Navigate the high-stakes world of infrastructure and energy development in Project Finance Simulation. Learn to balance risk and return, negotiate with lenders and investors, and bring a complex project from the drawing board to financial close.

Non-Recourse / Limited Recourse Financing

Capital Stack Structuring

Financial Modeling & Scenario Analysis

Risk Identification & Mitigation

Debt Sizing & Covenants

Public-Private Partnerships

Investment Analysis

Term Sheet Negotiation

In the simulation, participants will:

Create a compelling business case and information memorandum to attract investors.

Construct a detailed, scalable financial model from the ground up, integrating construction costs, operating revenues, and financing.

Design the optimal mix of equity, mezzanine financing, and senior debt to maximize returns while ensuring bankability.

Engage in live negotiations to secure the best possible terms on interest rates, tenors, and covenants.

Oversee the construction phase, making critical decisions when faced with delays or cost overruns.

Monitor operational cash flows, assess compliance with loan covenants, and evaluate exit strategies.

Structure the financing for a major infrastructure or industrial project.

Build and interpret a complex project finance model.

Evaluate project viability from the perspective of an equity investor, lender, and government sponsor.

Identify, allocate, and mitigate key project risks.

Negotiate term sheets and financing documents effectively.

Calculate and analyze critical project finance metrics (DSCR, LLCR, IRR, NPV).

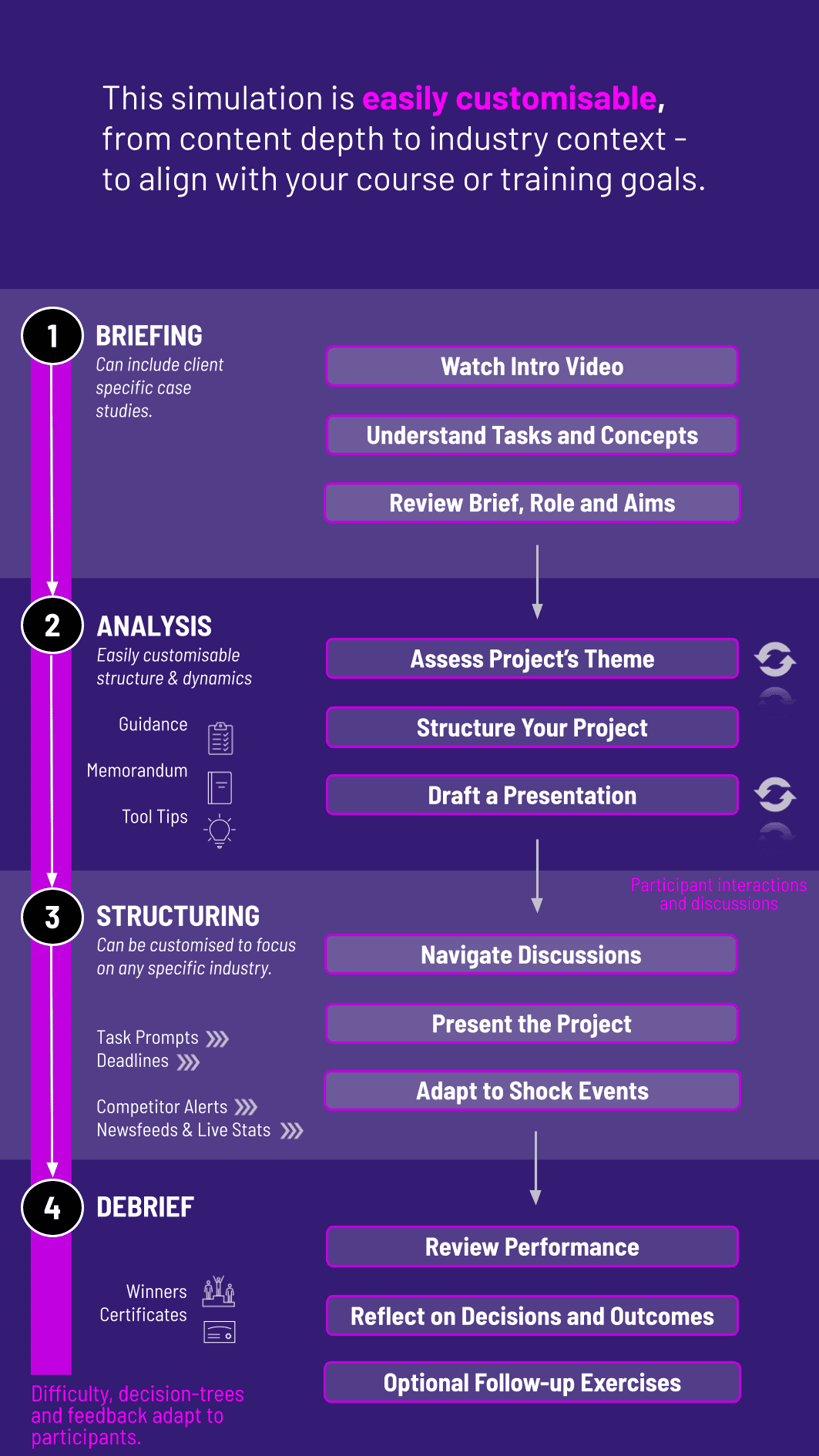

1. Team Formation and Briefing Participants are divided into project developer teams. Each team receives the project specifications.

2. Project Modeling and Structuring Teams build their financial model, run sensitivity analyses, and propose an initial financing structure.

3. The Bank Roadshow Teams present their project and financial model to a panel (instructors or other teams acting as banks) to secure a term sheet for the senior debt.

4. Equity Syndication Teams negotiate with private equity funds to secure the equity portion of the capital stack, focusing on the promised Equity IRR.

5. Construction and Operation The simulation engine runs the project, introducing random events. Teams must adapt and manage their finances to avoid default.

6. Review and Debrief All teams present their final project outcomes, financial returns, and lessons learned. A comprehensive instructor-led debrief ties the experience back to core concepts.

What are the technical prerequisites? Basic understanding of corporate finance would give participants an edge, but isn’t strictly required. The simulation includes model templates and guidance to support all levels.

How long does the simulation take to run? The simulation is highly flexible. Typical simulation length is 3-4 hours, but it can be modified to run as an intensive 2-day workshop or extended over a 5-8 week academic course.

Is this a generic simulation or based on a real project? Our simulations are based on realistic, anonymized case studies of actual projects, ensuring relevance and practical application.

How does this simulation help with career advancement? Project finance is a specialized and high-demand skill. This simulation provides tangible experience and a compelling talking point for interviews in infrastructure investing, commercial banking, and project development.

Accuracy, completeness, and sophistication of the project finance model and proposed capital stack.

Ability to secure favorable financing terms from lenders and investors during live negotiation rounds.

The ultimate financial success of the project, measured by achieved Equity IRR and successful debt repayment.

Clarity and persuasiveness in presenting the project proposal and final results.

Assessment may incorporate peer and self-review components, facilitator scoring, and debrief discussion. Results may feed into grades, executive feedback, certification or development plans.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.