The Reconciliation of Accounts Simulation plunges participants into a fast-paced role as a reconciliation specialist, where they must identify, investigate, and resolve discrepancies in real-time, ensuring the accuracy and reliability of financial data.

Bank Reconciliation

Account Reconciliation

Inter-company Reconciliation

Timing Differences

Investigative Accounting

Internal Controls

Materiality and Risk Assessment

Audit Trail

In the simulation, participants will:

Process and reconcile monthly bank statements against the company's cash book.

Investigate and resolve discrepancies in general ledger accounts.

Collaborate with virtual "colleagues" in the AP and AR departments to obtain missing information.

Analyze large datasets to identify patterns and outliers.

Document all investigation steps and final resolutions in a formal reconciliation report.

Manage their time and workflow to meet strict reporting deadlines.

Escalate potential fraud or significant control weaknesses to the virtual CFO.

Progress through increasing levels of difficulty, from simple errors to complex multi-period issues.

Execute a complete and accurate bank and general ledger account reconciliation.

Systematically identify, investigate, and resolve various types of accounting discrepancies.

Apply professional judgment to assess the risk and materiality of reconciling items.

Demonstrate the importance of reconciliation as a cornerstone of strong internal controls.

Improve efficiency and accuracy when working with large sets of financial data.

Communicate effectively to resolve issues that require input from other business units.

Develop a clear and audit-ready documentation trail for all reconciliation work.

1. Introduction and Role Assignment Participants are introduced to their role as a Reconciliation Specialist at "Global Synergy Corp" and the simulation dashboard.

2. Receive Data Each simulation round, participants receive a new set of data: a bank statement, a general ledger extract, and supporting documentation.

3. Identify Discrepancies Using the simulation's tools, they compare records to identify mismatches and outliers.

4. Investigate and Resolve Participants drill down into transactions, send queries to virtual departments, and determine the root cause of each discrepancy (duplicate payment, missing deposit, data entry error).

5. Document and Report For each item, they log their findings and take corrective action. At the end of the round, they submit a formal reconciliation package.

6. Feedback and Scoring The platform provides immediate, detailed feedback on accuracy, efficiency, and the quality of documentation. A performance score is generated based on these metrics.

7. Progress Successful completion allows participants to advance to the next, more complex period, introducing new challenges and account types.

What is the target audience for the Reconciliation of Accounts Simulation? This simulation is ideal for undergraduate and graduate business students, early-career accountants, finance professionals, and anyone in a role requiring a solid understanding of financial controls and data integrity.

What are the technical requirements to run the simulation? The simulation is entirely browser-based. Participants only need a modern web browser (like Chrome, Firefox, or Safari) and a stable internet connection. No additional software installation is required.

How long does it take to complete one full simulation? A typical simulation cycle, covering multiple accounting periods, is designed to be completed in 2-4 hours, depending on the participant's pace and familiarity with the concepts.

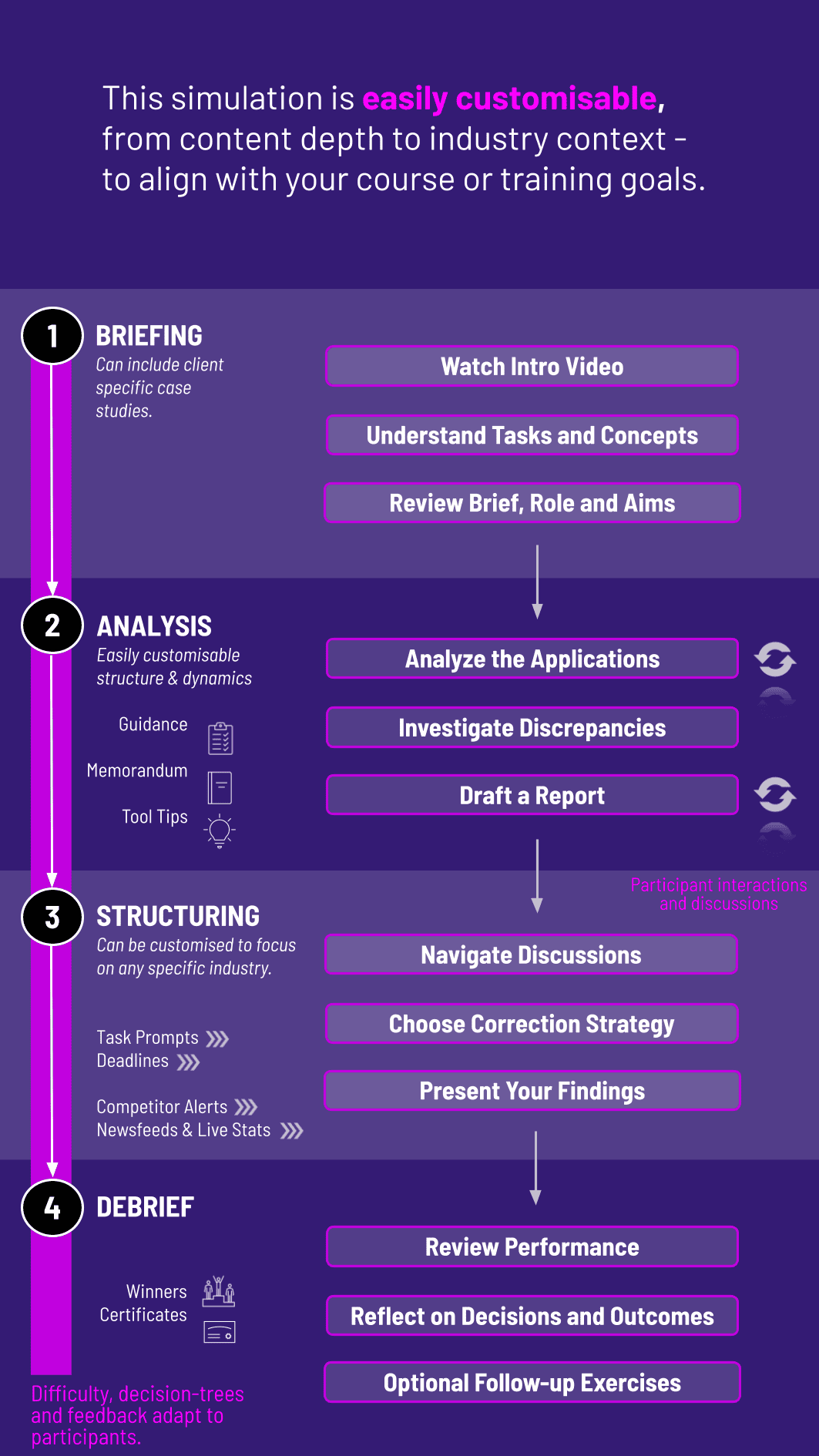

Can this simulation be customized for corporate training? Absolutely. We can customize the scenarios, company name, transaction types, and difficulty levels to match your organization's specific industry and internal processes.

Is this a single-player or multi-player simulation? The core simulation is single-player, allowing each participant to learn at their own pace. However, we offer team-based versions where groups compete or collaborate to resolve a complex reconciliation challenge.

How does the simulation platform assess performance? Performance is measured through a weighted scoring algorithm that evaluates the accuracy of resolved items, the speed of completion, and the quality and completeness of the documented audit trail.

Percentage of discrepancies correctly identified and resolved.

Speed and workflow management in completing tasks.

Completeness and clarity of the reconciliation reports.

Instructors can view cohort-level data to identify common areas of strength and weakness across the class.

Participants who achieve a passing proficiency score receive a digital certificate, validating their skills in account reconciliation.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.