The Refinancing Simulation replicates real-world lender-borrower negotiations and capital structure adjustments to provide a practical, hands-on learning experience in managing debt financing effectively.

Debt and capital structures

Loan refinancing types and terms

Interest rate negotiation and cost of capital

Credit risk assessment and lender dynamics

Capital structure optimization

Financial covenants and compliance

Amortization and refinancing schedules

Impact of economic conditions on refinancing

Negotiation and communication with lenders

Refinancing as a strategic financial tool

In the simulation, participants will:

Analyze company financial status and current debt

Assess refinancing needs and objectives

Evaluate different refinancing options and scenarios

Negotiate terms with simulated lender counterparts

Construct and present refinancing proposals

Manage refinancing execution and compliance

Monitor post-refinancing impact on financial metrics

Collaborate within teams acting as borrower and lender

Deliver investor or stakeholder updates on refinancing outcomes

Reflect on strategy effectiveness and decision impacts

Understand different debt structures and refinancing instruments

Master analysis of refinancing benefits and risks

Develop negotiation and communication skills with lenders

Apply financial modeling to refinancing decisions

Manage refinancing under real-world constraints and volatility

Assess refinancing impact on company financial health

Balance liquidity, cost of capital, and creditworthiness

Interpret refinancing-related covenants and compliance issues

Improve critical thinking in dynamic financial environments

Gain confidence in refinancing strategy formulation and execution

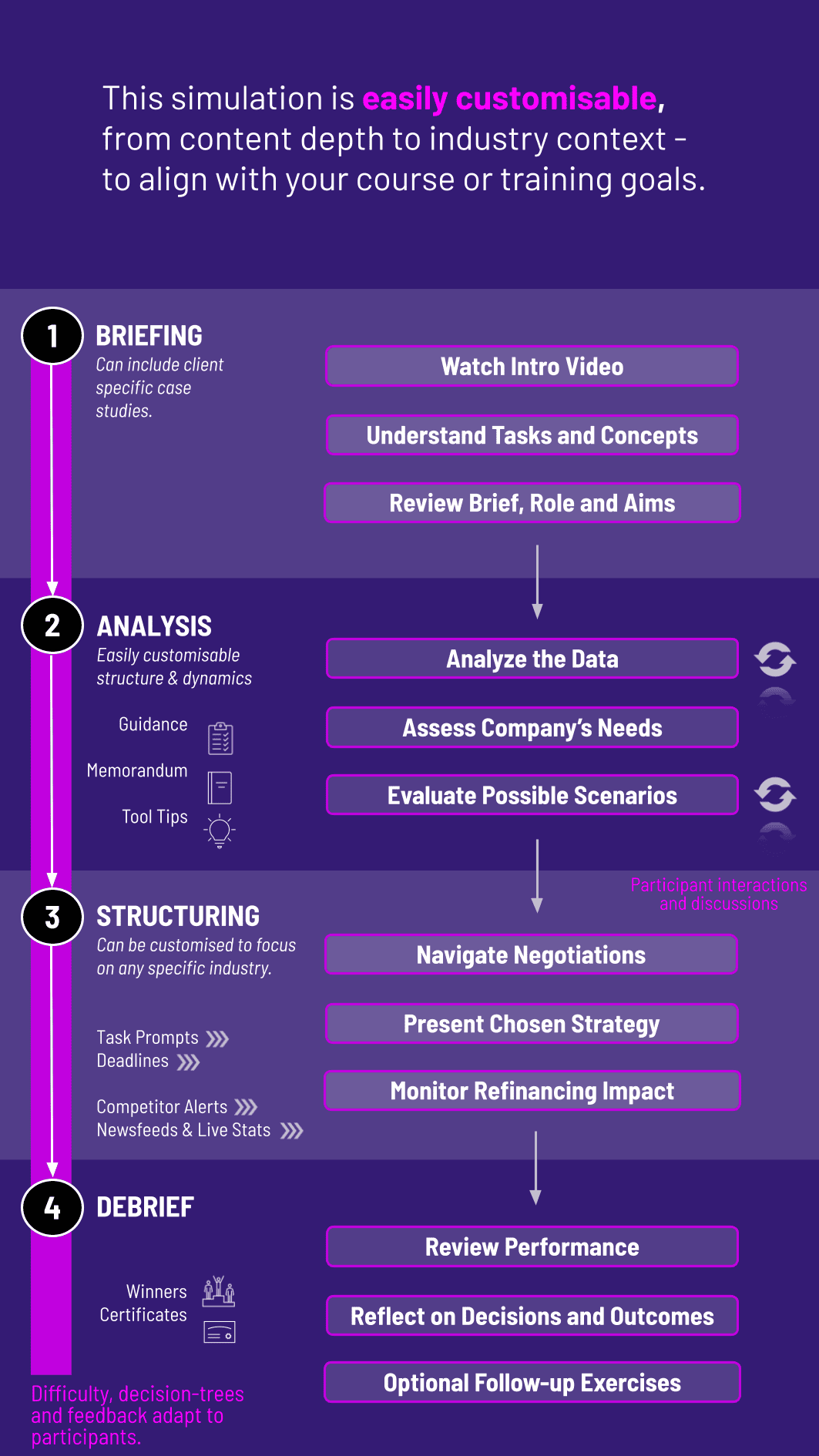

1. Scenario setup Participants begin with a realistic refinancing need, such as maturing debt, covenant constraints, or liquidity pressure, and receive a borrower profile, current capital structure, and market context.

2. Data and tools Access is granted to a data room containing financial statements, debt terms, market rates, and covenants. Built-in modeling tools enable cash flow forecasting, debt scheduling, and refinancing analyses.

3. Decision points Teams propose refinancing options (tenor, rate type, amortization, covenants) and decide on use of proceeds. Internal memos and lender-facing presentations are prepared to justify the chosen path.

4. Execution and feedback The rounds simulate evolving market conditions, rate shifts, and covenant tests. Immediate feedback focuses on financial outcomes, risk management, and communication quality.

5. Assessment and coaching Performance is graded on quantitative results (DSCR, leverage, NPV of refinancing) and qualitative judgment (risk rationale, stakeholder communications, teamwork). Post-round debriefs highlight strengths, gaps, and transferability to real-world scenarios.

What kind of company and scenario will participants be working with? The simulation typically features a mature, healthy company with existing debt that is nearing maturity or a company seeking to capitalize on favorable market conditions to optimize its balance sheet. Scenarios may include refinancing a corporate bond, renegotiating a syndicated loan, or navigating a leveraged recapitalization post-LBO.

Who do participants represent in the simulation? Participants act as the corporate treasury or financial strategy team of the company. Your role is to act in the best interest of the corporation and its shareholders, making strategic decisions on the timing, structure, and type of debt to issue.

Do participants interact with other stakeholders, like banks or investors? Yes, a core part of the simulation involves negotiating with simulated counterparties. This may include pitching your financing needs to investment bankers, evaluating competing term sheets from lenders, and communicating your strategy to credit rating agencies to secure the best possible outcome for your company.

Is this simulation only relevant for corporate finance roles? While it is essential for those pursuing careers in corporate treasury, investment banking, or credit analysis, the skills are highly transferable. Anyone in private equity, equity research, or general management will benefit from a deep understanding of how capital structure decisions directly impact corporate value and strategic flexibility.

How complex is the financial modeling involved? The simulation focuses on strategic decision-making supported by financial analysis. You will work with pre-built integrated financial models to project the impact of different refinancing options on the company's income statement, cash flow statement, and key credit metrics, without needing to build a complex model from scratch.

How is performance assessed in the simulation? Performance is evaluated based on the strategic success of your refinancing outcome. Key metrics include the achieved reduction in the weighted average cost of capital (WACC), the improvement in debt maturity profiles and covenants, the overall cost-efficiency of the transaction, and the rationale behind your chosen strategy.

Strategic selection of repurchase methods and timing aligned with market conditions and company goals Financial analysis and assessment of share repurchase impact on earnings per share (EPS), return on equity (ROE), and valuation metrics

Scenario analysis including rate shocks, credit spreads widening, and liquidity constraints.

Assessment of leverage limits, debt capacity, and refinancing risk under varying market conditions.

Ability to defend chosen refinancing paths with data-driven rationale.

Alignment with regulatory requirements, reporting standards, and governance processes.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.