In the Reinsurance Strategy Simulation participants make strategic choices around treaty design, capacity allocation, reinsurance purchasing, underwriting retention and capital optimisation in a dynamic market and risk environment.

Reinsurance treaty structures

Cedant vs reinsurer roles

Risk retention and transfer strategies

Capital relief and solvency impact through reinsurance decisions

Portfolio construction and accumulation control: managing exposures, peril diversification, aggregation risk

Cost-efficiency of reinsurance

Reinsurance market cycles and negotiation

Catastrophe modelling, dynamic financial analysis

Communication of reinsurance strategy

In the simulation, participants will:

Analyse an initial scenario and brief: current exposure profiles, business mix, capital base, strategic objectives

Review historical and projected loss data, catastrophe scenarios, accumulation maps, treaty pricing

Choose and design reinsurance programms: determine retention levels, layer structure, limits, attachments, type of treaty

Decide on capacity sourcing: whether to retain more risk or transfer it — and at what cost

Adjust underwriting/retention across lines of business to reflect reinsurance decisions and risk appetite

Monitor risk-return and solvency metrics

Collaborate and negotiate: teams may act as cedent, reinsurer or broker; they may negotiate treaty terms, capacity offers, or bid for risk

Prepare and deliver strategy presentations or memos

Understand the fundamental behaviours and structures of reinsurance markets and treaties

Evaluate reinsurance strategies (proportional vs non-proportional, retention levels, layer design) in the context of business objectives and risk appetite

Analyse the cost and benefit trade-off of reinsurance: premium cost, recoveries, capital relief, profitability impact

Manage accumulation risk and exposure concentrations across lines of business and perils

Understand how reinsurance decisions affect capital, solvency, underwriting volatility and shareholder value

Respond dynamically to market cycles, catastrophe losses and competitive pressure in a reinsurance context

Collaborate across functions to design coherent reinsurance strategy

Communicate reinsurance strategy clearly to stakeholders and justify the trade-offs made

Build confidence in making strategic decisions under uncertainty, constrained resources and competitive tension

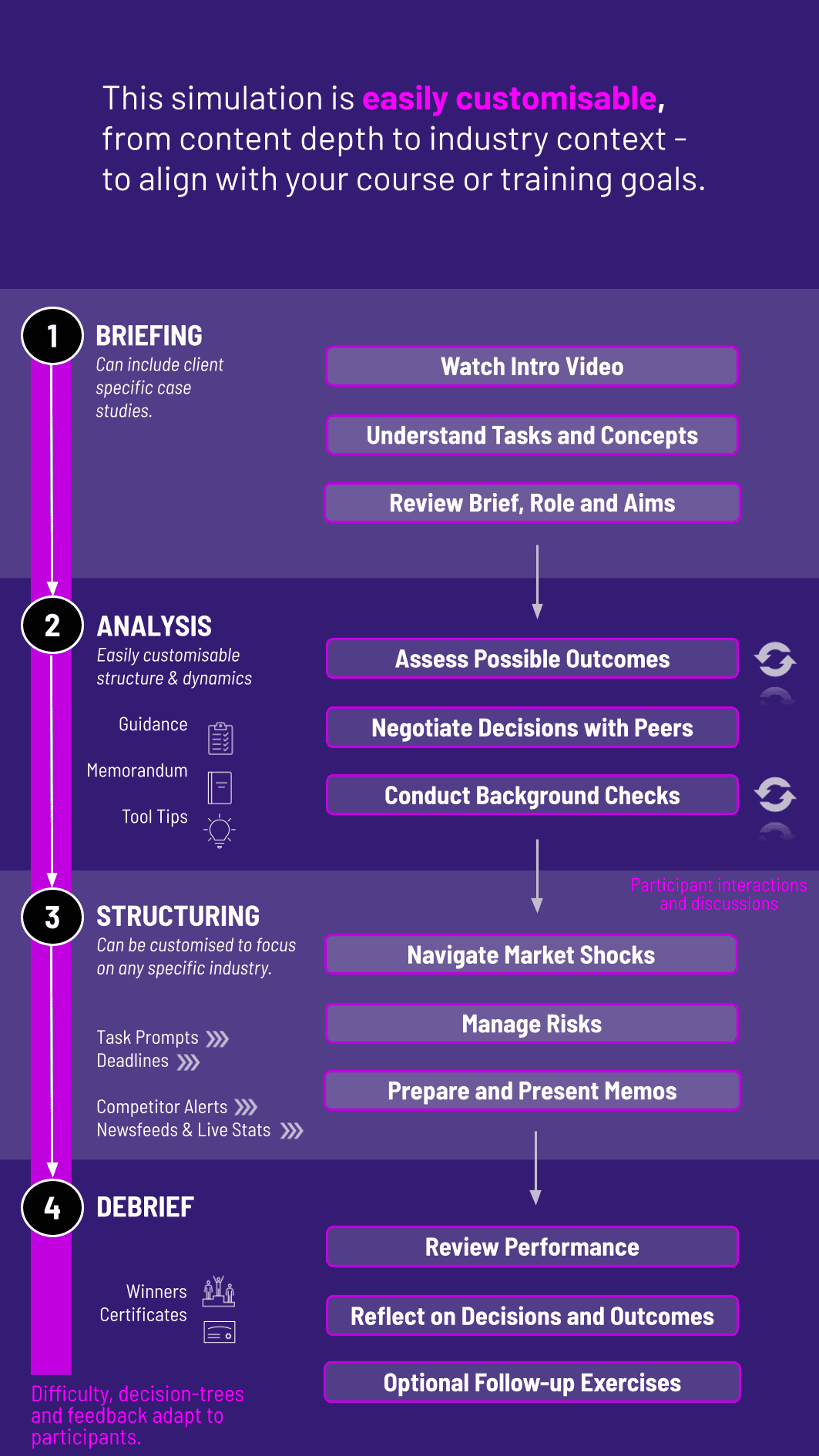

The simulation’s flexible structure ensures that these objectives can be calibrated to match the depth, duration, and focus areas of each program, whether in higher education or corporate learning.

1. Get into the Role Participants receive a scenario, team-roles (cedant, reinsurer, or mixed), background materials (portfolio mix, exposure maps, market data).

2. Analyze the Situation, Make Propositions Teams review the current exposure and risk-profile, decide their strategy for reinsurance placement/retention. They submit their decisions: treaty types, retention, layers, capacity, etc.

3. Review the Results Simulation provides the outcomes of the decisions made beforehand. Participants judge the success of their actions and must adapt to changes.

4. Implement New Strategy While taking into account new events provided by the simulation, participants must make decisions again, this time with their experience to guide them.

5. Review and Reflect Feedback highlights defensibility, consistency, risk assessment, and clarity of narrative.

Strategic soundness, quality and logic of reinsurance programme decisions

Financial performance: net underwriting result, cost of reinsurance, volatility of retained losses, return on retention

Efficiency in use of capital, solvency/rating-agency metrics, impact of reinsurance on capital relief

Control of accumulation risk, exposure concentrations, responsiveness to shock events

Clarity and persuasiveness of presentations/memos explaining strategy, trade-offs and outcomes

Team interaction, responding to evolving scenarios, learning from earlier rounds and adjusting strategy

Assessment may incorporate peer and self-review components, facilitator scoring, and debrief discussion. Results may feed into grades, executive feedback, certification or development plans.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.