Navigate the critical challenges of accounts receivable, where every decision directly impacts your company's liquidity, profitability, and customer relationships. This simulation places you at the heart of the credit-to-cash cycle.

Credit Policy Design

Days Sales Outstanding

Aging Schedule Analysis

Bad Debt Expense and Allowance for Doubtful Accounts

Cash Flow Forecasting

Customer Risk Assessment

Collection Strategies

Sales growth vs. credit risk

Collection aggressiveness vs. customer satisfaction.

In the simulation, participants will:

Analyze and approve/reject credit applications for new and existing customers.

Set and adjust the company's overall credit policy.

Allocate limited resources to specific collection activities (emails, calls, agencies).

Manage a portfolio of accounts through an interactive aging schedule.

Make critical decisions on when to write off bad debt or offer payment plans.

Interpret financial reports to see the impact of their choices on cash flow and profit.

Compete against peers or a benchmark to achieve the lowest DSO and highest net cash flow.

Design an effective credit policy aligned with strategic sales and financial goals.

Evaluate the creditworthiness of business customers using key financial metrics.

Analyze an aging schedule to identify risks and prioritize collection actions.

Quantify the impact of accounts receivable performance on company cash flow and profitability.

Develop a structured, staged collection process to improve recovery rates.

Articulate the trade-offs between different receivable management strategies.

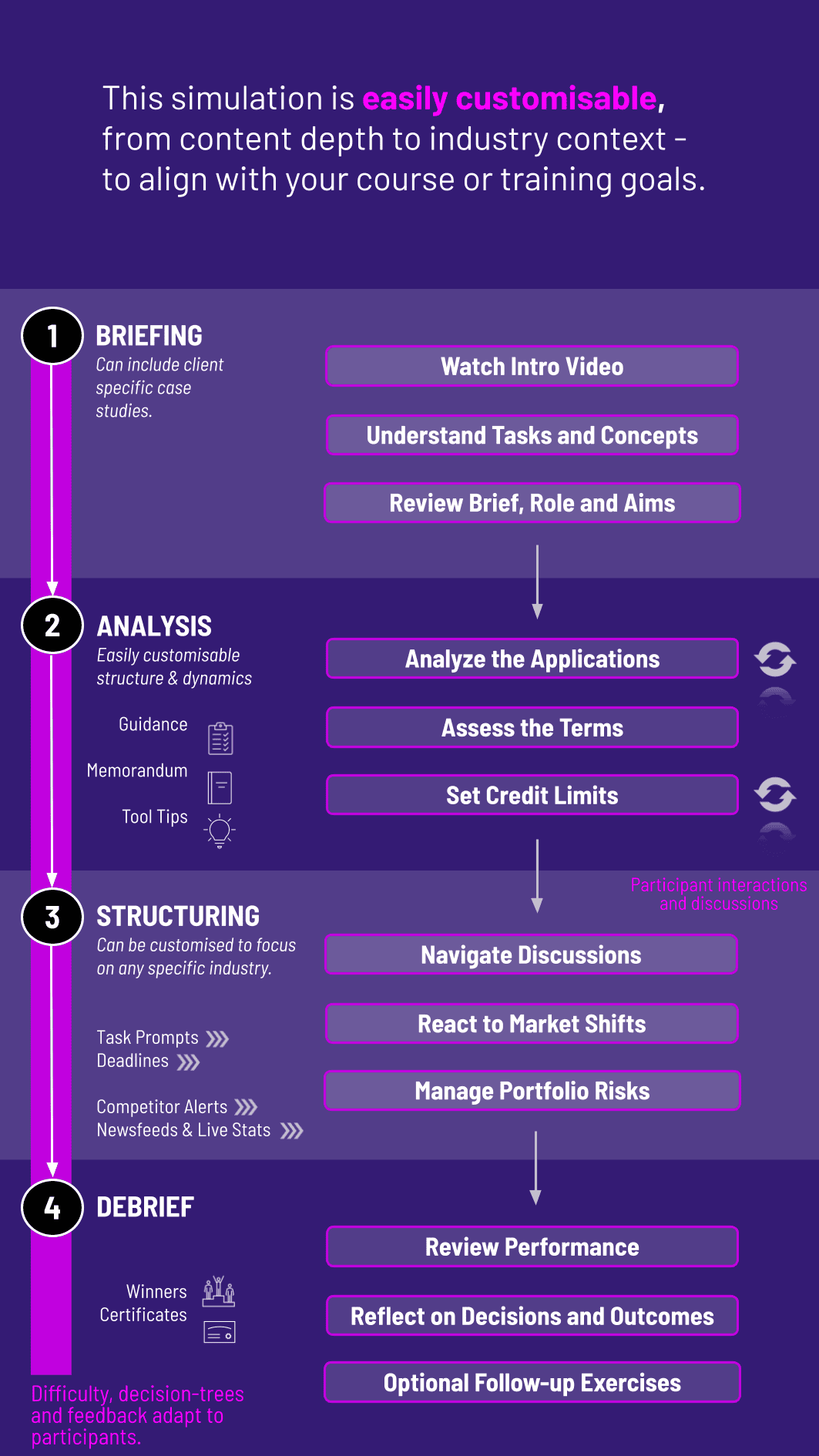

1. Introduction You are introduced to your company, its financial position, and a portfolio of existing customers with varying payment behaviors.

2. Decision Rounds Each round represents a fiscal quarter. You will review new order requests and set credit limits, allocate your collection team's effort to specific overdue accounts, choose actions for high-risk accounts (send reminder, hire collection agency, legal action) and adjust your overall credit policy based on economic updates.

3. Simulation Engine The simulation’s algorithm processes your decisions, simulating customer payment behaviors, potential defaults, and the reaction of sales to your credit policy changes.

4. Results and Feedback After each round, you receive a detailed report including an updated Aging Schedule, Income Statement, Cash Flow Statement, and key metrics like DSO. This feedback loop allows you to see the direct results of your strategy and adapt for the next round.

5. Debrief The session concludes with an instructor-led debrief linking the simulation experiences to core financial principles and best practices in receivable management.

What are the technical requirements to participate? The simulation is 100% browser-based. Participants only need a stable internet connection and a modern web browser (like Chrome, Firefox, or Safari) on any device.

Do I need prior experience in finance? A basic understanding of financial statements is helpful but not mandatory. The simulation includes introductory materials and is designed to be a learning tool for all levels.

How long does a typical simulation session last? A complete session, including introduction, multiple decision rounds, and a final debrief, can be run in a 2 to 4-hour workshop format or extended over a longer period for a university course.

Is this relevant for my business school curriculum? Absolutely. It directly complements courses in Corporate Finance, Financial Accounting, Working Capital Management, and Treasury Management, providing practical, hands-on application of theoretical concepts.

Can the simulation be customized for our specific industry? Yes. We offer customization options to reflect industry-specific payment terms, customer types, and economic factors, making the learning experience highly relevant for executive education and corporate training.

How does this simulation improve learning outcomes compared to a traditional lecture? Learning by doing is proven to be more effective. This simulation creates an emotional connection to the material, forcing participants to deal with uncertainty and consequences, leading to higher retention and a deeper understanding of the subject matter.

Days Sales Outstanding

Bad Debt to Sales Ratio

Net Cash Flow from Operations

Customer Satisfaction Index.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.