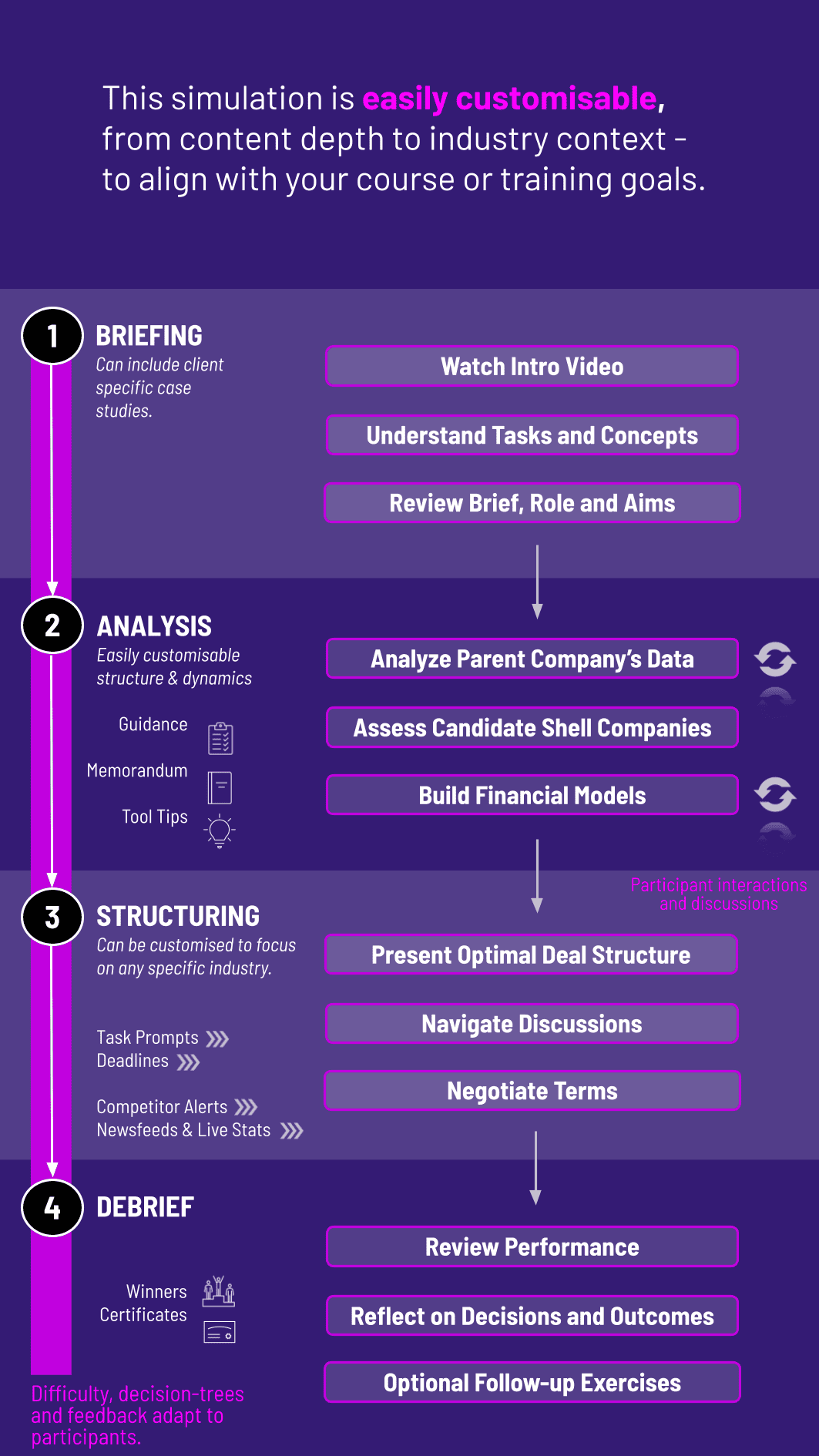

Can this simulation be customized for corporate training? Absolutely. We offer customized versions where the private company and shell profiles can be tailored to reflect your industry, making the learning experience directly relevant to your team's needs.

Financial soundness of the merger terms

Valuation of the private company

Negotiated exchange ratio

Due Diligence and Risk Assessment

Post-Merger Strategy

Scenario Response

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.