In this interactive Retail Banking Simulation, participants take on leadership roles in consumer banking, making real-time decisions across product portfolios, customer segments, and risk strategies to grow a retail bank sustainably.

Customer Segmentation and Profitability

Product Mix Optimization (Savings, Loans, Credit Cards)

Pricing and Interest Rate Strategies

Net Interest Margin (NIM) and Cost-to-Income Ratio

Non-performing Loans and Credit Risk

Customer Lifetime Value (CLV) and Retention Strategies

Financial Inclusion vs. Profitability

Digital Transformation and Channel Management

Regulatory Compliance and Fair Lending

Cross-Selling and Relationship Banking

Analyze customer data to understand segment behavior and profitability

Make pricing decisions for savings, loans, and credit products

Develop cross-sell and upsell strategies to increase share of wallet

Adjust credit policy to manage NPLs and risk exposure

Decide on investments in digital platforms vs. physical branches

Balance short-term earnings with long-term brand trust and inclusion

Monitor competitor moves and adjust product positioning

Respond to regulatory changes and macroeconomic shocks

Report performance to internal boards and external analysts

Recalibrate strategy across multiple rounds of decision-making

By the end of the simulation, participants will:

Understand the economics and operating model of a retail bank.

Analyze how customer behavior drives banking performance.

Set pricing and risk policy to optimize profitability across segments.

Manage trade-offs between growth, credit quality, and customer trust.

Design product strategies based on data and customer insights.

Interpret key metrics like NIM, ROA, and cost-to-income ratio.

Apply financial and ethical reasoning to lending and inclusion decisions.

Develop strategic responses to regulatory and market shifts.

Make cross-functional decisions involving marketing, risk, and operations.

Communicate results and rationale to senior stakeholders clearly.

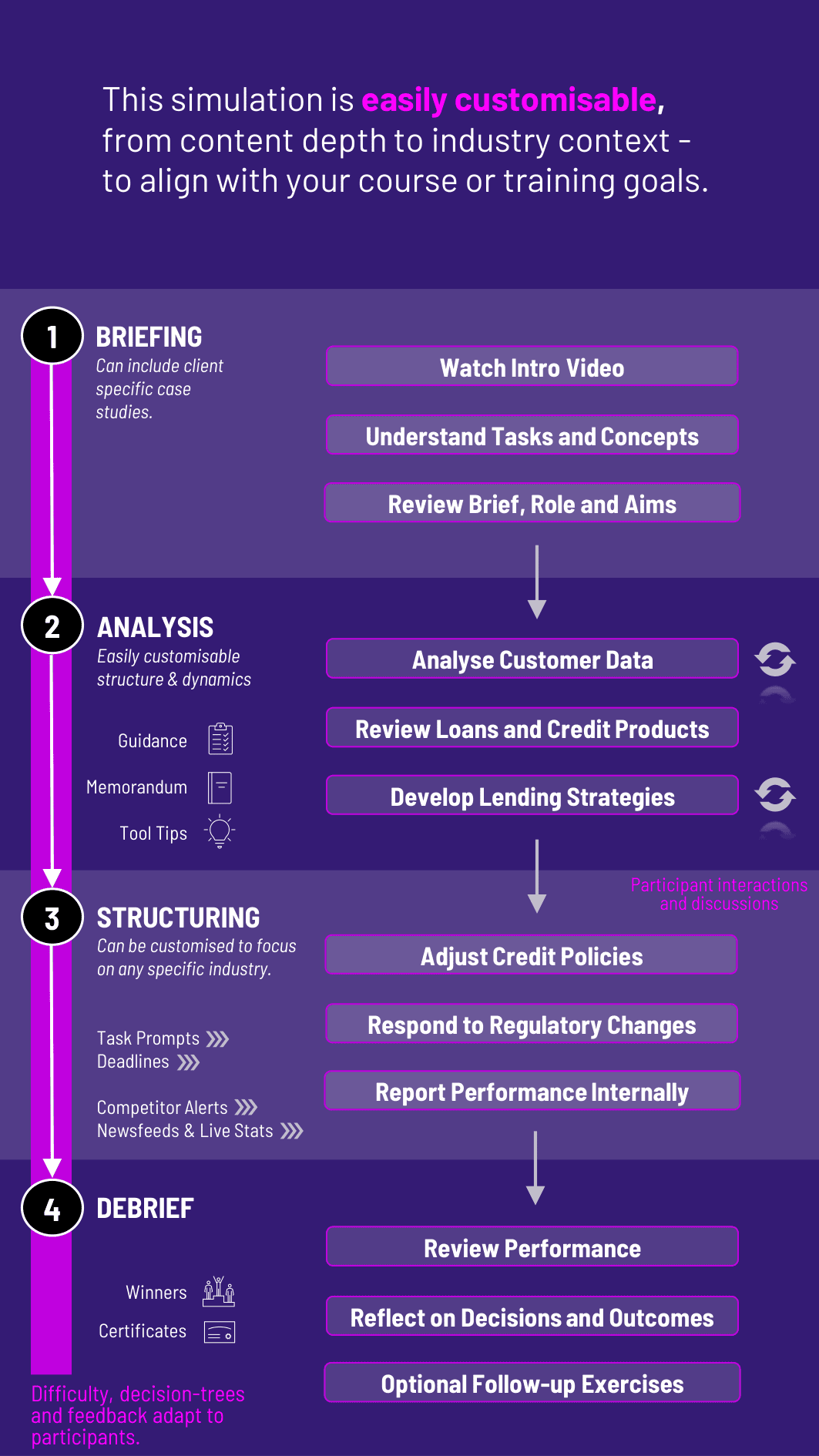

The simulation’s flexible structure ensures that these objectives can be calibrated to match the depth, duration, and focus areas of each program, whether in higher education or corporate learning.

Participants engage in fast-paced, realistic decision cycles that mirror the operational rhythm of retail banks.

1. Set Objectives and Analyze Bank Profile Each team or individual receives a bank profile, historical performance, and market context. They define their strategic focus - growth, profitability, inclusion, or stability.

2. Segment Customers and Build Product Strategies Participants review segmentation data and design tailored pricing and product mixes. This includes rate decisions, bundled offers, and loan terms across channels.

3. Manage Risk and Credit Strategy They establish credit policies, define risk thresholds, and simulate expected default rates. This requires careful balance between revenue goals and credit discipline.

4. Respond to Events and Market Dynamics Each round brings new developments - interest rate changes, new regulations, digital disruption—that force participants to adapt and reprioritize.

5. Track KPIs and Review Performance Participants receive feedback through key financial, customer, and operational metrics. They reflect on what worked, adjust strategy, and prepare for the next round.

6. Justify Strategy to Stakeholders At the end of each cycle, teams prepare a short report or presentation, simulating board-level communication and enhancing business storytelling skills.

Is prior banking experience required? No. Foundational financial concepts are built into the experience, making it accessible to both newcomers and advanced learners.

Can this simulation be used in executive education? Yes. It’s ideal for banking professionals, MBA students, and corporate learners.

Does the simulation support team play? Absolutely. Teams can simulate cross-functional departments or manage regional banking units.

Are ethics and regulatory issues included? Yes. Scenarios include dilemmas around fair lending, compliance, and reputational risk.

Can it be customized for specific regions (e.g., India, Africa)? Yes. The simulation can be localized with region-specific case elements and customer behaviour profiles.

Does it include digital banking scenarios? Yes. Participants can choose between physical, hybrid, or fully digital strategies.

What are the assessment options? Instructors can assess via financial KPIs, strategy memos, and stakeholder presentations.

Can it be used in courses like retail banking, strategy, or inclusion? Yes. It fits perfectly into retail banking, strategy, ESG finance, and customer experience curricula.

How long does it take? The simulation can be run in a 2 - 3 hour format or spread across multiple sessions.

What soft skills are developed? Participants improve collaboration, problem-solving, data storytelling, and customer-centric thinking.

Participants are evaluated on:

Financial performance (ROA, NIM, risk-adjusted returns)

Product mix alignment with customer segments

Responsiveness to market and regulatory events

Quality of risk controls and credit decisions

Inclusion and ethical decision-making outcomes

Team collaboration and communication effectiveness

Depth of reflection and iteration across rounds

Stakeholder communication (board reports, memos)

Integration of financial, operational, and marketing insights

Final strategy articulation and outcome clarity

You can also include memo writing and debrief presentations as part of the assessment structure. Additionally, you can also add a built-in peer and self-assessment tool to see how participants rate themselves. This flexibility allows the simulation to be easily integrated by professors as graded courses at universities and by HR at assessment centres at companies.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.