In this Regulatory Compliance in Finance Simulation, participants act as compliance officers navigating financial regulations, managing internal controls, responding to breaches, and aligning business operations with evolving regulatory frameworks.

Protocols: Onboarding, ongoing due diligence, suspicious activity reporting

Regulatory Frameworks: Adherence to various international rules

Internal Controls: Policies, procedures, surveillance, and escalation

Breach Management: Identifying, reporting, remediating internal or client violations

Ethical Decision-Making: Whistleblower protection, grey areas, and personal accountability

Compliance Communication: Training design, stakeholder messaging, documentation

Audit Readiness: Preparing for internal and external reviews

Global Risk Awareness: Adapting policies across jurisdictions with differing standards

Interpret relevant regulatory guidance and identify risks

Review internal policies and flag potential control gaps

Decide on how to respond to compliance incidents or alerts

Balance business needs with regulatory obligations

Recommend training, internal audits, or policy changes

Communicate clearly with regulators, executives, or front-office staff

Justify decisions in a documented audit trail

Respond to real-time feedback or fallout from their choices

By the end of the simulation, participants will be more confident in:

Identifying and responding to compliance risks across financial services

Interpreting and applying complex financial regulations to business scenarios

Managing stakeholder expectations during compliance breaches

Designing risk-based approaches to internal policy and monitoring

Communicating with regulatory bodies under scrutiny

Responding to grey-area dilemmas with professionalism and integrity

Leading proactive compliance programs, not just reactive policing

Embedding a culture of compliance into a growing or pressured firm

Navigating jurisdictional complexity across global financial regulations

Handling sensitive data, whistleblower protection, and reputational issues

This is ideal for learners in finance, law, or risk management roles preparing for careers in compliance, internal audit, or regulatory affairs. The simulation’s flexible structure ensures that these objectives can be calibrated to match the depth, duration, and focus areas of each program, whether in higher education or corporate learning.

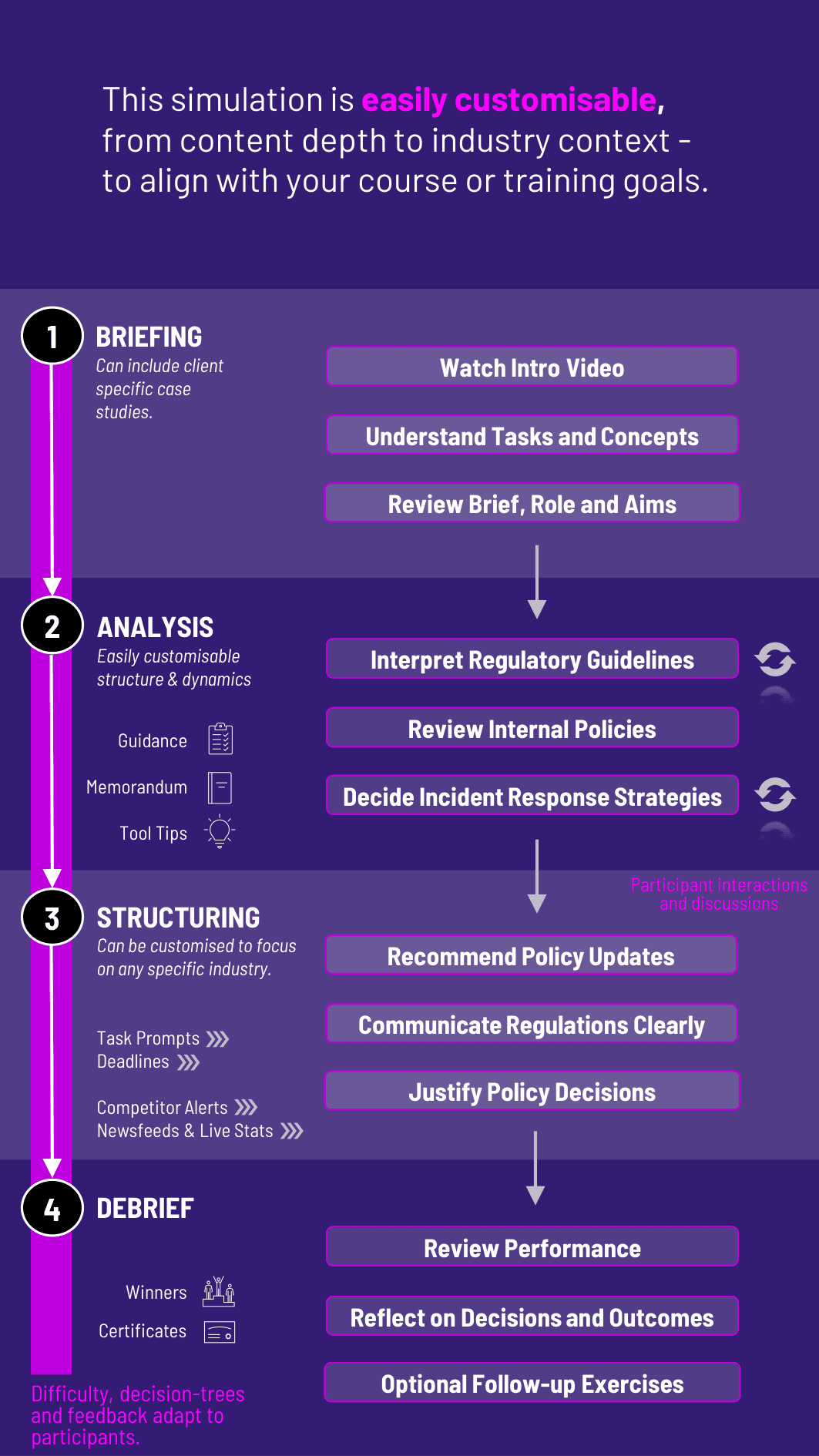

1. Receive a Scenario Brief Participants are given a live issue - e.g., a flagged transaction, regulatory notice, employee complaint, or due diligence concern.

2. Assess the Compliance Risk They review the relevant regulation, company policy, and business context to understand potential exposure.

3. Make Strategic Compliance Decisions Participants decide how to respond - e.g., escalate, remediate, notify regulators, revise training, or monitor further.

4. Communicate with Stakeholders They prepare communications to regulators, management, or front-line staff - justifying their rationale and proposing solutions.

5. Receive Feedback and Results The simulation provides real-time feedback based on regulatory outcomes, business impact, and reputational risk.

6. Iterate with New Scenarios Each new round increases in complexity: new geographies, overlapping rules, or deeper business-conflict trade-offs.

Do participants need prior legal or compliance knowledge? No. The simulation includes guided explanations. It’s suitable for beginners and intermediate learners alike.

Can it be tailored for specific sectors? Yes. Scenarios can be adapted for investment banking, wealth management, fintech, or global banking contexts.

Does it include international regulations? Yes. The simulation can include rules from U.S., U.K., EU, APAC, or multi-jurisdictional frameworks.

Can teams collaborate in decision-making? Absolutely. Teams can take roles (e.g., head of compliance, legal advisor, business lead) to reflect real-world tensions.

Are ethical dilemmas included? Yes. Participants must deal with ambiguous or sensitive situations where the right path isn’t always clear.

Is the simulation quantitative? It’s more qualitative, focusing on analysis, policy interpretation, and decision communication.

Can participants practice written communication? Yes. The simulation includes drafting internal memos, incident reports, or regulatory disclosures.

How is performance measured? Based on risk mitigation, communication quality, business alignment, and stakeholder satisfaction.

Is this simulation suitable for corporate training? Yes. It's widely adaptable for financial institutions, regulators, and cross-border firms.

How long does it take? It can run in a 3 - 4 hour duration or be expanded into a multi-session module with layered scenarios.

Risk identification and decision-making

Regulatory understanding and logical application

Communication under scrutiny

Stakeholder awareness and balance

Ethical clarity and professionalism

Written and verbal clarity

Adaptability across scenarios and jurisdictions

Assessment formats may include short memos, team presentations, policy recommendations, or audit readiness reports. Peer and self-assessments can be integrated into corporate learning pathways or university course credit structures.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.