Students take on the role of quantitative analysts, building models, testing strategies, and managing financial risk to optimize performance under real-world pressures with our quantitative finance simulator.

The Quantitative Finance Simulation places students in the role of quantitative analysts (quants), responsible for building and applying mathematical models to solve complex financial problems.

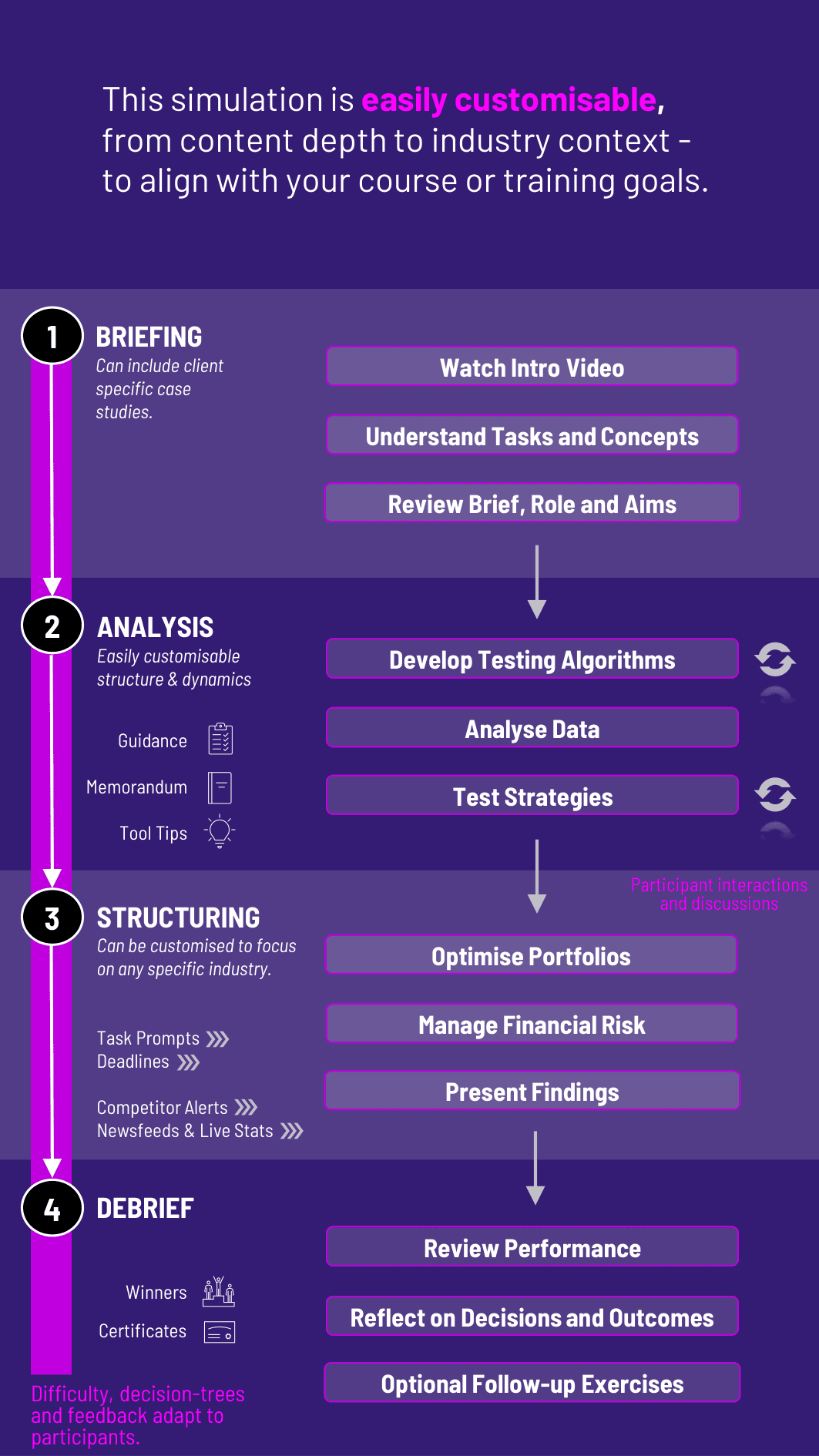

Students develop, test, and implement strategies based on real-world market data, all within a dynamic and competitive trading environment. The quantitative finance simulation emphasizes precision, speed, and adaptability as students balance innovation with risk control.

This hands-on experience brings to life the tools and techniques used in hedge funds, investment banks, and proprietary trading firms. Students explore applications in algorithmic trading, derivatives pricing, portfolio optimization, and financial engineering.

By replicating real-world trading and investment scenarios, this quantitative finance simulation challenges students to use logic, math, and programming to solve nuanced problems. It’s ideal for learners seeking roles that blend finance, analytics, and technology - and for instructors looking to embed experiential learning into advanced quantitative finance or financial engineering courses.

Who is this simulation best suited for? It's designed for students and professionals pursuing careers in quant finance, trading, financial engineering, or fintech.

Do I need programming skills? Basic familiarity with Python or R is helpful, but support materials are provided for all experience levels.

What kind of data is used in the simulation? A combination of historical and simulated real-world data feeds to support analysis and modeling.

How long does the quantitative finance simulation last? Typically 6–8 hours, but modular design allows flexible implementation over multiple sessions.

Does it include coding exercises? Yes, the quantitative finance simulation incorporates code-based analysis and modeling using standard quant tools.

Is the simulation collaborative or individual? It can be delivered in team or solo formats, depending on course structure or organizational goals.

Can it be customized for advanced learners? Yes, instructors can tailor the difficulty and focus - e.g., high-frequency trading, risk analytics, or machine learning.

What are the key deliverables? Students produce models, performance reports, trading strategy decks, and risk analyses.

Is instructor support available? Yes, including instructor guides, solution frameworks, and setup assistance.

How does this support career readiness? It develops technical and analytical capabilities critical to roles in hedge funds, banks, and tech-driven finance teams.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the quantitative finance simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the quantitative finance simulation can benefit you.