The Recapitalization Simulation plunges participants into the complex process of fundamentally altering a company's capital structure, challenging them to balance risk, return, and stakeholder interests to maximize firm value.

Capital Structure Theory

Leveraged Recapitalization

Cost of Capital

Debt Capacity and Financial Distress

Earnings Per Share and Valuation

Credit Ratings and Debt Covenants

Stock Market Reactions and Signaling

Shareholder Value Maximization

Mergers and Acquisitions

Investment Banking Advisory Role

In the simulation, participants will:

Conduct a deep dive into the target company's financial statements, cash flow stability, and competitive position.

Build a dynamic financial model to project the impact of various recapitalization structures on valuation, EPS, credit metrics, and WACC.

Determine the optimal amount of debt the company can sustain by analyzing interest coverage ratios and debt-to-EBITDAs.

Decide on the specific mechanism (special dividend, tender offer) and structure the new debt.

Present and defend the recapitalization plan to the board of directors (instructors/facilitators), addressing concerns about risk.

React to real-time market movements, analyst downgrades, and competitor actions triggered by their financial decisions.

Evaluate a company's current capital structure and articulate why a recapitalization could create value.

Quantify the impact of increased leverage on a company's valuation, cost of capital, and key financial ratios.

Design an optimal recapitalization strategy that balances tax benefits with the risks of financial distress.

Construct a professional-grade financial model to analyze and present a leveraged recap transaction.

Communicate a complex financial strategy persuasively to senior management and stakeholders.

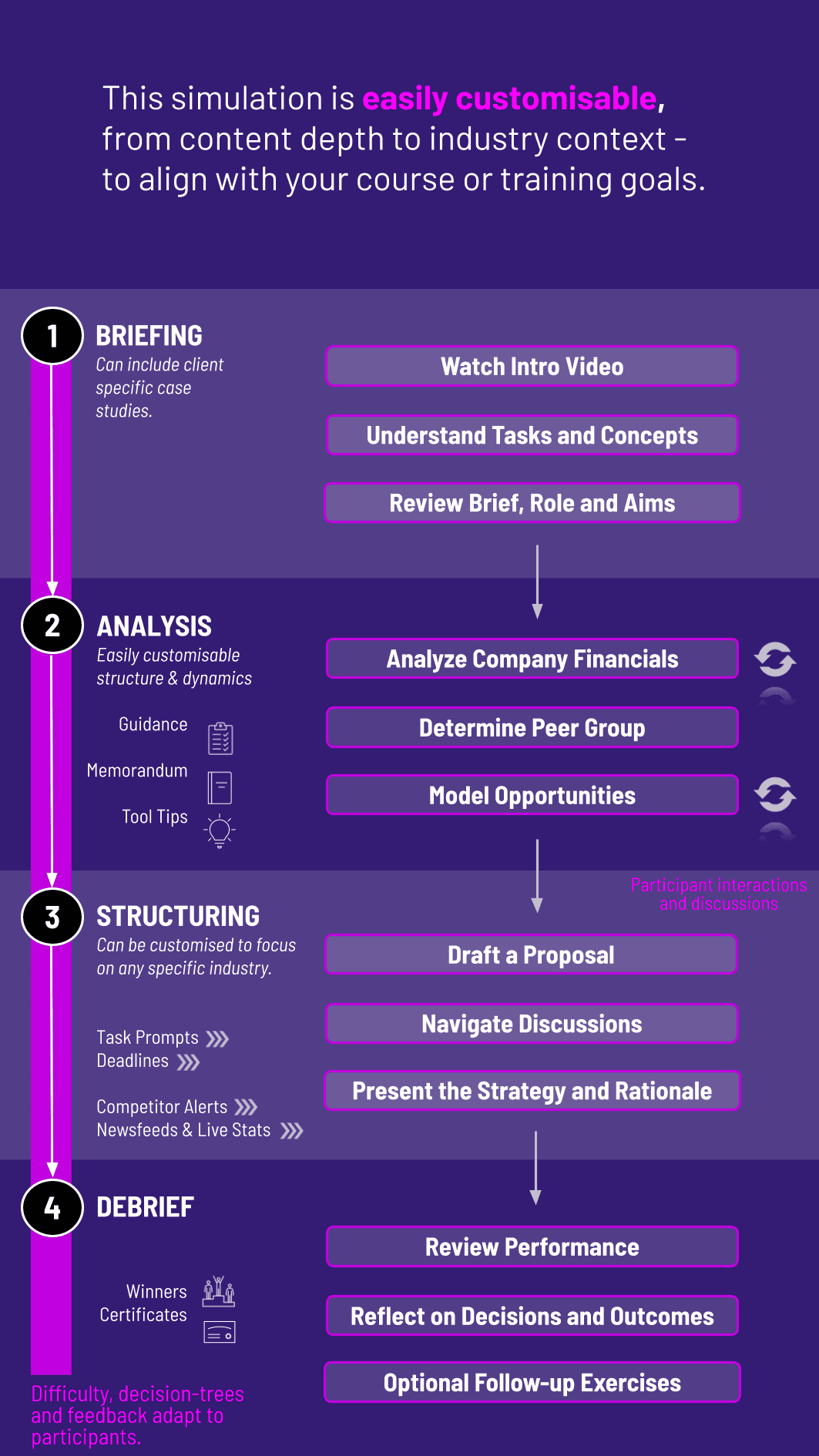

1. Introduction and Briefing Teams receive a detailed case study of "AlphaCorp", a stable but undervalued company with a conservative balance sheet.

2. Financial Analysis Phase Teams analyze AlphaCorp's financial health, benchmark it against leveraged peers, and identify the value-creation opportunity.

3. Financial Modeling and Strategy Phase Using a provided Excel-based template, teams model different debt levels and recap structures. They must decide on the final size and form of the recapitalization.

4. The Boardroom Pitch Each team presents its final recapitalization proposal to the "Board of Directors", justifying their chosen strategy with data from their models and strategic rationale.

5. Debrief and Results The facilitator reveals the market's reaction to each team's plan, followed by a guided debrief linking the simulation outcomes to core finance theories.

What is the ideal participant count for this simulation? The simulation is highly flexible. It works effectively with small groups of 10-15 participants and can be scaled to accommodate large classes of 50 or more by adjusting team sizes.

Is this a competition? Yes, it can be. Teams are often ranked based on the value created, the robustness of their financial model, and the persuasiveness of their boardroom presentation, fostering a competitive and engaging environment.

How long does the simulation take? The core exercise can be completed in a 3-4 hour session. A more comprehensive version, including advanced modeling and in-depth stakeholder analysis, can be extended over 8-16 hours.

Can this simulation be combined with other topics? Absolutely. The Recapitalization Simulation pairs perfectly with our M&A Simulation (as an alternative strategy) and Debt Financing Simulation (to dive deeper into structuring the debt portion).

Is this simulation relevant for executive education? Without a doubt. The strategic nature of recapitalization makes it highly relevant for executives, managers, and high-potential leaders in corporate development, FP&A, and general management roles who need to understand how capital structure decisions drive value.

Accuracy and functionality of the financial model.

Soundness of assumptions and debt capacity analysis.

Quantitative rationale for the chosen recapitalization structure.

Clarity, logic, and persuasiveness of the boardroom pitch.

Ability to defend the strategy and handle challenging questions.

Quality of slides and supporting materials.

Active contribution to team discussions and model building.

Professionalism and collaborative spirit throughout the simulation.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.