Master the art of wealth management and become the trusted advisor to your ultra-high-net-worth clients. Navigate volatile markets, build bespoke portfolios, and learn the delicate balance of risk, return, and client relationships.

-Asset Allocation and Portfolio Construction

Risk Profiling and Client Profiling

Modern Portfolio Theory and Efficient Frontier

Alternative Investments

Liquidity Management

Tax-Efficient Investing

Behavioral Finance and Client Bias

Performance Reporting and Client Communication

Wealth Preservation and Intergenerational Wealth Transfer

Ethical Considerations and Fiduciary Duty

In the simulation, participants will:

Conduct in-depth interviews to understand client risk tolerance, cash flow needs, and long-term objectives.

Create a formal, customized IPS for each client to guide all investment decisions.

Allocate capital across a wide universe of assets including equities, fixed income, commodities, and alternative investments.

React to market news, economic data, and changing client circumstances by executing trades and strategically rebalancing portfolios.

Use advanced analytics and dashboards to monitor portfolio performance, risk metrics and attribution.

Present performance reports, justify strategic decisions, and manage client emotions during periods of market stress.

Construct a diversified, multi-asset class investment portfolio tailored to a specific client's risk and return objectives.

Evaluate the risk/return characteristics of various asset classes and their role within a UHNW portfolio.

Apply the principles of Modern Portfolio Theory to optimize asset allocation.

Demonstrate the ability to communicate complex investment strategies and performance results effectively to clients.

Manage client relationships by aligning financial advice with stated and unstated life goals.

Adapt investment strategies dynamically in response to changing market conditions and client needs.

1. Team Formation and Client Assignment Participants are divided into teams, each assigned a unique ultra-high-net-worth client with a detailed profile.

2. Initial Strategy Teams analyze their client, draft an Investment Policy Statement, and make their initial asset allocation decisions.

3. Decision Input Teams input their trading and allocation decisions into the online platform.

4. Scenario and Market Resolution The simulation engine processes all decisions, incorporating real-world market data and random economic/business events.

5. Results and Reporting Teams receive detailed performance reports for their portfolios, including key metrics and updated client satisfaction scores.

6. Client Interaction Teams review feedback from their "client" and must prepare a communication or report addressing their performance.

Do participants need prior finance experience? A basic understanding of financial concepts is beneficial, but not always mandatory. The simulation includes briefing materials and is designed as a practical learning tool for various experience levels.

How long does the simulation typically last? The duration is flexible. It can be run as an intensive one-day workshop or extended over several weeks as part of a full academic course.

Is this a competitive simulation? Yes, teams are typically ranked on a composite score that balances quantitative portfolio performance (e.g., risk-adjusted returns) and qualitative client satisfaction metrics.

What kind of assets can we invest in? The platform features a broad universe, including global equities, government and corporate bonds, ETFs, mutual funds, and alternative investments like real estate investment trusts and private equity funds.

How is client satisfaction measured? Client satisfaction is impacted by adherence to the IPS, communication frequency and quality, performance relative to benchmarks and expectations, and how well teams handle periods of volatility.

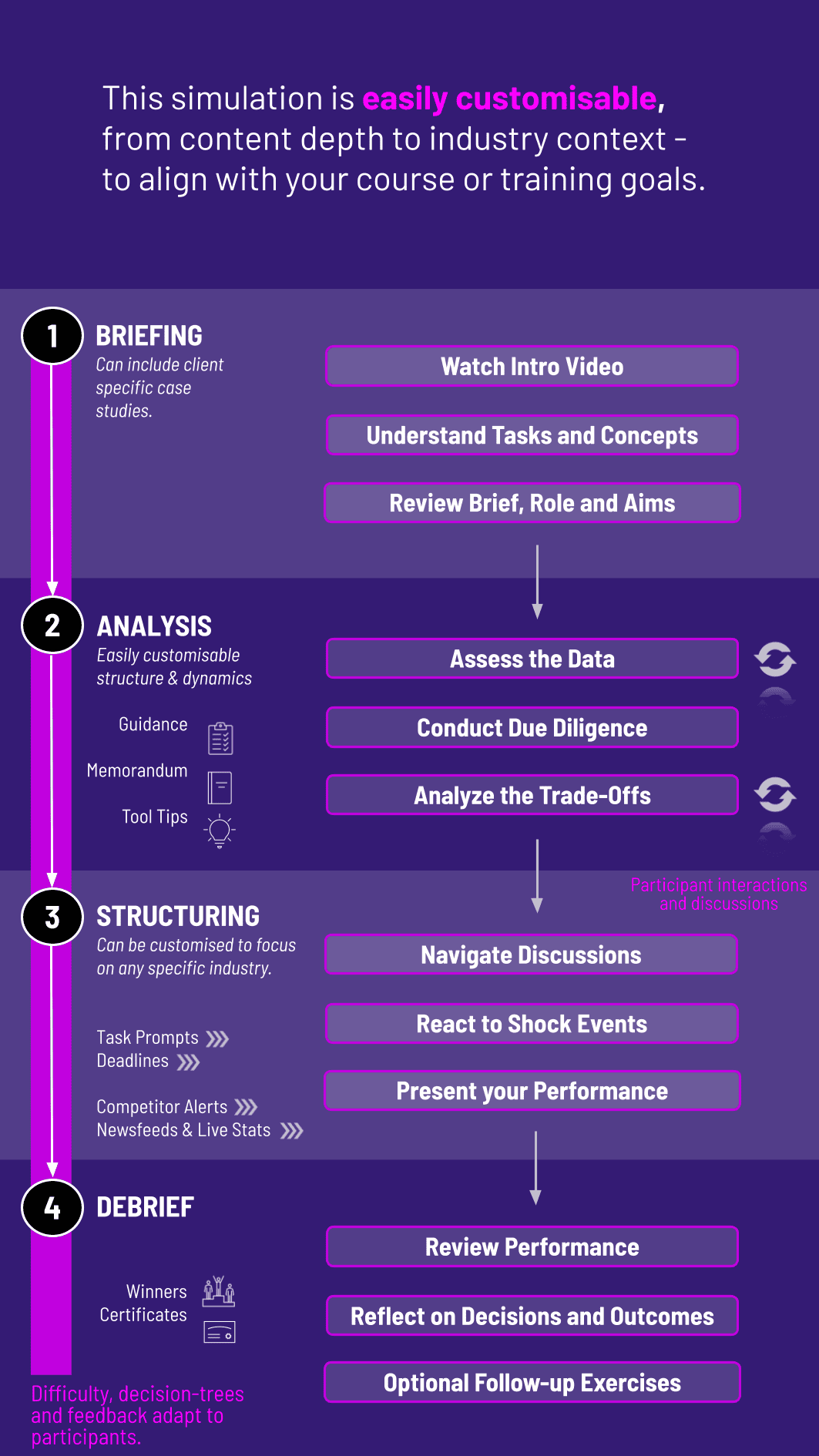

Can the simulation be customized for our institution? Yes, we offer customization options for client profiles, asset universes, and specific learning objectives to align with your curriculum or training goals.

What technical requirements are needed to run the simulation? The simulation isweb-based and requires only a standard web browser and a stable internet connection for each participant. No specialized software is needed.

Portfolio Perfomance Score

Net Worth Growth

Client Satisfaction Score

Final Strategic Report and Presentation

Peer Evaluation and Participation

Assessment may incorporate peer and self-review components, facilitator scoring, and debrief discussion. Results may feed into grades, executive feedback, certification or development plans.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.