Master the engine room of the hedge fund industry. Far from a theoretical exercise, the Prime Brokerage Simulation replicates the dynamic interplay between a prime broker and its hedge fund clients.

Prime Brokerage Services and Ecosystem

Margin Financing and Haircuts

Securities Lending and Rebate Rates

Counterparty Risk Management

Hedge Fund Lifecycle and Strategy Analysis

Capital Introduction

Portfolio Margining (VAR-based, Reg T)

Collateral Management

Profit and Loss Drivers for a Prime Broker

Client Onboarding and Due Diligence

In the simulation, participants will:

Evaluate the risk and profitability of potential hedge fund clients based on their strategy, track record, and portfolio.

Negotiate and set margin requirements, financing rates, and cuts on various asset classes.

Decide which client securities to lend out to short sellers and manage the associated risks and rebate fees.

Act decisively during market volatility by issuing and managing margin calls to protect the firm from counterparty default.

Prepare and present compelling proposals to win new hedge fund business in a competitive RFP process.

Balance the trade-off between risk and return to maximize the prime brokerage desk's revenue and manage its balance sheet efficiently.

Articulate the full suite of services provided by a prime broker and their value proposition to hedge funds.

Calculate margin requirements using different methodologies and understand the impact of leverage on a client's portfolio.

Evaluate the creditworthiness and risk profile of a hedge fund client.

Manage the key revenue streams of a prime broker, including financing spreads and securities lending fees.

Respond effectively to a simulated market crisis by managing counterparty risk and liquidity.

Develop a strategic client acquisition plan, leveraging capital introduction and competitive pricing.

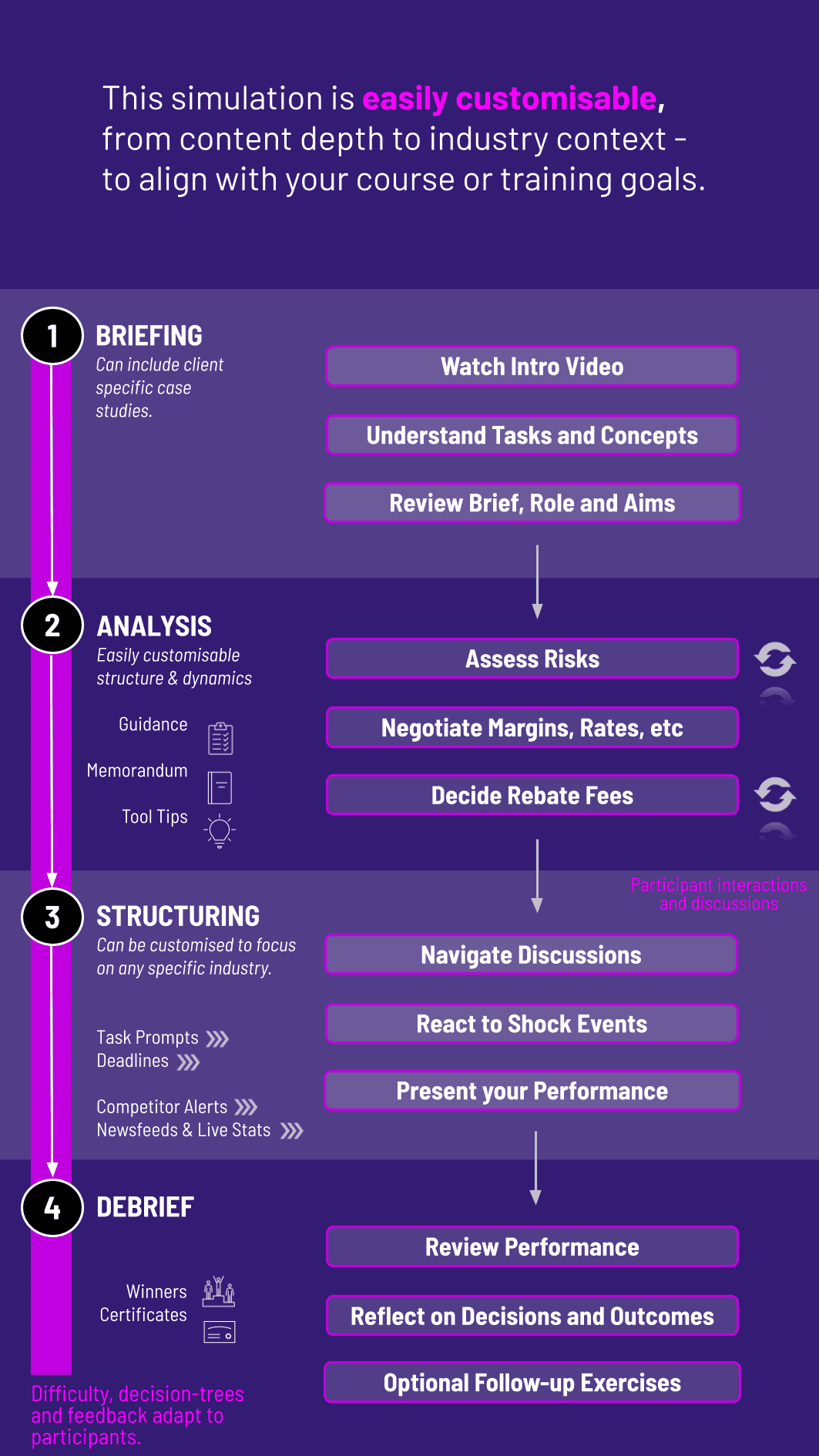

1. Setup and Briefing Teams are introduced to their starting portfolio of hedge fund clients and the simulation platform.

2. Analyze New RFPs Review and bid on new hedge fund mandates.

3. Manage Existing Clients Monitor client portfolios, adjust financing terms, and handle securities lending opportunities.

4. React to Market Shocks Navigate random economic events that trigger volatility and margin calls.

5. Review P&L Analyze their desk's performance, understanding what drove revenue and losses.

6. Debrief The simulation concludes with an instructor-led debrief linking the teams' in-game decisions to real-world prime brokerage operations and strategic challenges.

What are the benefits of using a simulation over a traditional lecture? Traditional lectures teach the "what," but simulations teach the "how." This experiential learning approach builds muscle memory for complex decision-making, risk assessment, and strategic thinking in a safe, consequence-free environment.

Do I need prior experience in prime brokerage to participate? No prior experience is necessary. The simulation includes foundational materials and is designed to build knowledge from the ground up, making it accessible while challenging for those with existing knowledge.

How long does the simulation typically take to complete? The simulation is highly flexible. A typical program runs over 3-5 rounds and can be completed in a half-day workshop, a full-day session, or integrated over several weeks in a university course.

Is this simulation relevant for aspiring hedge fund professionals? Absolutely. Understanding the prime broker's perspective is a critical advantage for any hedge fund employee. It demystifies financing costs, clarifies the margin process, and reveals the levers a prime broker can pull, enabling better negotiation and relationship management.

What technical requirements are needed to run the simulation? The simulation is 100% web-based. Participants only need a modern web browser (Chrome, Firefox, Safari) and a stable internet connection. There is no software to install.

How does the simulation assess performance and declare a winner? Performance is measured quantitatively through a composite score based on the prime brokerage desk's profitability, risk-adjusted returns, and market share growth. The winning team best balances the pursuit of revenue with prudent risk management.

Hypothesis clarity and testing logic

Investor communication and pitch delivery

Reflection on failure and resilience

Iterative improvement across rounds

Assessment may incorporate peer and self-review components, facilitator scoring, and debrief discussion. Results may feed into grades, executive feedback, certification or development plans.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.