Step into the high-stakes world of private capital. Participants will source deals, perform rigorous due diligence, model complex LBOs, and negotiate terms, providing a comprehensive, hands-on experience in the entire investment lifecycle.

Private Equity Fund Structure

Deal Sourcing and Screening

Leveraged Buyout Modeling

Valuation Methods (DCF, Trading Comps, Precedent Transactions)

Capital Structure (Debt and Equity Financing)

Debt Covenants and Credit Agreements

Management Equity Incentive Plans

Operational Due Diligence

Investment Committee Memorandum

Portfolio Management and Value Creation

Exit Strategies (IPO, Strategic Sale, Secondary Buyout)

In the simulation, participants will:

Analyze multiple company profiles to identify the most attractive investment opportunity.

Construct a dynamic, three-statement LBO model from scratch in Excel.

Analyze historical financials, market data, and company operations to assess risks and opportunities.

Model different debt structures and understand the impact of covenants on the deal.

Synthesize findings into a professional-grade investment committee presentation.

Defend the investment thesis and financial model, answering challenging questions.

Analyze the IRR impact of different holding periods and exit multiples.

Understand the end-to-end process of a private equity investment, from sourcing to exit.

Build, analyze, and interpret a comprehensive Leveraged Buyout financial model.

Apply core valuation methodologies in a leveraged acquisition context.

Evaluate the impact of different capital structures and debt terms on investment returns.

Identify key value creation levers and potential risks within a target company.

Communicate a complex investment recommendation clearly and persuasively, both in writing and orally.

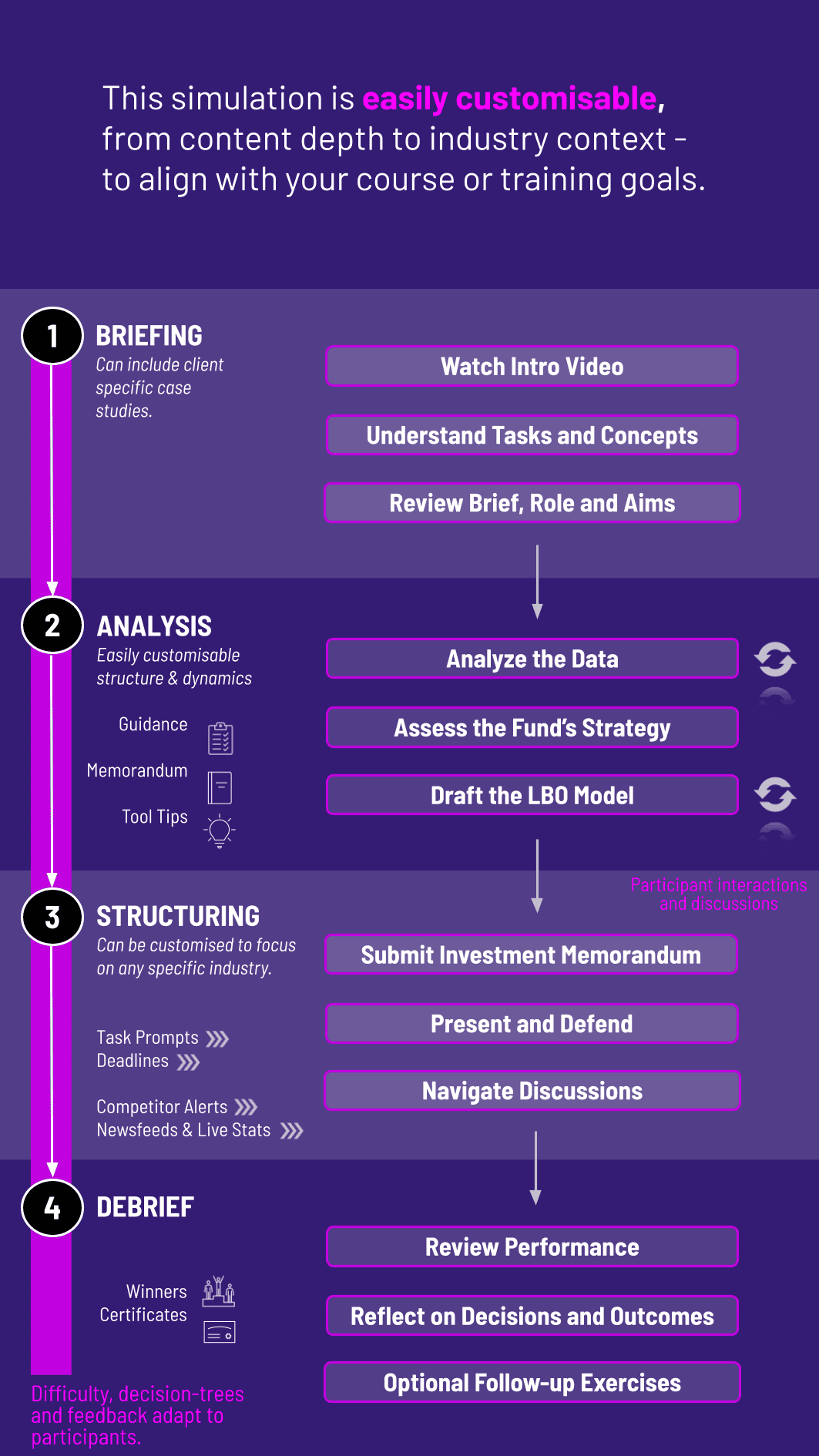

1. Team Formation and Briefing Participants are grouped into PE firms and receive their fund's strategy and capital details.

2. Deal Sourcing Phase Teams review dossiers on several potential target companies, selecting one to pursue.

3. Due Diligence and Modeling Using the platform's integrated data room and Excel interface, teams analyze the target and build their LBO model.

4. Investment Committee Submission Teams submit a formal Investment Memorandum summarizing their analysis, valuation, and recommendation.

5. Final Presentation and Defense Teams present their deal to a simulated investment committee, defending their model and thesis under scrutiny.

Do I need prior experience in LBO modeling? While prior finance knowledge is helpful, it is not mandatory. The simulation is designed with a structured learning curve, including instructional materials, templates, and guidance to help participants at all levels build a robust LBO model.

What software is required to participate? The core simulation runs through our online platform. All you need is a modern web-browser (Safari, Firefox, Chrome) and an internet connection.

Is this simulation suitable for MBA students and finance professionals? Absolutely. The simulation is tailored for MBA students, recent graduates, and early-career professionals in finance looking to transition into private equity or gain a deep understanding of leveraged acquisitions.

How long does the simulation typically take to complete? The simulation is flexible and can be run as an intensive 2-3 day workshop or a multi-week course module, typically requiring 15-25 hours of total participant engagement.

How are participants assessed and graded? Assessment is multi-faceted, based on the accuracy of the financial model, the quality and depth of the investment memorandum, the persuasiveness of the final presentation, and the overall financial viability of the proposed deal.

Can this simulation be customized for a corporate training program? Yes, we offer customizations to reflect specific fund strategies, industry focuses, or geographic regions relevant to your firm's training objectives. Please contact us for a bespoke proposal.

What makes this simulation different from a standard finance case study? Unlike a static case study, this is a dynamic, decision-driven simulation. Participants make active choices on which deal to pursue, how to structure the financing, and what value creation plan to implement, and they see the direct, quantifiable impact of those decisions on the investment's IRR.

Correct model structure, accurate debt schedules.

IRR/MOIC calculations, and sensitivity to assumptions.

Clarity of investment thesis, depth of due diligence, coherence of valuation argument, and professional presentation.

Ability to persuasively communicate the deal's merits, defend assumptions under questioning, and demonstrate strategic understanding.

The fundamental financial soundness and projected returns of the proposed acquisition.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.