This simulation places you in the role of a Quant at a leading hedge fund, where you will design, backtest, and implement algorithmic trading strategies.

Algorithmic Trading and Execution

Statistical Arbitrage

Factor Modeling and Smart Beta

Time Series Analysis and Forecasting

Portfolio Optimization (Markowitz, Black-Litterman)

Backtesting and Strategy Validation

Risk Metrics (VaR, Expected Shortfall, Drawdown)

Machine Learning in Finance (Regression, Classification, Clustering)

Stochastic Processes and Volatility Modeling

Market Microstructure and Transaction Costs

In the simulation, participants will:

Formulate a quantitative investment thesis based on market anomalies or statistical patterns.

Code and refine algorithmic trading strategies (mean-reversion, momentum, factor-based).

Rigorously test your strategies against historical data to evaluate their viability and avoid overfitting.

Deploy your algorithms in a simulated live market environment that reacts to other participants' trades.

Continuously monitor your portfolio's risk exposure and adjust strategies to stay within limits.

Analyze your P&L attribution and key performance indicators to iteratively improve your models.

Compete against other teams (quants) for the highest risk-adjusted returns.

Design and implement a fully systematic, rules-based trading strategy.

Apply programming skills to solve quantitative finance problems.

Construct a diversified portfolio optimized for risk-adjusted returns.

Critically evaluate the performance of a trading strategy through rigorous backtesting and out-of-sample testing.

Interpret and manage financial risk using industry-standard metrics.

Understand the impact of transaction costs, slippage, and liquidity on strategy profitability.

Communicate complex quantitative strategies and their results effectively to stakeholders.

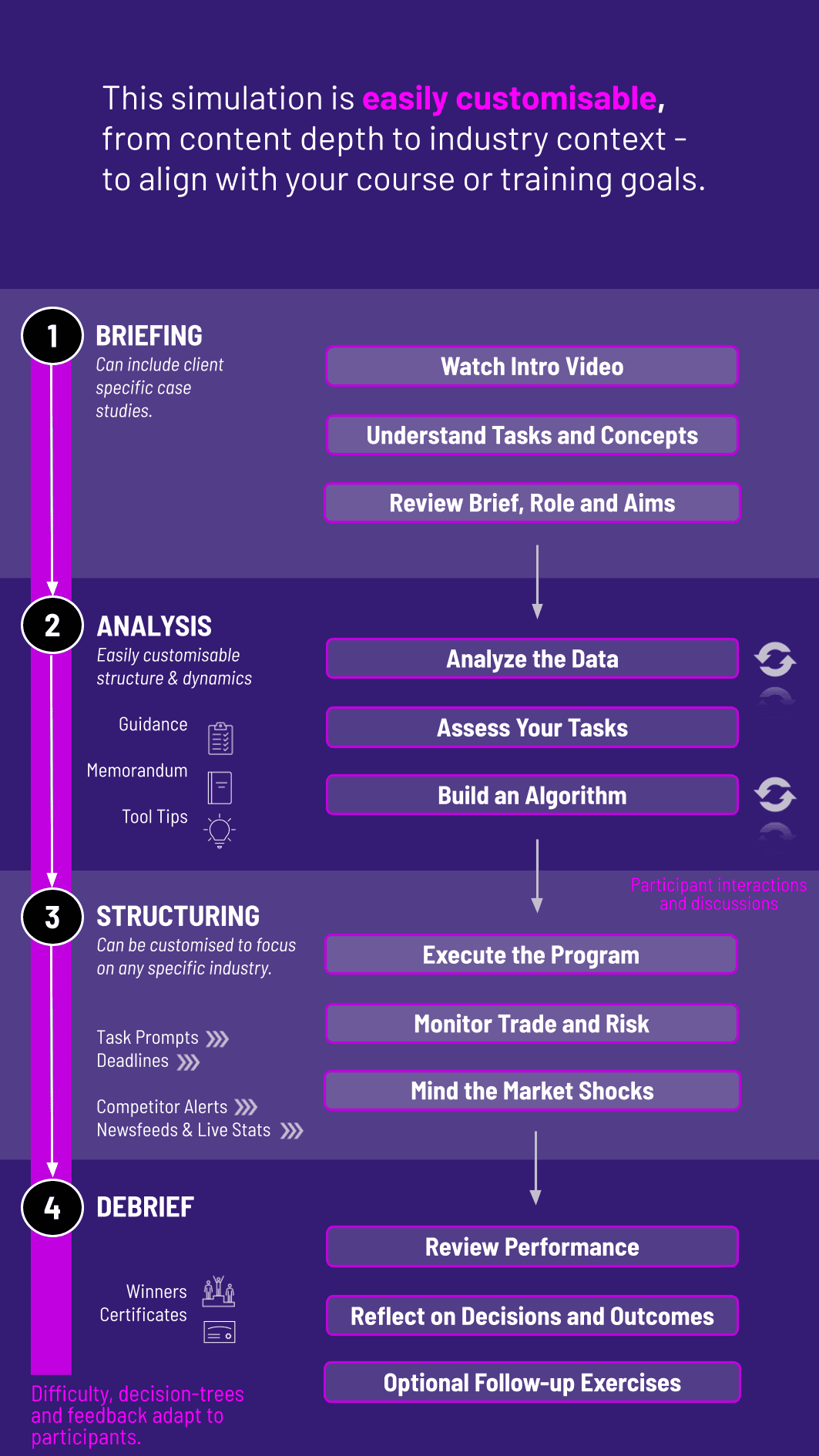

1. Team Formation and Briefing Participants are grouped into quant teams, given a virtual capital allocation, and introduced to the trading platform and data universe.

2. Tool Familiarization Access the web-based platform with an integrated development environment, financial data libraries, and documentation.

3. Strategy Development Phase Teams research, code, and backtest their strategies using historical data. Instructors can monitor progress and provide guidance.

4. Live Trading Round The simulation begins with a live clock. Teams deploy their algorithms, which execute automatically based on their code. The market evolves, reacting to a built-in "market maker" and the aggregate orders of all teams.

5. Monitoring and Iteration Teams can monitor their live P&L, risk dashboard, and adjust their code between trading days to improve performance or manage new risks.

6. Debrief and Final Assessment The simulation concludes with a ranking based on a final score (combining returns, Sharpe ratio, and drawdown). A comprehensive debrief session analyzes winning strategies, common pitfalls, and key learning takeaways.

What prerequisites are needed for the Quantitative Analyst Simulation? A foundational understanding of finance, statistics, and programming is highly recommended. The simulation is designed for advanced undergraduates, MBA students, or finance professionals looking to transition into quant roles.

Do I need to be an expert programmer to participate? No, you do not need to be an expert. However, comfort with basic programming logic and syntax is essential. The platform provides code templates and a library of common functions to help you get started.

What kind of data is provided in the simulation? The simulation provides a rich dataset, typically including high-frequency and daily data for equities, ETFs, indices, and futures. This can include price/volume data, fundamental data, and potentially alternative data sources.

How is the performance of our strategy evaluated? Performance is evaluated on a composite score that prioritizes sustainability and risk management. Key metrics include the Sharpe Ratio, Maximum Drawdown, and Alpha generation, not just total return.

Is this simulation suitable for a corporate training program? Yes, it is ideal for training programs at asset management firms, hedge funds, or bank trading floors to upskill analysts in quantitative techniques and systematic thinking.

How long does a typical simulation last? Simulations can be tailored, but a standard program often runs over 2-4 weeks, allowing sufficient time for strategy development, backtesting, and multiple live trading rounds.

Final Portfolio Score, based on a composite metric combining Sharpe Ratio, Total Return, and Maximum Drawdown at the end of the live trading period.

Evaluation of the readability, efficiency, and robustness of the submitted code, including comments and a README file.

Collaboration, division of work, integration of roles, and final coherence

Rating by peers and self-reflection on approach and decisions

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.