Preferred Stock Issuance Simulation offers participants an immersive experience in the process of issuing preferred stock, emphasizing strategic decision-making, market analysis, and regulatory compliance.

Structure and features of preferred stock (dividends, redemption, participation rights)

Pre-issuance preparations and financial assessment

Regulatory and legal compliance (SEC rules, disclosures)

Marketing and pricing of preferred shares

Role of underwriters and investor roadshows

Issuance execution and post-issuance management

Impact of market conditions on issuance success

Communication with investors and stakeholders

In the simulation, participants will:

Analyze company financials and preferred stock terms

Develop a pricing and marketing strategy for the issuance

Conduct simulated roadshows and investor meetings

Collaborate with underwriters to refine the offering

Make decisions under changing market conditions

Execute the issuance and manage post-sale investor relations

Prepare and present investor updates and regulatory documents

Understand the full lifecycle of preferred stock issuance

Apply regulatory and compliance requirements effectively

Develop pricing strategies responsive to market and investor demand

Manage investor communications and expectations

Navigate coordination with underwriters and legal teams

Build strategic judgment in financial structuring for capital raising

Recognize the importance of timing and market analysis in issuance success

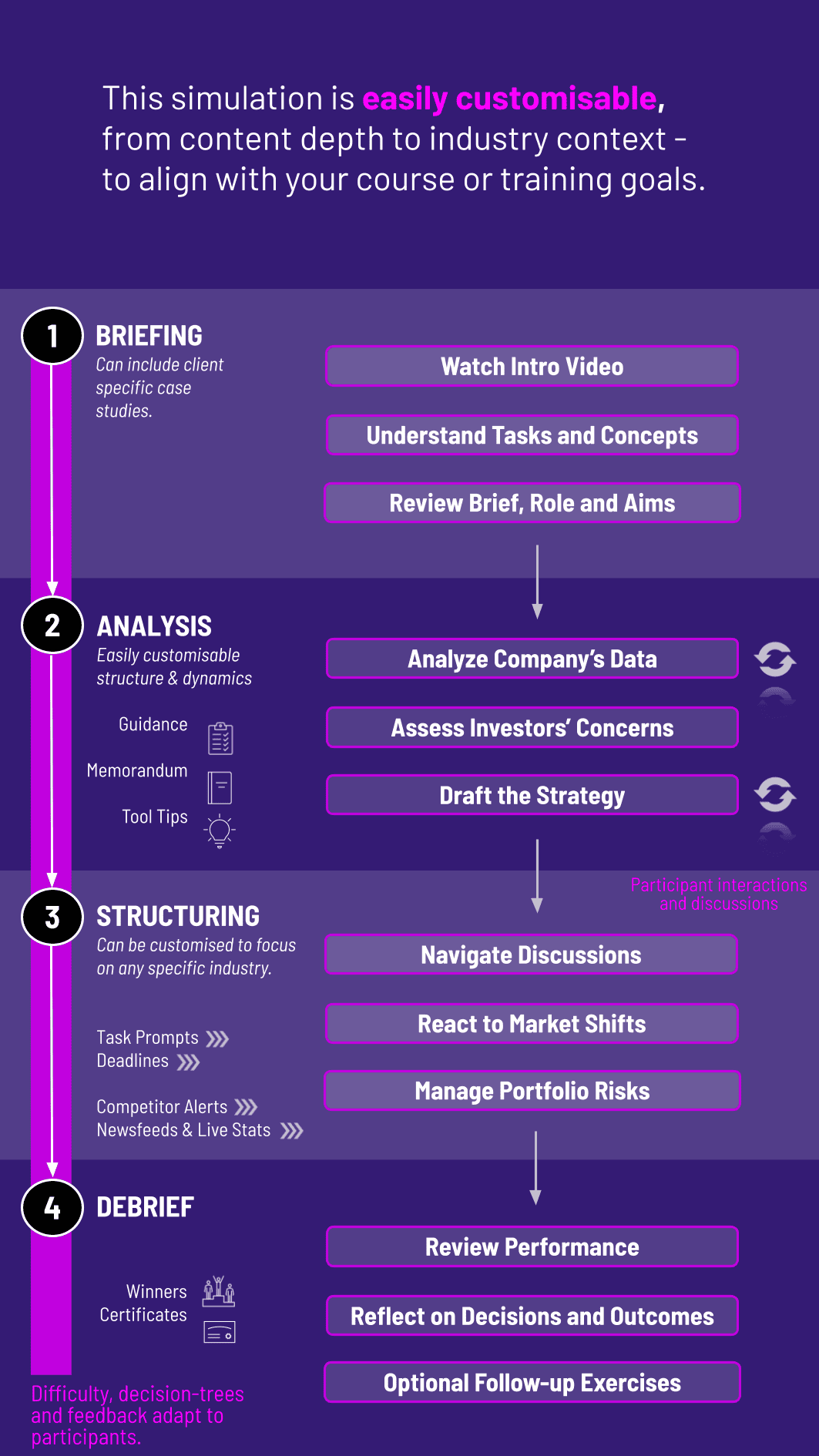

1. Receive a Scenario or Brief Participants are provided with a corporate profile, current financials, market conditions, and a mandate outlining repurchase objectives.

2. Analyze Financials and Market Data Using provided data, teams analyze cash flow availability, stock price trends, regulatory boundaries, and investor sentiment.

3. Develop a Repurchase Strategy Choose the type of buyback (open market, tender offer, accelerated), scale, timing, and funding sources while considering impact on valuation and capital structure.

4. Execute Decisions Through Rounds Implement buyback actions in iterative rounds, adjusting in response to market feedback, stock price movements, liquidity, and evolving corporate priorities.

5. Collaborate and Communicate Coordinate between finance, legal, and investor relations roles to manage compliance, risk, and stakeholder messaging.

6. Review Outcomes and Reflect Evaluate buyback effectiveness using performance metrics including EPS growth, cash flow impact, stock price changes, and shareholder feedback.

7. Adapt Strategy as Needed React dynamically to simulated shocks such as market volatility spikes, regulatory changes, or liquidity constraints by modifying repurchase plans.

What is the core objective of this simulation? The primary objective is to provide a hands-on, practical understanding of why and how a corporation issues preferred stock. You will learn to structure the terms, price the security, negotiate with investors, and understand the profound impact this financing choice has on a company's capital structure, control, and valuation.

What specific terms of preferred stock can we design in the simulation The simulation allows you to model and negotiate the key terms that define a preferred stock issue. You will work with critical features such as the dividend rate and type, deciding between a fixed or floating rate. You'll also structure its cumulative or non-cumulative nature, its seniority in the capital stack, and any voting rights. Furthermore, you can design convertibility features, including ratios and triggers for conversion to common stock, as well as callability provisions and schedules for early redemption.

Who is the target audience for this simulation? This simulation is ideally suited for a range of finance professionals and students. This includes MBA and finance students specializing in corporate finance or investment banking, as well as investment banking analysts and associates seeking to deepen their financial product expertise. It is also highly relevant for corporate finance professionals at companies that use or are considering hybrid financing, and for private equity and venture capital professionals who frequently interact with preferred stock.

Do we play as the company issuing the stock or the investors buying it? The simulation is typically designed from the perspective of the issuing company's corporate finance team. Your goal is to successfully structure and issue the preferred stock to meet the company's strategic capital needs while balancing the demands of potential investors. Some advanced versions may include investor negotiation roles.

What financial metrics and models are used in the simulation? You will work with a suite of industry-standard models and metrics to guide your decisions. This includes calculating the cost of preferred stock, performing earnings per share analysis with a focus on dilution from convertible shares, and assessing the impact on credit ratings. You will also analyze key leverage and coverage ratios and utilize comparable company analysis for accurate pricing.

How does the simulation model market conditions and investor demand? The platform uses a dynamic engine where your chosen terms directly influence the simulated market's response. For example, offering a low dividend rate for a high-risk company will result in low investor demand and a failed issuance. This dynamic forces you to re-calibrate your strategy in real-time, mirroring the pressures and trade-offs of the real financial world.

Is this simulation relevant for understanding venture capital and startups? Absolutely. Preferred stock is the primary security used in venture capital financing rounds. This simulation covers the core concepts that are critical for any founder or startup financier to master, including liquidation preferences, anti-dilution provisions, and specific voting rights.

What prior knowledge is required to participate effectively? A foundational understanding of corporate finance is helpful, but not a strict requirement. The simulation includes primer materials on preferred stock mechanics, ensuring that motivated participants from diverse backgrounds can quickly get up to speed and succeed.

Ability to determine optimal timing, method, and scale of repurchase considering market conditions and company financial goals.

Financial impact analysis, evaluation of effects on EPS, ROE, cash flow, and overall shareholder value.

Resourcefulness in capital allocation and liquidity management

Anticipating and managing stock price reactions and investor sentiment resulting from repurchase announcements and execution.

Navigation of legal restrictions, disclosure requirements, and tax implications linked to repurchases.

Identifying and managing risks including overpaying shares, leverage, and market volatility.

Quality of communication and investor relations

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.